5 min read

I remember the day we decided to start Good Financial, our social enterprise (SE). It was a beautiful day in Hong Kong. The sun was shining, the streets were buzzing, and as I walked excitedly down the street I knew we were onto something special. I also knew we would have significant capital requirements.

To get started we invested $200,000 USD of our own money, then raised another $400,000 from friends and family. At the same time, demand from customers was overwhelming. We had 5,000 customers in our first 6 months. That’s when I knew raising capital was going to be even more important than I anticipated.

Admittedly, I was completely new to raising capital. My first business was bootstrapped and never took outside investment, so I was eager to learn.

Soon after, we had some extremely good luck. Our guardian angels at AVPN and Credit Suisse got in touch. We were selected for their pilot programme on “Investment Readiness“. This was exactly what we needed!

It has been such a valuable experience for us, I wanted to share our key insights in the spirit of paying it forward. As we strive to become investment ready, these are ideas that shape our thinking.

STEP 1: START WITH THE INVESTMENT READINESS FRAMEWORK

The first conversation between founder and funder should begin by filling out Village Capital’s VIRAL* investment readiness pathway together. VIRAL is an amazing tool. In essence, by using it you will take a shortcut to getting aligned.

The framework allows both parties to assess the SE across 8 different categories and answers the question: “What stage is your operation at?” It quickly highlights strengths and areas for further development. It only takes 15 minutes to complete and provides a comprehensive summary of the business.

The best part is that it’s not abstract or conceptual. It uses clear descriptions and definitions, and in doing so, creates a common language for both parties to understand each other better. This minimises miscommunication or misunderstanding, which means that the conversation gets off to a great start. It’s a truly remarkable tool and simplifies the process of getting to know each other.

STEP 2: DEEPLY EXPLORE THE IMPACT

As a community of like-minded people, we are united by our common desire to do good. This is what brings us together. Given this, it makes sense that fully explaining the impact of the SE would come next. There can’t be any uncertainty or doubt about the impact.

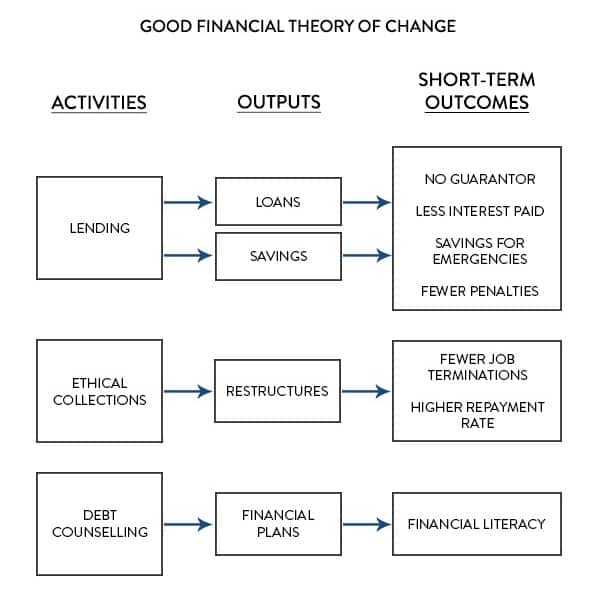

The logic needs to be fully demonstrated through a Theory of Change or Logic Model. Getting granular here is a good thing.

This will break down the problem, what activities the SE does to solve it, the outcomes created, and the long-term impact. Discussing each step in a logical order, and telling real-life stories, creates further clarity and certainty about the impact. Where possible, quantifying the impact adds extra power and creates a stronger case for growing the SE.

For the funder this granular detail and human-centered storytelling makes the impact come alive. It provides a strong foundation to continue the rest of the conversation.

STEP 3: FOCUS ON UNIT ECONOMICS

After demonstrating the impact, the next big question will be about the financials. Admittedly, entrepreneurs tend to be optimistic. We are inherently biased to believe the future will be rosy. Our optimism is a good thing, but it’s also important to ground entrepreneurs in numerical accuracy and sound unit economics.

Unit economics are crucial to becoming investment ready because if you have unit economics that are broken, adding investment will only create a big problem. However, if the unit economics are sound, investment fuels both healthy growth and impact.

After exploring the unit economics in detail and building a financial model both founder and funder will gain a sense of confidence about the financial prospects of the business, and this leads both parties to feel good about the impact and the future of the SE .

BUILDING TRUST

At the end of the day, building trust is what truly matters to becoming investment ready. In our busy, distracted world, building trust is hard. Every interaction makes a difference.

Trust is not some vague quality. It is the specific state that exists when two people are in sync. And getting in sync requires a series of great conversations where alignment is created and a common language is developed (step 1), shared values around positive impact are reinforced (step 2), and an inspiring, but realistic, vision for the future is developed alongside a sound financial forecast (step 3).

By following these 3 steps I believe trust can be created and both founder and funder can enjoy the process.

GETTING READY TO SCALE

As for Good Financial, our VIRAL investment readiness assessment showed that we have a strong value proposition, product, and business model, but need more work on preparing to scale. We have now proven our idea but as we move from early-stage to scaling, we need to standardise our operations. Moreover, as a growing fintech company focused on lending, our capital requirements will be significant. I am really excited to implement these learnings and work closely with funders to build the future of finance for migrant workers.

* VIRAL is created by Village capital as a self-awareness tool that companies can use to become ready to raise investment, regardless of their current stage, while investors can use this framework to articulate whether and why a company is a good fit for them . This enables companies and investors to have one common language to talk about a company’s current stage and what type of investors are best suited for the company at a given point in time.