3 min read

Japan Social Innovation and Foundation (SIIF) plays a key role in building a viable impact investing ecosystem in Japan by providing risk capital and impact management expertise to address pressing social issues, measuring and managing social impact generated by investees, and advocating system and policy changes. A sustainable impact investing ecosystem encompasses policy development, funding and financial product provision, knowledge creation, human resources enablement and cultural fostering as well as rigorous management and active promotion of social impact. SIIF looks to the Impact Management Project (IMP), a global platform and network for building consensus on measurement, management and reporting standards, to manage its investments’ impact. By measuring the impact generated by each of its investee ventures using the IMP framework, SIIF incorporates its value in its decision-making and throughout the investment management process.

SIIF’s mission is to cultivate a social impact investing ecosystem to solve social issues together

Source: SIIF Annual Report 2018

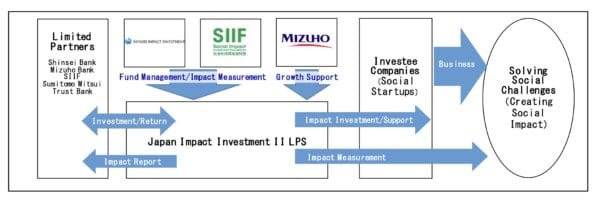

In June 2019, SIIF set up an impact investment fund (the Fund), currently at about USD 25 million, with Shinsei Bank Group and Mizuho Bank.

The Fund’s investment scheme

Source: https://www.shinseibank.com/corporate/en/news/pdf/pdf2019/190628_impact2_e.pdf

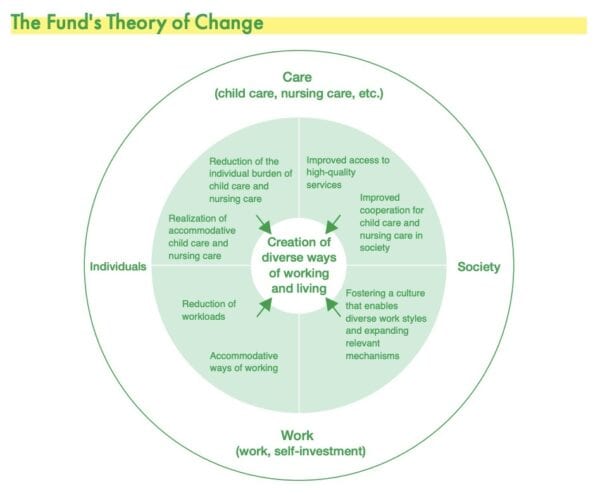

The Fund’s Theory of Change centers around creating diverse ways of working and living for individuals in Japan. For example, child care and elderly care will be more affordable and accessible, and society will also be able to accommodate and diverse work styles to improve quality of life.

Source: SIIF Annual Report 2018

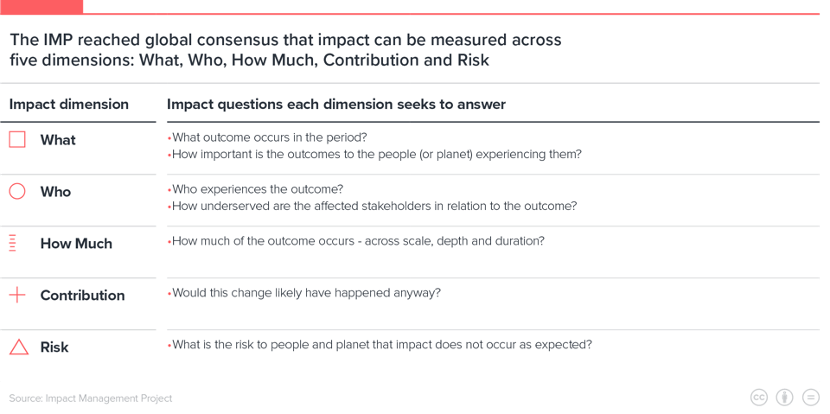

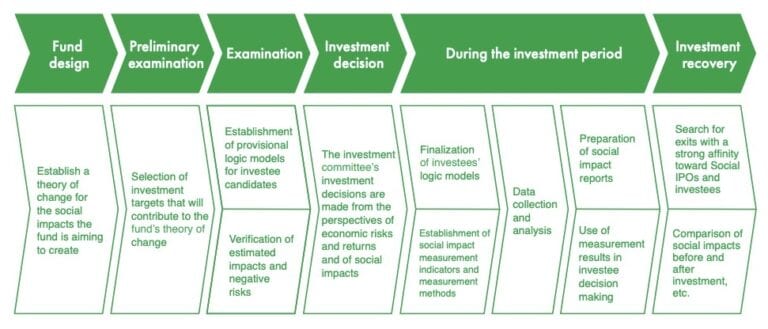

The Fund looks to invest in social startups that align with its Theory of Change. At the Due Diligence phase of assessing potential investments, SIIF develops a logic framework for each investee candidate and identifies what potential outcomes each candidate might generate. SIIF, then, analyzes each potential outcome using the IMP’s 5-dimension model, ie. What, Who, How much, Contribution, and Risk. For instance, who are the beneficiaries? Who are the stakeholders? Are the desired outcomes important to the beneficiaries or stakeholders? As the Fund seeks market rate return on top of impact, SIIF finds it also crucial to deep dive into the business model of each investee candidate and analyze the relationship between the financial return and social impact to avoid any risk of misalignment.

IMP’s five dimensions

Source: Impact Management Project

There can be challenges in accessing all the data required, especially since impact data and evidence are not always readily available for benchmarking. SIIF takes a realistic viewpoint towards this so as not to make this process too cumbersome for either the Fund manager or the investees. Typically, after about 3 or 4 meetings, appropriate indicators can be identified with supporting data.

Process of measuring the Fund’s social impact

Source: SIIF Annual Report 2018

When asked why SIIF chose to adopt the IMP model for impact measurement and management of investee ventures, Fumi Sugeno, Head of Business Development at SIIF, commended IMP’s internationally recognized methodology as well as its flexibility for customization to fit different contexts and different stakeholders. She appreciated IMP’s efforts to build consensus while bringing knowledge and experience together, thus keeping a good balance between a measurement standard and management flexibility.

Other LPs of the Fund also welcomed SIIF’s adoption of the IMP model in the investee due diligence and investment decision-making processes. In fact, Mizuho Bank, one of Japan’s largest banks, joined IMP’s advisory group soon after, demonstrating its full support of the IMP framework.

As an ecosystem builder of impact investing in Japan, SIIF takes on advancing behavior change in the financial and investment community. By adopting the IMP model in its investment decision making, SIIF has embarked on the impact measurement and management journey and encourages more Japanese partners to participate in this fast-moving process so as to make it relevant to the Japanese investment community from an early stage. Learn to measure impact using the IMP framework here.