4 min read

There is an urgent need to stimulate private sector investment into areas highly disrupted by climate change, such as food production, water and natural environment, infrastructure, disaster risk management and nature based solutions. Climate finance for these sectors is critical to advance the Sustainable Development Goals, including alleviating poverty and supporting the most vulnerable groups. The question remains: how can we significantly scale up investment into goods and services which build resilience to the effects of climate change?

We know that investing into companies providing goods and services which build resilience is risky. Not only does it require investing into some of the most climate vulnerable regions, but it does so in sectors which are notoriously complex to invest into, and which may traditionally require public sector resources. However, the extent of this challenge cannot be met by public resources alone, it urgently requires the innovative capacity, technologies and financial resources of the private sector. Yet, addressing the acute under-investment requires overcoming a number of barriers for private actors.

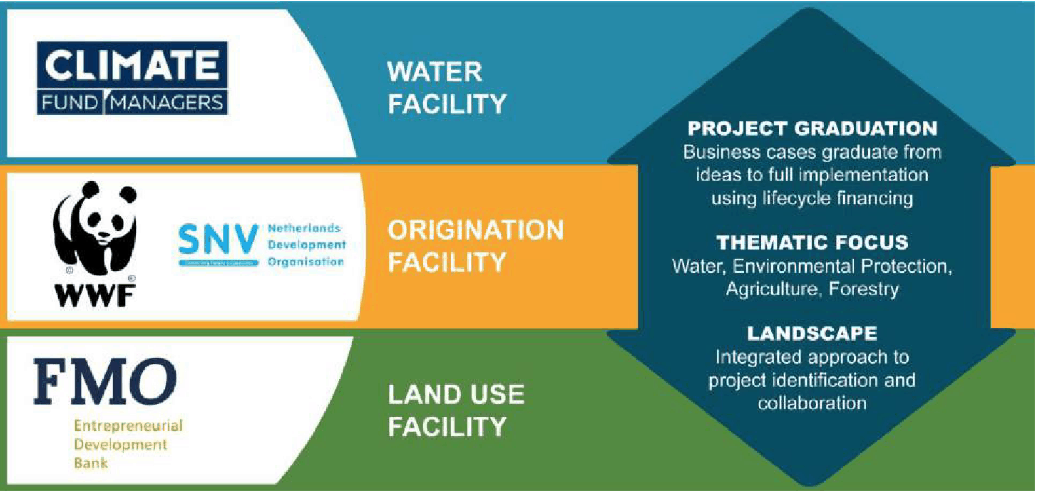

Recognising that there is a major deficit in financing for climate change adaptation, the Dutch Fund for Climate and Development (DFCD), was established. The DFCD is an innovative partnership between FMO- the Entrepreneurial Development Bank, SNV – the Netherlands Development Organisation, Climate Fund Managers and WWF Netherlands, primarily aimed at investing into companies providing goods and services which will help economies adapt to the effects of climate change. One of the architects of the fund, was Richard McNally: ‘’We realised early on that a more innovative structure was needed to mobilise investment for climate change adaptation, we therefore built the facility around the three pillars of – project graduation, priority investment themes and a landscape approach’’. These key elements of the DFCD Facility are described below.

‘’The DFCD provides a unique vehicle that can showcase a new way of delivering climate finance and positively contribute to its global ambitions and efforts to strengthen the international response to the climate challenge’’.

– Aart Mulder (FMO Manager of DFCD)

The project graduation mechanism allows the fund to efficiently generate part of its own pipeline of projects. A lack of bankable projects or a pipeline of projects, was seen as a major constraint, commonly mentioned by public and private investors, to investing in low-carbon, climate resilient projects. The DFCD therefore included an Origination Facility, managed by SNV and WWF, to identify and work with companies. The DFCD provides life cycle financing; starting from identification and support to structuring the prospect, through to investment and possibly re-financing. The combination of local knowledge of SNV and WWF-NL with the understanding of financial solutions from an international development bank, has helped create and develop high impact, climate resilient, bankable solutions.

The DFCD Impact in action. “The DFCD’s focus on climate change adaptation allows the fund to make investments into new solutions and new technologies that are the key to driving resiliency and impact at a very high level.”

– Alex Downs, Regional Investment Officer, Asia

The fund has a thematic focus guiding its investment priorities. Priority investment themes were chosen based on where there is the strongest need for investment in climate-resilient development, as identified in the UNFCCC 1.5C report, while also showing good potential for financial returns. Focal investment themes included: (i) water and sanitation, (ii) climate smart agriculture, (iii) forestry; and (iv) general environmental protection. The fund’s activities have attracted interest from both public and private sector stakeholders seeking to understand how the projects, and the benefits they deliver, can be replicated.

The DFCD has a landscape lens. The Consortium is focusing its work in a set of key landscapes in which vulnerable ecosystems and populations face an elevated risk of climate change impacts. The landscape focus provides opportunities to identify projects that amplify the impacts of others or to offset the negative impacts that a standalone project might have. For example, upstream conservation agriculture and solar irrigation efficiency projects may enhance the efficiency of downstream water treatment and drinking water supply installations.

The DFCD is excited to join AVPN and share lessons and learn from other members on how we can upscale investment into climate change. This is particularly important in the run up to COP 26 in Glasgow which will kick off discussions on a new, larger climate finance goal for 2025 with a greater focus on climate change adaptation.