By Sarah Butler-Sloss, Chair of Ashden Trust and Founding Director, Ashden

The problem

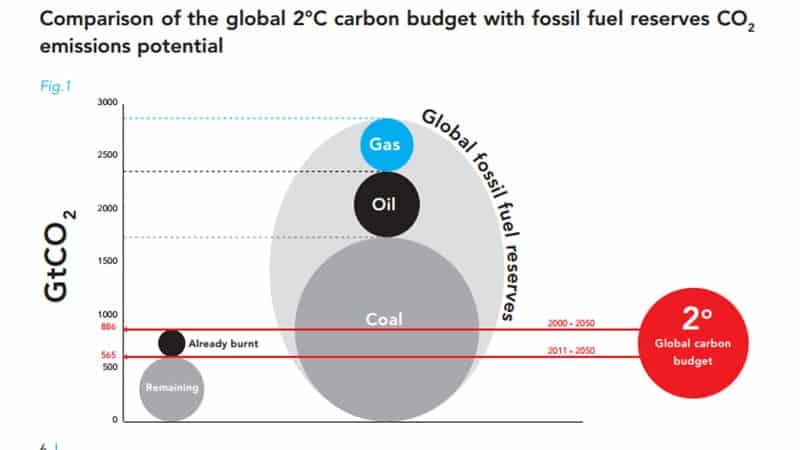

The risks from climate change globally, and to Asia particularly, are enormous. Nations across the world agree that the average global temperature must not increase by more than 2°C from 1990. It is now widely accepted that for this to happen, 80% of fossil fuels must remain in the ground and yet no fossil fuel company has demonstrated how their business is compatible with this 2°C limit. But it is equally vital that everyone has access to affordable energy.

The solution

In just a few years, over 400 organisations and thousands of individuals with combined assets of over $2 trillion have come together to pledge to divest from fossil fuel extraction companies, and invest in “climate solutions”, like solar power, energy efficiency, water preservation and more.

Inspired by Wallace Global Fund and Rockefeller Brothers Fund, as chair of Ashden Trust I helped establish Europeans for Divest Invest to catalyse further commitments globally. This year, some of the world’s largest investment Institutions including California State Pension Fund, Axa, Norwegian Sovereign Wealth Fund, and the Church of England now see the financial and ethical merits of divesting from coal in particular. Many more have opted to divest from the full list of 200 fossil fuel companies including over 100 charitable trusts, foundations, and family offices .

Impact

It is clear that board rooms of asset managers, as well as fossil fuel companies are starting to take note. Businesses like Total have sold their coal operations saying “We cannot claim to be providing solutions to climate change while continuing to produce or market coal”. Peabody Coal has reported that divestment is a threat to their product demand and securities. In the run up to COP21, it is more vital than ever that we act now to send a strong message to the climate negotiations in Paris. It is important that Christiana Figueres, executive secretary of the UN Framework Convention on Climate Change endorses divest invest as the way to send this message.

As a grant maker and award giver to climate solutions, divest invest ensures that our investments are aligned with our grant making. No longer do we help with one hand, and harm with the other. What is more, the growing range of opportunities has allowed our funds exposed to fossil fuel stocks.

For the venture philanthropist in particular, divest invest is the perfect cause; a powerful action that we can take together, sending strong signals to the market and politicians, but most importantly allowing us to double our impact – by moving funds away from the polluting companies, we maximise the opportunity to support the causes that we love.

To take the pledge, and help accelerate the clean energy transition, visit http://divestinvest.org/