5 min read

For many Non-Profit Organisations (NPOs), their understanding of cash flow management lies on the level of knowing that their cash reserve is above a certain amount. In a time of unprecedented economic downturn, more NPO leaders have started to feel anxious about whether they would have sufficient cash now and in the next few months. Leaders are finding themselves looking at numbers more often and have been asked to look into cash flow management (which is something they are not necessarily prepared for).

For NPO leaders who are not financially trained or have no idea what cash flow management is, I have two pieces of news for you. The bad news is that, compared to the corporate world, there are very limited options to help NPOs with cash flow. For example, NPOs in most countries are not eligible for bank loans. The good news on the flipside is that this means there are only a few things you need to learn to be on top of your organisation’s cash flow situation. Trust me, if you can read your personal bank statement, you will be able to understand cash flow management.

There are three main misconceptions about cash flow management:

- Spending within budget = Managing cash flow

- Managing cash flow is the finance team’s job

- Future cash flow needs to be projected as accurately as possible

If you believe any of the above is correct, read on.

Misconception 1: Spending within budget = Managing cash flow

Most NPOs operate with an annual budget (including income and expenditure) where they control and track their actual spending against the budget. However, spending within budget does not guarantee that you will have cash to pay for those expenditures.

This is similar to how we manage our personal finances. For instance, you could have budgeted for a new phone for October. But you may not have enough cash on hand to pay for the phone before your October’s salary comes in on the 25th. I am sure there are many other instances where you can afford something yet do not have sufficient cash to pay for it at that moment.

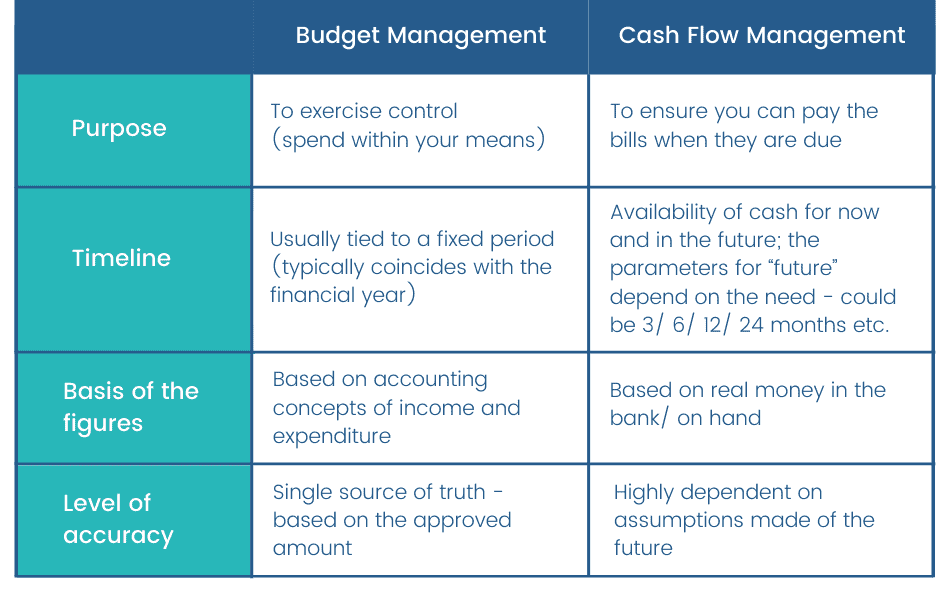

And that is where the key difference between budget management and cash flow management lies:

We all need to go beyond managing our budget to managing cash flows as well. The shift requires you to take into account the time factor when managing your income and expenditure. For example, if a large grant that was supposed to come in this month gets delayed to 2 months later, would you have sufficient cash to pay your employees and vendors in the meantime? You will not know unless you are keeping tabs on your cash flow position.

Once you are aware of your cash flow position, you can then implement various strategies to improve your cash flow position. The rule of thumb is to always spend within your means, to collect money as fast as you can, and to stretch payment as long as possible.

Misconception 2: Managing cash flow is the finance team’s job

It is not wrong to think that the finance team should be responsible for cash flow management. Since the finance team usually has access to bank statements and other financial information, they should rightly be the ones to monitor, report cash balance and project future cash situations.

To ensure and sustain a healthy cash flow, however, your entire management team (or even the ground staff) should be held responsible. Take grants as an example. Many grants are disbursed at key milestones contingent on the fulfilment of KPIs. When such KPIs are not fulfilled, the budgeted full grant amount may be reduced. For this, Programme leads would have more control or would be more cognisant of the possibility of not being able to fulfil certain KPIs, hence they also have the responsibility to communicate such situations to the finance team.

This is even more critical when projecting cash flows, which is based on a set of assumptions. These assumptions are usually driven by operations. In particular, finance teams would not know when the next fundraising event is, the payment terms of vendors, or whether the budgeted expenditure will or will not be spent.

Hence, cash flow management should be a collective effort by the core management team and the finance team.

Misconception 3: Future cash flow need to be projected as accurately as possible

There is nothing wrong in striving to make your cash flow projections accurate. But the bad news is that there is just no way we can project cash flow 100% accurately as we have no control over the future. Especially in these volatile times, there are bound to be uncertainties and risks such as the timing of when the grant may come in, or how many tickets you can sell for a virtual fundraising gala.

Instead of spending time to perfect your assumptions, you should use the time to evaluate different scenarios, i.e. ask yourself the WHAT IF questions.

What if my fundraising campaign sees a 50% drop in donations?

What if my fundraising campaign goes viral and donations increase by 30%?

A good cash flow projection will not only have one view of the future but give you an idea of everything that could possibly happen – the most likely scenario (base-case), the worst-case scenario, and the best-case scenario. So you will never be caught off-guard and you can evaluate different options and make more informed decisions.

Convinced but not sure how to incorporate scenario planning in your cash flow projections? Start from a robust, dynamic cash flow projection template and apply some Excel magic to determine what actions to take based on the scenario.

Manage your cash now to continue your mission

With limited resources, I can understand the need for an NPO to focus all manpower and effort on their beneficiaries. Yet, without cash, you will not be able to continue delivering your services. So, make sure cash flow management is always in your priority, even if it means you need to start brushing up on your excel skills.