4 min read

Impact investors are fueling solutions to the systemic challenges framed by the UN Sustainable Development Goals (SDGs) — and they include Asian investments that catalyze solutions to social and environmental problems, finds a new report from Toniic, the global action community for deeper impact investing.

T100 Focus: The Frontier of SDG Investing unearths data from 76 Toniic member portfolios totaling $2.8 billion in committed capital that are 100% activated for impact across asset classes.

The SDGs map developmental issues particularly relevant to Asia, where rapid per capita income rise highlights the need to balance growth with economic equality and environmental sustainability. Issues like these spurred Toniic member Annie Chen to found RS Group in Hong Kong “to invest in the future we want to create.”

Investors like Chen are filling financing gaps across the continent to foster sustainable cities and affordable clean energy as well as address human health and resource consumption.

Affordable housing is crucial to sustainable cities and communities

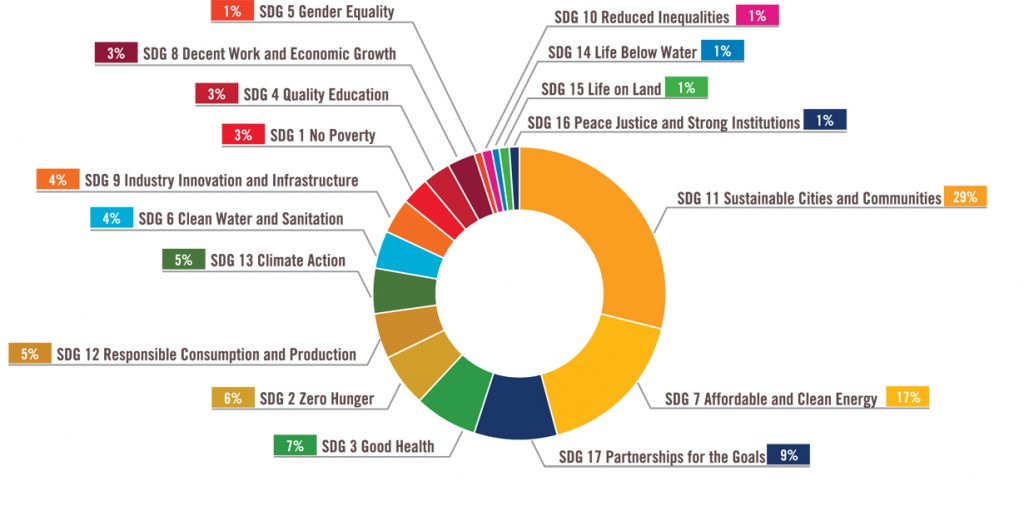

While the aggregated portfolios address all 17 SDGs, just five account for more than 60% of investments: sustainable cities and communities (SDG 11), affordable clean energy (SDG 7), good health (SDG 3), zero hunger (SDG 2), and responsible consumption and production (SDG 12). The Tonic Directory has examples of investments in Asia that touch each theme.

Sustainable cities and communities are the top target of the portfolios worldwide, attracting nearly a third of all SDG investments. As urban areas continue to expand, people all over the world are struggling with pollution, inadequate infrastructure and lack of services. This is reflected in India: 20% of the population lives below the poverty line and there are 1.77 million homeless people, and it is also one of Asia’s most vibrant impact investing markets, according to AVPN. Two Toniic investments that focus on serving low-income communities are Elevar Equity Fund, which provides early-growth capital to ventures focused on services, such as housing; and Bangalore-based Unitus Ventures, which invests in startups with the mission to reduce poverty through economic self-empowerment.

Clean energy investments grow renewable energy access

Ensuring access to affordable, sustainable energy attracts the second-largest amount of capital across T100 portfolios, invested in three themes: the transition from fossil fuels to clean energy (65%), access to clean energy (28%) and energy efficiency (7%). Investments in SDG 7 are spread across a variety of asset classes, and investors are expecting higher financial returns, possibly due to the relatively high exposure to private equity.

Asia and the Pacific account for more than half of global energy consumption, mostly from fossil fuels. To grow renewable energy access, Toniic members have made direct investments in companies like Energy in the Philippines, which designs and installs solar PV products, and GreenOil, a social enterprise that produces renewable energy in India using farming waste.

Asia Environmental Partners uses a broader approach and focuses on long-term investments in Asian companies. The fund has deployed over $370 million across Asia in energy efficiency, renewable energy, waste management and carbon credits.

Focus on good health, responsible consumption

A broad spectrum of capital is infused into healthcare. Investors in SDG 3 mainly support access to healthcare (58%) and disease prevention and response (34%). There is a near-even split of private equity for startups that develop new models and products, and public equity focusing on companies of scale. In China, for example, impact investors have targeted Bonzun, whose health monitoring software for pregnant woman has helped over 2 million people. In India, the venture capital fund HealthQuad invests in a variety of early-stage healthcare companies.

Investments in sustainable agriculture—mainly through real assets such as farmland—feed SDG 2, zero hunger. Direct investments accounted for two-thirds of SDG 2 allocations, funding companies like DripTech, a company in Pune and Beijing that produces irrigation systems for small-plot farmers. Investors also support social enterprises that provide income for small-scale farmers, like Hilltribe Organics in Thailand, and Kennemer in the Philippines, which finances organic cacao growers.

Finally, SDG 12 investments reflect the widespread need to minimize resource extraction and use of toxic materials. Fixed income takes the lead, followed by public equities like Generation Asia Fund, a $1.5 billion fund that invests in public equities. With Asian consumers’ buying power increasing, the fund is focusing on increasing sustainable consumption.

Impact investors inspire solutions in Asia and beyond

The report shows that investments across asset classes and returns are needed to address all the SDGs, and each goal has distinctive investment opportunities. It will take a spectrum of capital to address the broad range of issues Asia faces.

Many investments of the T100 portfolios are in listed companies and target commercial returns; others are private and illiquid, with a range of return expectations, but all with the aspirations for tremendous impact far beyond what is typically achievable with public market investments.

These investors — like RS Group in Hong Kong, which supports a regional impact investing sector — are not just focused on growing wealth but financing sustainable solutions to major global problems and sparking a transition to finance that addresses climate and environmental issues. For more information on opportunities to fund sustainable development around the world, dive into T100 Focus: The Frontier of SDG Investing.