4 min read

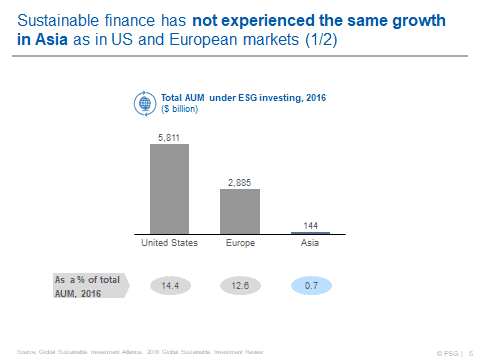

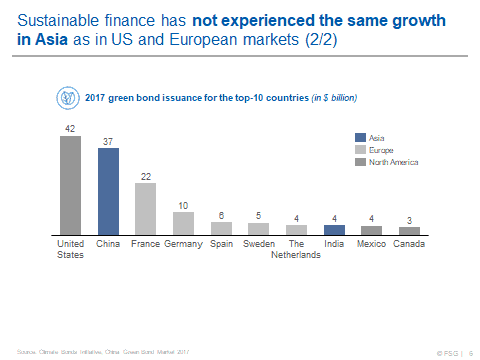

Despite the dramatic growth in sustainable finance mechanisms in recent years, Asia has yet to realise its full potential and continues to lag behind the US and Europe. While the market for green bonds has grown globally from $87 billion in 2016 to $167 billion in 2018, only 2 Asian countries – China and India – were included in the top 10 countries based on cumulative green bond issuance. The fact that 83% of ESG assets under management in Asia are concentrated in Japan reveals an even wider gap between most of Asia and the more advanced ESG markets. In our recent report, “Financing the Future of Asia: Innovations in Sustainable Finance,” by FSG Advisory Services Pvt Ltd. and AVPN with the support of the Rockefeller Foundation, we delve into the importance of sustainable finance in Asia and the innovations coming out of the region.

Sustainable finance is pivotal for Asia for 5 reasons:

- Sustainable finance takes a more holistic perspective of development.

Institutional investors that take a long-term perspective acknowledge that financial returns cannot outrun social and environmental consequences. Many Asian countries currently favour aggressive growth tactics over sustainable practices, and if this continues, the United Nations estimates that by 2050 the Asia-Pacific’s GDP could decline by 3.3% from current levels. In 2017, Japan’s Government Pension Investment Fund (GPIF), the world’s largest asset owner with $1.5 trillion in assets, announced its intention to raise its ESG asset allocation to $29 billion. - ESG practices can offer more opportunities to generate strong returns.

Several studies have shown that companies with robust sustainability practices can outperform their counterparts. In China, the China Alliance of Social Value Investment (CASVI) developed a ranking list, Social Value 99, of the top 99 Chinese companies with strong social value to demonstrate that ESG performance does not lead to lower financial returns. - Asia has the ability to lead in prototyping new models.

Although Asia continues to face development gaps, the convergence of engaged investors and innovative tools is leading to new sustainable finance models. India was the first country in the world to issue a development impact bond (DIB), which is a performance-based financial instrument that repays private investors with donor funds if development outcomes are achieved. The $422,000 Educate Girls DIB was launched in 2015 and successfully concluded in 2018. A much larger $11 million Quality Education India DIB was launched in late-2018. - Finance innovations are making communities more resilient.

Asia is prone to natural disasters and this threat is growing due to the effects of climate change. Yet innovations in sustainable finance are making it easier for people to respond to them. This includes the Southeast Asia Disaster Risk Insurance Facility (SEADRIF), a pooled insurance product offering immediate payouts to governments during serious natural disasters, which currently covers Cambodia, Laos, and Myanmar. Conservation finance models, such as climate funds investing in Indonesia’s rainforest to mitigate carbon emissions and support local communities, could also be expanded to other areas in the region. - Sustainable finance can be aligned with other trends in investing.

The intention of sustainable finance to generate positive and sustainable impact on the economy, community and environment without compromising financial returns is similar to Shariah-compliant finance. This reveals the potential of aligning sustainable finance with Islamic finance. In 2017, the first ever green sukuk, green bonds that are compliant with Islamic finance standards, was issued in Malaysia. The following year, Indonesia issued the first sovereign green sukuk with a second tranche issued in 2019.

Cross-sector collaboration is key to mainstreaming the sustainable finance sector

Asia’s growing interest and momentum in sustainable finance sends a strong signal that the region can fulfil its potential as a leader in sustainable finance. But to realise this potential, cross-sector and cross-national collaboration is needed to engage stakeholders along the continuum of capital and replicate successful models in other areas. In order to enhance sustainable finance, stakeholders must first create new financial vehicles. Second, risk capital must strengthen these untested vehicles to make them investment-ready. Finally, sector participants must collaborate and mobilize capital to mainstream these vehicles.

Those who wish to drive dialogues around sustainable finance should attend the AVPN Conference which will cover the topic through different plenary and breakout sessions. Join Standard Chartered Bank, Temasek International and leading practitioners to explore opportunities to encourage more mainstream capital into the sector; Moody’s Corporation, Schroders and other ESG investors to discuss challenges and opportunities in using ESG and promoting sustainability; FSG, Mann Deshi Foundation and thought leaders to grow innovative finance in health, agriculture, climate and energy sectors.