Co-author: Shweta Bhardwaj

4 min read

Mental health in India

India’s mental health crisis afflicts approximately 15% of its population[1]. In fact, the prevalence of mental health disorders has been increasing steadily from 125 million population in 1990 to 197 million in 2017. Despite it being a huge national problem, India’s expenditure on mental health was just 1.3% of its government health expenditure in 2017[2].

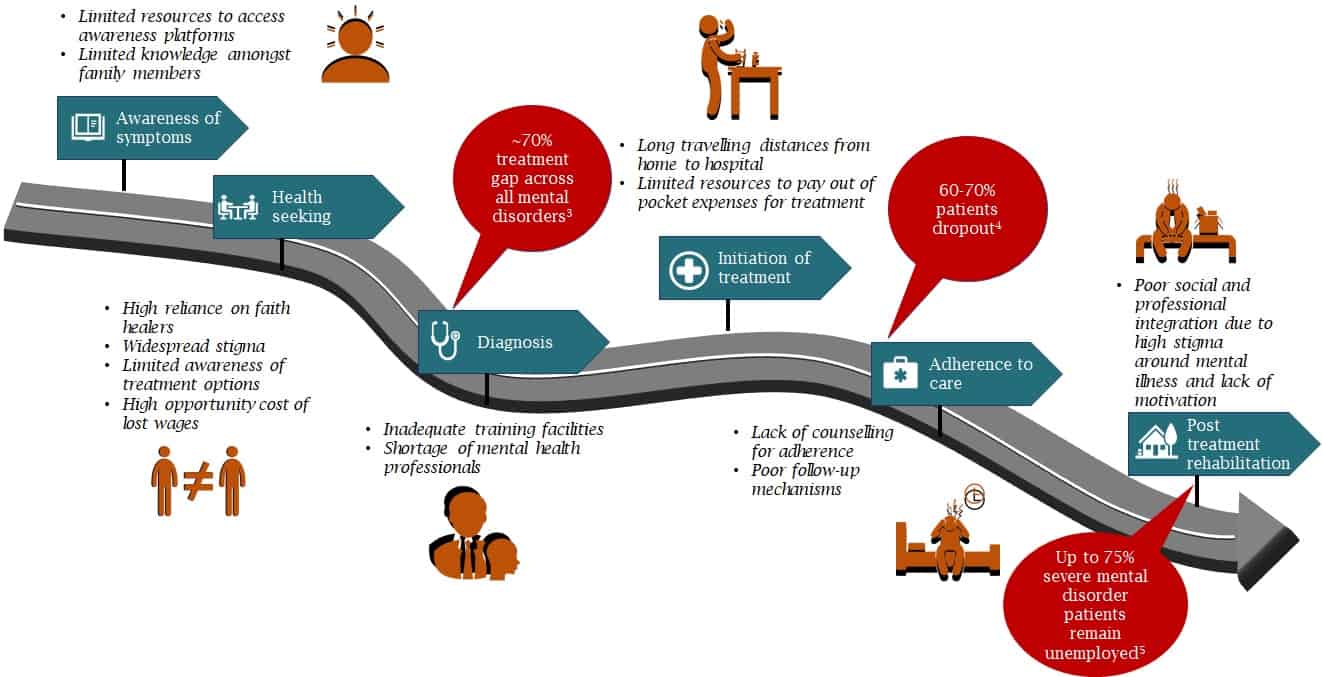

Without being historically prioritized across Indian states, mental health has been further exacerbated by the COVID -19 pandemic. There are several challenges across the patient care journey of mental health in India, as illustrated below:

Identifying innovative mental healthcare models

To improve mental health care delivery in the country, we need effective, innovative, and scalable mental health interventions. Some elements of these models can include:

- Establishing a well-defined care pathway for frontline workers to detect, counsel, and refer individuals at the community level.

- Conducting behavioural change communication campaigns to destigmatize mental health issues and present the options for care for both patients and caregivers.

- Enabling anonymous modes to seek help, such as mental health helplines or apps.

- Improving healthcare accessibility by leveraging digital tools and strengthening mental health service delivery at primary and secondary care levels.

- Improving adherence to care through psycho-social education, setting up follow-up mechanisms

or change of treatment regimen with increased adherence.

Defining the role of impact finance in scaling up mental healthcare models

Two key barriers to mental health financing include low-spending and underutilization of available expenditure. In the last few years, however, impact financing has emerged as a significant investment opportunity that not only delivers measurable health impact alongside financial returns, but also increases access as well improves efficiency of funding in the country.

- Impact finance increases access to funding:Innovative finance instruments can attract private capital by reducing or externalising the risks during the early stages into areas not traditionally funded such as mental health. Philanthropic actors can provide seed capital in the form of convertibles or competitive awards to fund innovative models across the mental healthcare spectrum. Such support can help develop proof of concepts that could be scaled by more traditional venture capital or private sector players. Grand Challenges Canada’s Global Mental Health program[6], for instance, focuses on funding high impact innovations that improve treatments and/or expand access to care for people, especially youth, living with or at risk of mental disorder.

- Impact finance improves efficiency of funding:Innovative finance can also be an effective mechanism in improving outcomes-per-dollar spent by ensuring incentives are aligned towards maximising outcomes. Service providers often face challenges in securing funding for large scale multi-year programmes. Pay-for-success mechanisms (including impact bonds) and conditional financing instruments (such as milestone-based payments) help secure long- term commitments by allowing for donors to only pay for successful outcomes. These models can be particularly advantageous as donors only pay for measurable results, while the programme implementor is made accountable to ensure the best programme delivery. The Resolve Social Benefit Bond in Australia[7] , for example, has funded a recovery-orientated community support programme that aims to support people who spend long periods in mental health inpatient facilities or require frequent repeat care. This has generated savings for the New South Wales Government when participants became less reliant on public health and other services.

Impact financing can thus serve as a catalyst for risk capital to achieve a financial return as well as make measurable contribution to the achievement of health-related Sustainable Development Goals (SDGs). By partnering with the philanthropic actors, private sector can adopt impact financing models for mental health care, thereby complementing public funding and mobilizing resources to scale innovative mental healthcare delivery models.

[1] IHME, Global Burden of Disease

[2] Mental health financing challenges, opportunities, and strategies in low- and middle-income countries: findings from the Emerald project

[3] National Mental Health Survey 2015 16

[4] Evaluation of treatment adherence in outpatients with schizophrenia; Factors Affecting Non-Adherence among Patients Diagnosed with

Unipolar Depression in a Psychiatric Department of a Tertiary Hospital in Kolkata, India

[5] A cross sectional study of employment pattern in patients with severe mental illness

[6] https://www.grandchallenges.ca/programs/global-mental-health/

[7] https://www.socialventures.com.au/work/resolve-sbb