Clarifying doubts for new impact investors looking for opportunities

5 min read

The term ‘impact investing’ was first coined in 2007, but despite being a young concept in Asia, the opportunities and potential it carries have been making big headlines.

Impact investing is defined by the intention to generate positive and measurable social and environmental impact alongside financial returns. It is part of a larger umbrella of social investments wherein various forms of capital are structured in ways that consider and value financial performance and social value creation.

You’d have seen the growing indicators: $904 million was deployed by private impact investors in Southeast Asia between 2007 and 2017. An additional $11.3 billion was deployed through development finance institutions. In the last four years, the compound annual growth rate in impact investing in East and Southeast Asia alone was 20%, higher than the U.S and Canada.

In 2019, the Global Impact Investing Network (GIIN) unveiled the 4 core characteristics of impact investing to clarify the essential elements of this social investment approach.

Source: GIIN

If you are an impact investing entrant, it has never been a more exciting time to join the community. But, being the newest member can be a little intimidating. Here are a few tips to navigate your way through the field:

Key impact investing players in Asia you should look out for

1. Philanthropists-turned-impact investors

Traditional foundations are expanding beyond their grantmaking practices – and have been catalytic in building the impact investing scene in Asia.

2017 was a big year for Japanese and South Korean foundations. Nippon Foundation set up the Japan Social Impact Investment Foundation (SIIF) to build impact investing market. SK Happiness Foundation shifted its primary focus to support social enterprises (SEs) by mainstreaming impact investment among financial institutions. By the end of the year, the latter had dispersed impact investing capital through direct investments in SEs (USD 4 million), SE funds run by the government (USD 2 million) and the Social Investment Fund (USD 4 million).

As the first foundation to conduct mission-related investment in China, Narada Foundation allocated part of its endowment for impact when it invested RMB 50 million (USD 7.5 million) in Ehong Capital’s Yuhe Fund in 2018 to support organisations with social and environmental impact.

2. Institutional impact investors

Institutional investors have also started to explore impact investing approaches. South Korea’s ‘Growth Ladder Fund’ is the country’s first government-led impact investment fund, which seeks to allocate KRW 135 billion (USD 120 million) by 2022. Both the Shinhan Financial Group and the KB Financial Group have created renewable energy funds of KRW 100 billion (USD 88 million) and KRW 150 billion (USD 132 million), leveraging innovative financing tools to support climate and environmental issues.

In 2018, DBS and IIX jointly launched the Women’s Livelihood Bond, with USAID and Australia’s Department of Foreign Affairs and Trade (DFAT) guaranteeing 50 percent of the loan portfolio’s principal. This is now in its 2nd tranche, and aims to support 1 million women across Asia with sustainable livelihoods. The proceeds are lent to microfinance institutions and social enterprises, which then provide loans to support women’s livelihood development. The bond acts as a channel to attract greater amounts of capital, but at the same time reduces the risk for investors by combining lower-risk loans to well-established microfinance institutions with higher-risk loans to social enterprises.

3. Experienced investors who are becoming more collaborative

Investors are becoming more sophisticated in their impact practices. Not only are they creating localised impact through sustainable funds, but they are also growing industry capacity through co-investment platforms.

Taiwan-based impact fund, B Current Impact Investment, adopts a club funding model to share resources and risk among co-investors. To date, it has allocated NT$125 million (USD 4 million) of financing and is launching a 3rd fund.

Along the same lines, Social Finance India offers two products: India Impact Fund of Fund and the India Education Outcomes Fund. Established by the Social Finance Global network and the Global Steering Group for Impact Investment, both of them aim to attract a total of USD 1.7 billion.

China, too, has been having accelerating partnerships between experienced and new investors. Narada Foundation, once again, is the role model. When it launched the China Social Enterprise and Impact Investment Forum (CSEIF) in 2014, Narada Foundation was instrumental in bringing together 16 other Chinese foundations and social investment agencies. CSEIF pools resources to develop the social enterprise and investment industry through research, education and capacity building.

4. Governments that are creating an enabling ecosystem

Governments have been supporting the social economy by attracting private capital and driving sustainable investing. In 2018, Crevisse Partners and Merry Year Social Company (MYSC), two South Korean impact funds, launched Remake City, a global impact accelerating programme, in Jakarta, Hanoi and Ho Chi Minh City, with support from KOICA. Following the programme, Crevisse and MYSC also made follow-on equity investments into successful ventures with strong market traction.

In Southeast Asia, Malaysia launched the Social Outcome Fund with RM3 million (USD 725,000). Following a Social Impact Bond model, the government repays private capital investment if the intervention is successful. The Fund has had two tranches in 2017 and 2019.

The State Bank of Vietnam also introduced the Green Bank Development Scheme; By 2025, all banks will need to increase their loans to green projects while implementing environment and social risk management schemes in their lending activities.

Where can you start?

In their report, Roadmap for the Future of Impact Investing: Reshaping Financial Markets, GIIN highlights 6 categories of action to enhance the effectiveness of impact investing. The first is to strengthen the identity of impact investing.

Against this backdrop, the first key action all impact investors need to take is to establish clear principles and standards for their practice.

Where do you place yourself? Identify yourself across the 4 archetypes

There is no one-size-fits-all to impact investing. Even investors of the same maturity can have significantly different traits, motivations, and challenges.

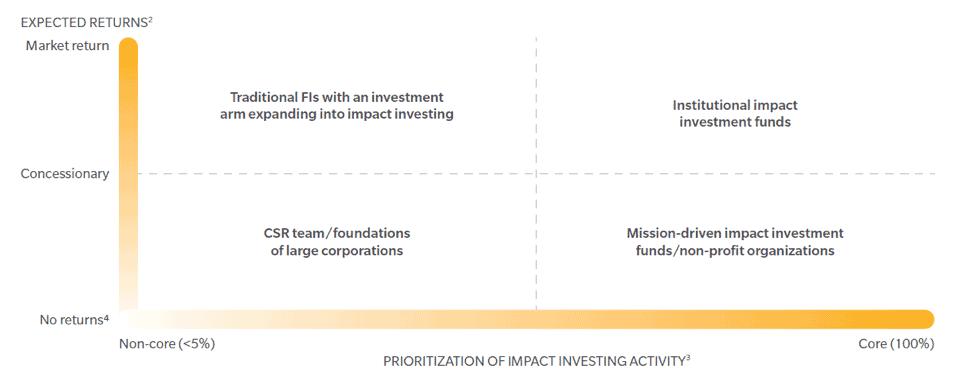

We have noticed 4 broad archetypes of impact investors in Asia, differentiated along the spectrum across 2 factors: (i) expected returns on investment and (ii) prioritization of impact investing activities.

Source: Impact Investing in Asia: Overcoming Barriers to Scale

Find out what are the drivers behind each archetype and the challenges they typically face.

Time to get started

Start your impact investing journey by exploring who’s who in the field. View a pipeline of deals on the AVPN Deal Share Platform (AVPN members gain full access to the deals) and take this self-assessment test to find out what resources you can provide to support social purpose organisations at different growth stages.

To learn more about the challenges you may face down the road and how you can address them, download the ‘Impact Investing in Asia’ Report, co-published by Oliver Wyman, GIIN, and AVPN.