4 min read

The public health emergency triggered by the COVID-19 pandemic has led to a substantial contraction in economic activities globally, wiping off jobs, engulfing ‘business as usual’ scenarios and pummelling stock markets.

There is, however, a silver lining. This crisis has changed the way capital markets look at Environmental, Social, Governance (ESG) risks in investment portfolios and funds. It has proven that ESG factors have been critical for businesses to achieve financial resilience.

The emerging significance of embedding ESG factors during a pandemic

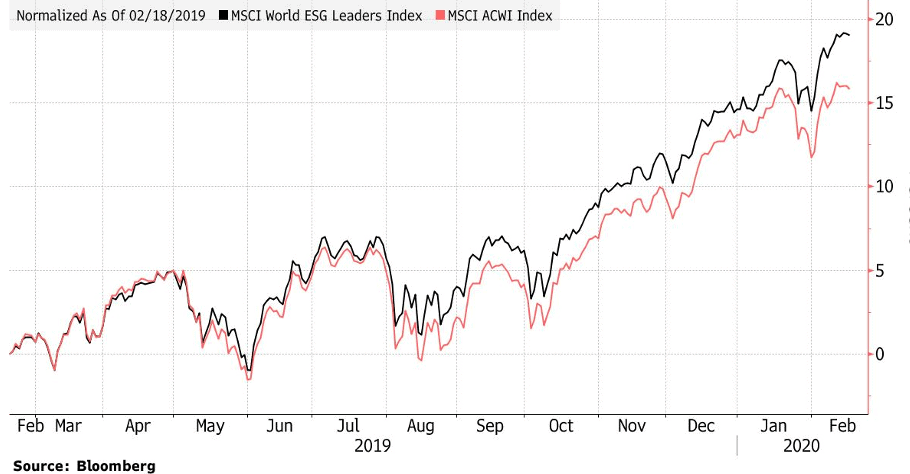

The United Nations has been encouraging their signatories to utilize ESG data to effectively cope against deleterious business outcomes amidst the crisis. In fact, the COVID-19 pandemic has given rise to an unexpected global “strengthening of convictions towards ESG portfolios” as they have been outperforming their traditional counterparts during this period of economic and social turmoil.

Fig 1: ESG stocks surpasses it’s peer

Source: “Good as Gold: ESG stocks have been outperforming the MSCI all-country World Index”

It is, therefore, timely that the Hong Kong Monetary Authority (HKMA) started regulatory reforms to achieve sustainable finance at the close of 2019.

Spotlight on Hong kong’s regulation: sustainability at the core of regional development

On 7 May 2019, the Hong Kong Monetary Authority (HKMA) initiated mandatory sustainable and green practices into all its future investment decision making to mobilize its HKD 4 trillion valued (in US $) Exchange fund. Inducted as a signatory member of the United Nations-supported Principles for Responsible Investment (PRI) in August 2019 , the HKMA is helping businesses transition and adopt ESG best practices in line with international sustainability measures. It is launching three initiatives which includes:

1. Developing a framework for Green & Sustainable Banking through

- Phase One: designing a common “greenness” assessment structure for banks, imbibing green principles and methodologies with support from relevant international bodies

- Phase Two: industry engagement and stakeholder consultation to communicate and set expectations from for the new regulations and development in the banking industry

- Phase Three: Monitor and evaluate the bank’s progress against set goals

2. Making ESG – risks adjusted investments a priority

Screening for ESG risks and opportunities for private investment portfolios as well as for public equity ownerships. ESG compliance is currently in place to assess credit risks of Hongkong’s bond market.

3. Establishing the Centre for Green Finance (CGF) to facilitate knowledge exchange for the Hong Kong banking and finance industry.

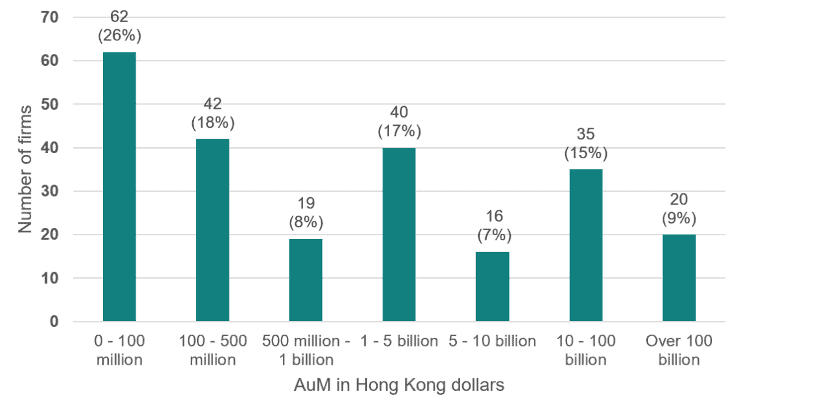

Findings from a survey by the Securities and Finance Commission (SFC) of Hongkong in late 2019 revealed that 83% (660) of the surveyed asset management firms considered at least one environmental, social and governance factor in their investment processes. Asset management firms including small ones (defined by their AUM) also used ESG practices in their research and portfolio management.

Fig 2 : Assets under Management (AUM) in Hongkong of surveyed asset firms, 2019

In order to strengthen the ESG disclosures for listed companies in Hongkong, SFC has also been working closely with the Hong Kong Stock Exchange (HKEX). The HKEX has published new reporting guidelines on December 18, 2019 which will come into force on 1 July, 2020. To prevent ESG inertia among listed companies due to lack of expertise, the HKEX also developed e-learning courseware as guidance for effective ESG reporting.

According to the Hong Kong Green Finance Association, the new set of ESG reforms could be a great enabler to attract more foreign investors for HKEX-listed companies. It would be “crucial to capture the growing demand for investors and avoid capital flowing out of Hong Kong in search of alternative sustainable investment solutions”[1].

The way forward: ESG-led financing strategies for economic development

Hong Kong’s new regulatory actions are emblematic of the growing opportunity for impactful capital markets and investment strategies in Asia and ESG regulatory trends in Vietnam and Singapore[2]. What the city state has rolled out is part of the growth of ESG encouragement measures in Asia that includes diverse financing strategies for regional economic development (view appendix).

The pandemic has exposed core interdependencies and vulnerabilities within economic, social and natural systems. The resilience of ESG portfolios, however, can inspire global investors who have been sitting on the side lines of ESG investment to reconsider these opportunities. Spurred by regulatory advancements and enabling technology, Hong Kong may be the role model the world needs to effectively transition out of the crisis.

Appendix: ESG-led financing strategies adopted by key investors across Asia

Private sector capital mobilization platforms such as the SFi (Sustainable Finance initiative) Hong Kong, a coalition for targeted sustainable social impact portfolios

Launching of ESG forums such as World Wild Life Fund’s (WWF) co-partnered multi-stakeholder platform – Asia Sustainable Finance Initiative (ASFI) to enable financial institutions to fast-track ESG integration to meet nationally determined goals under the SDGs and Paris Agreement.

Corporate engagement via targeted impact investments by corporations such as Johnson and Johnson, Singtel Group and Danone

Addressing environmental risks: Some prominent examples of businesses meeting their carbon emission targets with the incorporation of science based target initiatives (SBTi) include, City Development Limited (CDL), Singtel Group and Unilever;

Promotion of circular economy investments by HSBC, Bank of America, and integrating sustainability in investments portfolios by UBS;

Incorporating tangible measures to contain social and governance risks as exemplified by corporations such as Grab and American Express, during the recent COVID-19 crisis.

[1] https://www.hkex.com.hk/-/media/HKEX-Market/News/Market-Consultations/2016-Present/May-2019-Review-of-ESG-Guide/Responses-(December-2019)/cp201905r_083.pdf

[2] In November 2019, the State Bank of Vietnam issued a directive to all Vietnamese banks requiring them to (i) include ESG risk assessments in credit risk analysis, and (ii) establish dedicated ESG analysis units by 2025. In the same month, the Monetary Authority of Singapore (MAS) announced the establishment of a US$2 billion green investment programme which will invest in funds that can demonstrate the incorporation of ESG considerations in their investment process.”

https://www.mayerbrown.com/en/perspectives-events/publications/2019/12/results-of-hong-kong-sfcs-survey-on-esg-and-climate-change-in-asset-management-key-takeaways-for-asset-managers