Co-author: Priscilla Boiardi

6 min read

|

|

Launched at the 13th EVPA Annual Conference, “Financing for Social Impact” analyses (i) how funding can be shaped to best meet the financial needs of social purpose organisations (SPOs) and (ii) how actors (both private and public) collaborate in the VP/SI space to bring more resources to SPOs. The report features a large number of case examples, including many from the emerging field of hybrid finance.This report is also a handy guide to deploying each financial instrument, from grants to debt, equity and hybrid financial instruments. The EVPA report is the result of a 9-month journey with a group of over 30 experts from the venture philanthropy and social investment (VP/SI) space. |

Insight 1: Tailoring the financial offer is crucial for VPO/SIs, to make sure SPOs are getting the right support, and interests and objectives are aligned

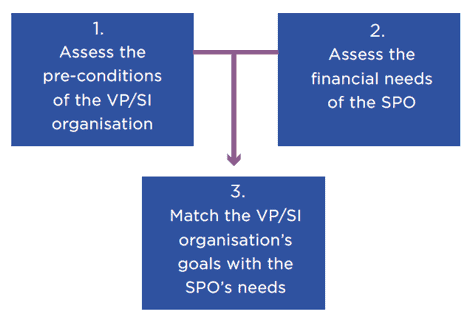

- Tailored financing is a 3-step process through which a VPO/SI finds the most suitable financial instrument(s) to support a SPO, from grant, debt, equity, and hybrid financial instruments.

Figure 1: Tailored financing as a 3-step process (Source: EVPA Knowledge Centre)

- When choosing which financial instruments to use, the VPO/SI should integrate its social impact objectives into its risk and financial returns considerations.

- The final decision on which financial instrument to deploy for a specific deal will depend on both the risk/return/impact profile of the VPO/SI (assessed in Step 1 in Figure 1) and on the financial needs and characteristics of the SPO (assessed in Step 2).

Insight 2: The financial needs of a SPO can be assessed following a 3-step process

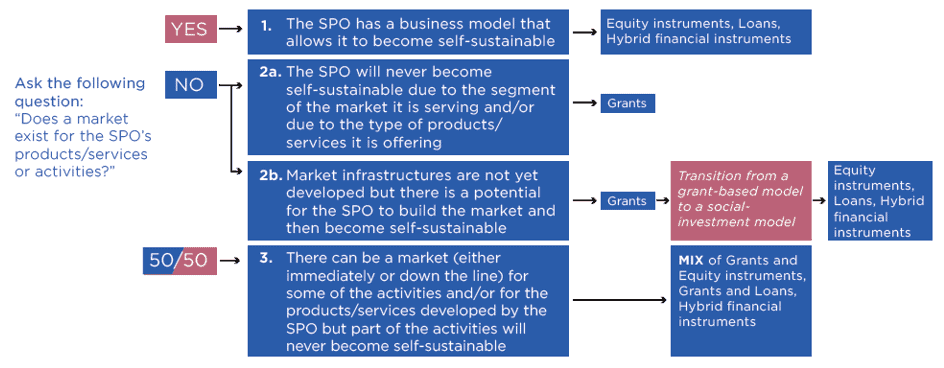

Figure 2: Assess the SPO’s financial needs (Source: EVPA Knowledge Centre)

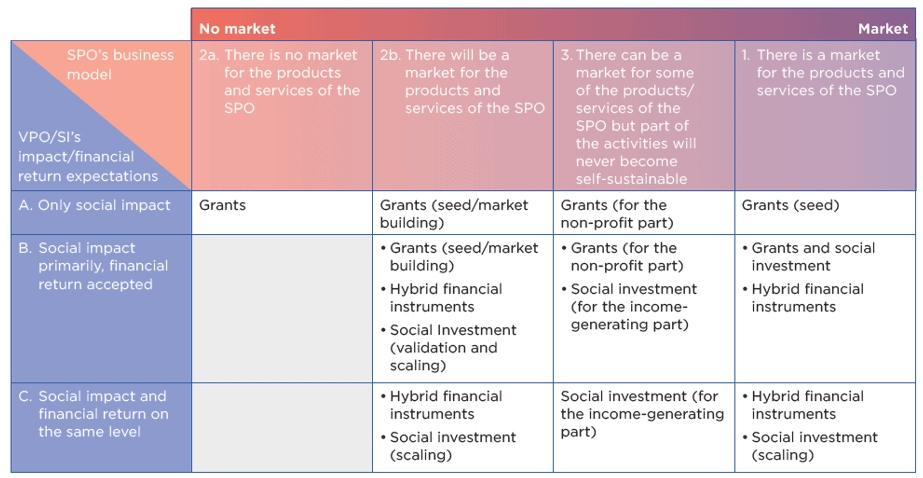

- There are cases in which the SPO already has a self-sustainable business model. Thus, it can be financed through financial instruments such as loans, equity and/or hybrid financial instruments.

- If no market exists for the SPO’s activities, due to the particular activity run (e.g. advocacy), the VPO/SI will only be able to finance it through grants.

- In some cases, a SPO can take advantage of an initial grant that helps it take off and become able to rely also on other type of financial instruments, passing through a transition from a grant-based model to a social-investment model.

- In other cases, SPOs can adopt a hybrid structure (i.e. a combination of a for-profit entity and a not-for-profit one). In such cases, social investment will be raised through the for-profit entity, while the non-profit will raise funding through grants. The hybridity will allow for more flexibility in terms of the achievement of both the social mission and the financial impact objectives of the SPO, thus channelling resources more efficiently.

Insight 3: The right match between VPO/SI’s goals and SPO’s needs is the way to solve existing funding gaps for SPOs to achieve self-sustainability and scaling

- A correct allocation of capital in the right form to the right SPO can help avoid market distortions; SPOs that have the potential to be financed through loans and equity should not be financed through grants, as it can generate over-dependency and delay the use of sound business practices.

- Each financial instrument is particularly suitable for specific situations and needs to be chosen during the due diligence phase.

Table 1: Matching the expectations of the VPO/SI with the financial needs of the SPO (Source: EVPA Knowledge Centre)

Insight 4: Hybrid finance is a way for VPO/SIs to tailor their financing offer

- Hybrid finance opens up a highly divided market, in order to give space for the true complexity of the market. This is helpful for SPOs that are neither purely philanthropic nor purely commercial.

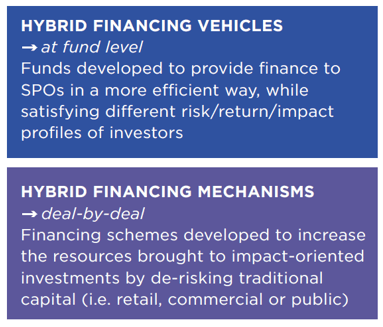

- Hybrid finance is the allocation of financial resources to impact-oriented investments, combining different types of financial instruments and different types of risk/return/impact profiles of capital providers. Hybrid finance encompasses diverse forms of collaboration between actors: hybrid financing vehicles and hybrid financing mechanisms (Figure 3).

Figure 3: Hybrid financing vehicles and mechanisms (Source: EVPA Knowledge Centre)

- Both hybrid financing vehicles and mechanisms effectively bring more resources to developing societal solutions and de-risk traditional capital (i.e. public, commercial and retail).

- Hybrid financing vehicles are innovative ways of financing for social impact. As no track record on their effectiveness exists, evidence on their impact will need to be collected.

Insight 5: Tailored financing and hybrid finance bring with them several challenges, which need to be considered

- Legal constraints in certain countries make it difficult (if not impossible) for VPO/SIs to deploy financial instruments diverse from grants, as well as for SPOs to accept social finance (e.g. equity, hybrid financial instruments).

- There is a need for more social investment intermediaries to help VPO/SIs match their wishes with the needs of the SPOs.

- Bringing together multiple actors with different processes, ways of working, risk appetites, impact and return expectations and timeframes can be challenging, so making sure all parties’ objectives are aligned is crucial.

To read the whole report, watch experts share their insights, or subscribe to the upcoming webinar on 31st January, click here.