Co-Author: Sam Whittemore, Ramraj Pai, and Swasti Saraogi

3 min read

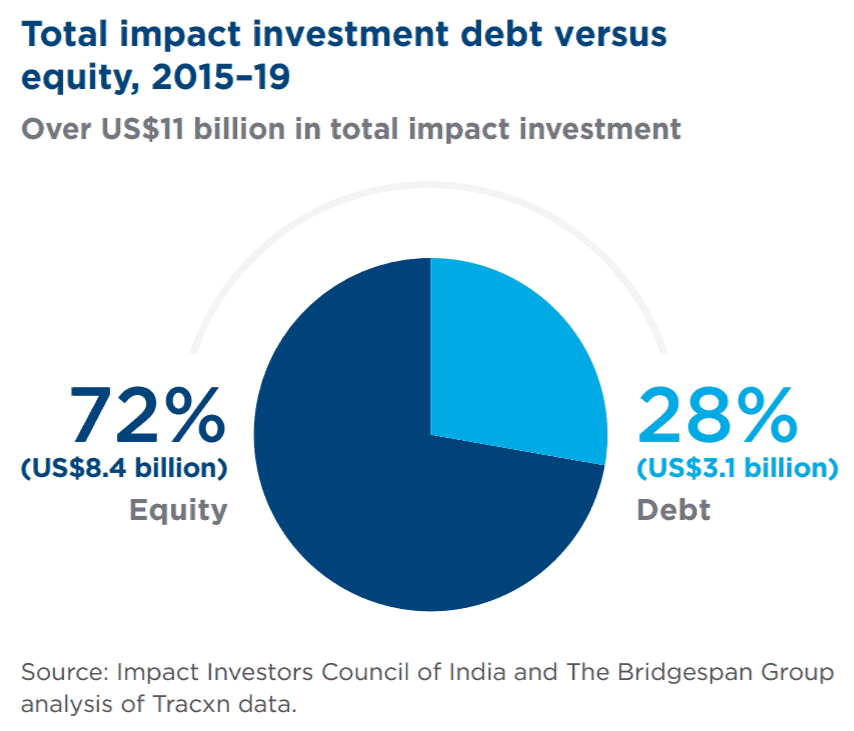

India’s impact enterprises, companies that strive for social benefit as well as profit, have a debt problem: not too much, but too little. They need debt capital to fuel their growth and advance their social or environmental goals. But most lenders steer clear, citing perceived risks and lack of creditworthiness.

To better understand the challenges that Indian impact enterprises face in borrowing money, the India Impact Investors Council (IIC) and The Bridgespan Group joined in a research project to chart the debt landscape, identify the barriers to debt financing, and propose avenues for making debt more accessible. Our report, Giving Credit Where Due: A Case for Debt Financing in Indian Impact Enterprises, provides an overview of three main areas:

- Financial data analysis: We analysed the balance sheets of 422 leading impact enterprises to gauge their creditworthiness and estimate the gap between their current debt and their potential to absorb more. The analysis showed that 60 percent of the enterprises met our criteria for creditworthiness. Creditworthiness, however, does not necessarily mean access to credit. When we looked at debt on the books of those 422 companies and compared that to a conservative estimate of borrowing potential, the gap came to INR 1,564 crore, roughly US$216 million.

- Barriers to debt financing: We identify the major debt financing barriers attributable to all the major players: impact enterprises, lenders, data providers, and regulators. Banks, for instance, require collateral to backstop loans. But most impact enterprises can’t meet collateral requirements, because they provide a service (such as education or healthcare) that relies on people or software, rather than on hard assets such as machinery or equipment. Young enterprises also often lack the management and data systems that underpin financial reporting required for assessing creditworthiness. Moreover, India lacks a regulatory structure that defines impact investments as a distinct asset class with standards that meet the needs of young, growing companies.

- Potential solutions: No one type of debt financing serves all. We highlight a continuum of approaches that meet the specific needs of underserved impact enterprises, including loan guarantees, flexible loan products, and innovative approaches to due diligence and underwriting. Alternative Investment Funds (AIFs), for example, have grown in popularity as a way for institutional or high-net-worth investors to invest in impact enterprises. And cash-flow lending addresses the collateral barrier that prevents most small to medium-size enterprises (SMEs) from obtaining loans.

The report also highlights the need for development of the debt “ecosystem” for impact enterprises. That includes partnerships between banks and impact investors, educational outreach to impact entrepreneurs to help them understand the role and sources of debt financing, and recognition of debt as an asset class that needs a regulatory framework supportive of young, growing impact enterprises.

Overcoming the barriers to debt financing for India’s impact enterprises will not happen quickly. But a number of approaches show promise, and progress already is being made toward building a stronger, more vibrant debt finance ecosystem. As that ecosystem matures, credit may live up to its promise as a game-changer for India’s impact enterprises. We invite you to read the full report and engage with us.