5 min read

“At the end of the day, I believe we all share the same underlying goal of gender equality, and while it’s easy to get distracted by all the details, it’s important to remind ourselves of that!”

– Shuyin Tang, Partner, Patamar Capital

What motivated you to become a gender lens investor?

We have been thinking about the overall impact of our portfolio on women and girls for some time, even before we started formally engaging with GLI. Many of our team have had a long history of investing and supporting businesses in the microfinance sector, where women play such a crucial role. We had also noticed that the customer bases of many of our portfolio companies were predominantly female.

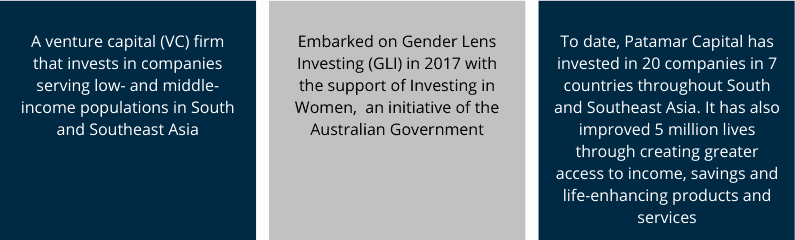

We began engaging more deeply with gender lens investing in 2017, when we were selected as an impact investing partner by Investing in Women (IW), an initiative of the Australian Government. Joining the IW initiative allowed us to learn from experts such as the Criterion Institute and gave us access to a strong peer group of other like-minded investors. It was great to learn and share best practices, discuss new ideas and perspectives, and delve deeper into the practicalities of applying a gender lens to our respective portfolios.

What guides your investment decisions? Have you seen any returns?

The guiding force is different for each of our funds. For the IW Fund and the Beacon Fund (a new fund that we plan to launch soon), gender is the key guiding force. For others, gender is definitely an important factor but not the only one. We strive to apply a gender lens in all our operations and investment decisions and classify all our funds as gender lens funds.

Our approach to gender lens investing is captured in two areas:

- Our due diligence process. We developed a list of questions that act as ‘conversation starters’ about gender for discussions with entrepreneurs, industry experts, the company’s customers and other stakeholders. Covering various areas, from the company’s organisational policies to customer profile, these questions help us to better understand the entrepreneurs’ motivations and values, and how well they understand the gender dynamics in their business. The results of this due diligence must be included in our Investment Committee memos, forcing the team to think deeply about these issues, instead of simply indicating a ‘yes/no’ in a checklist.

- Our internal investment and business practices. We ensured that gender lens analysis is present in our Investment Committee memos and discussion agendas. For our Investing in Women (IW) Fund, we had an Investment Committee that was majority female for the first time. We also rolled out simultaneous electronic voting instead of having members cast their votes verbally, one after another, to reduce unconscious – or even conscious – bias in investment decisions. As gender-lens investing assumes a more prominent place, our team continues to actively seek out gender-disaggregated data. For example, a colleague recently discovered that the majority of pharmacists signing up with one of our portfolio companies in the healthcare sector is female. With this information, we advised the company to customise their engagement approach and marketing strategy to reach out to women more effectively.

How does Patamar Capital encourage more mainstream businesses and investors to join the gender lens ecosystem?

We are seeing greater interest in gender lens investing in Southeast Asia recently, which is a good thing. There is usually a dedicated event or a number of sessions on gender lens investing in social investment-related conferences and seminars. However, there is still ambiguity on how companies can move from simply having an interest in gender lens investing to actually taking action.

We are focusing on helping our portfolio companies apply a gender lens in their activities. Whether we’re engaging with them on talent management, customer acquisition or retention strategies, we try to bring gender-related issues to the forefront. This helps our portfolio companies see that gender can contribute to capturing opportunities and reducing risks.

Any tips for new or interested entrants to gender lens investing?

The most important tip is just to get started on it, rather than trying to digest all the literature available on the topic. Decide how you want to engage with GLI, in line with your company goals and values, and put that strategy into execution as soon as possible.

It’s important not to overcomplicate things when you are starting out. Gender can be a polarising topic, and sometimes we might spend too much time creating a perfect approach. In our experience, it’s better to experiment, make some mistakes, learn along the way and course correct. Our approach to gender has evolved a lot from what it was three years ago. All the learning (and struggles) along the years was definitely worth it, and brought us to where we are today.

Also, the biggest myth of gender lens investing is that it’s only about investing in more female entrepreneurs. In fact, I myself thought so when we first started out on our gender lens investing journey. It’s certainly important to increase capital flows to female entrepreneurs, but this can also result in organisations adopting opportunistic or ‘quick fix’ approaches. For instance, organisations might find women entrepreneurs to invest in just to meet certain ‘quotas’, instead of pursuing more transformative use cases – such as systematically changing investment approaches and processes to better meet women’s needs at many levels.

How can AVPN support the work that you and your peers?

AVPN can definitely help organisations like us propagate the overall gender lens investing agenda, as it plays a crucial role in providing connections and resources across a diverse group of investors, philanthropists and other stakeholders. It has the convening power to gather knowledge and expertise, and also enable easy knowledge sharing through the strength of its network.

It’ll be great to see AVPN’s conferences and events continuing to promote the gender agenda, and keep the spotlight shining on it. Resources on how organisations can translate interests in gender lens investing to actionable strategies will certainly be valuable for those that are just starting out on this journey.