5 Min Read

Summary points:

- Gain an overview of what a Development Impact Bond (DIB) is and how it works

- Identify targeted recommendations to leverage upon as a DIB stakeholder

With the realization that $1.4tn a year is needed to meet the 17 Sustainable Development Goals (SDGs), there has been a heightened focus on innovative financing mechanisms. Development Impact Bonds (DIBs) are one such mechanism. A panel discussion at the Dasra Social Impact Forum (DSIF) that took place on 23rd February 2018 broke down the realities of how effective these bonds are, and what’s needed to make them successful.

What is a Development Impact Bond (DIB)?

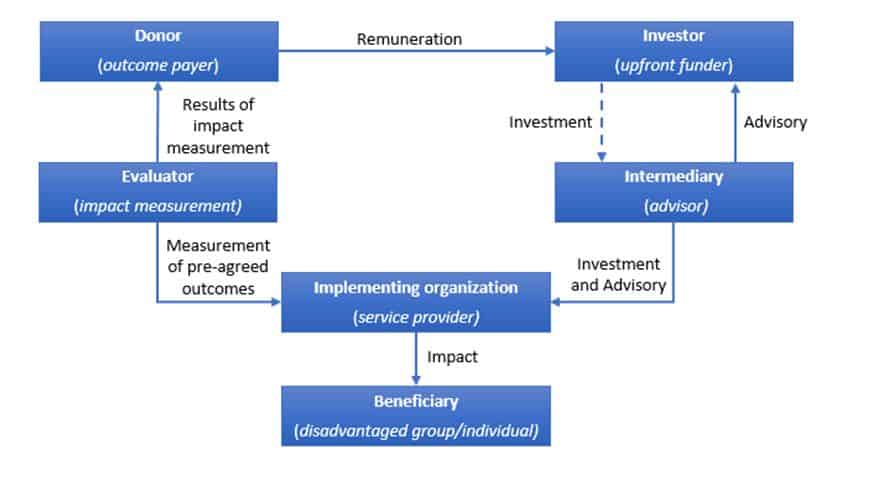

In a DIB, private investors provide upfront funding for a development program and get remunerated by donors if the program achieves pre-agreed outcomes. Here is a useful primer by Instiglio that elaborates further.

Why DIBs?

An analysis of 90+ DIBs shows that they enable impact in 2 ways.

- More dollars are driven towards the development sector as DIBs attract funding from sources that would have otherwise not entered the sector.

- DIBs improve the performance of implementer organizations. Accelerated systemic maturity, enhanced staff productivity, better resource allocation and greater accountability to the beneficiaries have been cited as some of the improvements.

Structure of a DIB

Recommendations for DIB stakeholders

If the benefits are so enormous, why aren’t there more DIBs in India? The evidence points towards certain resources and expertise that each stakeholder needs to have. To help create a more favorable market for DIBs, specific recommendations have been curated for each stakeholder. Most of them are obvious, sometimes too obvious, and yet they are rarely worked upon consciously.

Donor

- Develop partnerships

Donors have the unique advantage of influencing the ecosystem and other stakeholders. To incentivize investors and non-profits to be innovative, it’s important to work closely with them and find ways to align diverse interests. - Create funding that supports experimentation

Studies have shown that non-profits do not experiment enough for the fear of funding repercussions. Donors have the power to incentivize the identification of best practices by separating funding milestones from the rate of success.

Investor

- Aligning the environment and outcomes

Very often, even when an outcome is achieved, the chances of making a sustainable impact are lower if the environment is not aligned to it. For instance, if the aim to empower a woman does not take into account the influence of external factors, such as her parents, society and government, she will face backlash. Thus investors are encouraged to think about these factors when identifying outcomes to “purchase”. - Clearly demarcated roles

Clarify in detail, the role of every single stakeholder involved in the DIB and have a governance structure in place that will help serve as a “go-to” when things go awry.

Intermediary

- Know the costs involved

How much does the intervention cost? What does it take to achieve an outcome? Knowing the answers to these questions at the beginning helps to determine the success potential of a DIB. - Identify the best strategy

Identifying the right intervention to “economize” is important to achieve maximum impact. One way of getting data for this is to have long-term rate cards for interventions that utilize different strategies in the same sector. - Expand the evidence repository

Develop a repository of best practices that can be shared with all stakeholders to save time in going through tried-and-tested failures.

Implementing organization

- Know your metrics for impact measurement

If there are no well-defined metrics for impact measurement, success becomes difficult to measure. Every organization should define and validate their primary baseline (the status-quo statistics of the relevant problem) and measurement metrics upfront. - Install Performance Management Systems

Performance Management Systems (PMS) are expensive and it takes time to recover their costs because only long-term data is useful. However, they make it significantly easier to report progress to investors, which in turn serves as a base for attracting more funding. - Experiment, experiment, experiment!

DIBs work well because they allow for failing fast since they are driven by evidence-based decision making. This means that it is important to experiment with different strategies so that the winner is identified as early as possible.

Evaluator

- Mid-Course corrections

Since DIBs are new, it is likely that there will be initial gaps between pre-agreed outcomes and actual progress. Real-time updates should be given to the implementing organization so that mid-course corrections can be made to minimize these gaps. - Constructive Support

Evaluators are likely to be the closest stakeholder to the implementer organization. Hence it is important to provide constructive and motivational feedback while implementers test these new mechanisms.

DIBs in India

There are currently 2 DIBs in India (Educate Girls’ and Utkrisht impact bond) with DFID announcing another one recently in March 2018. We have a responsibility to build an ecosystem that allows for innovative mechanisms to flourish. Intermediaries like Dasra are working towards this and stakeholders have expressed positive views about the Indian ecosystem becoming more conducive for evidence-based action.

References: