Co-Author: Sudarshan Sampathkumar

5 min read

Impact investing has taken off in India over the past decade. Investors have channeled more than $11 billion into some 600 Indian enterprises aiming to create a positive social and environmental impact alongside financial return. Yet capital still remains scarce for social enterprises that require patient, flexible capital and expect to generate only modest returns, at least initially. In other words, more investors are needed who are willing to put impact first.

Impact First and the Returns Continuum

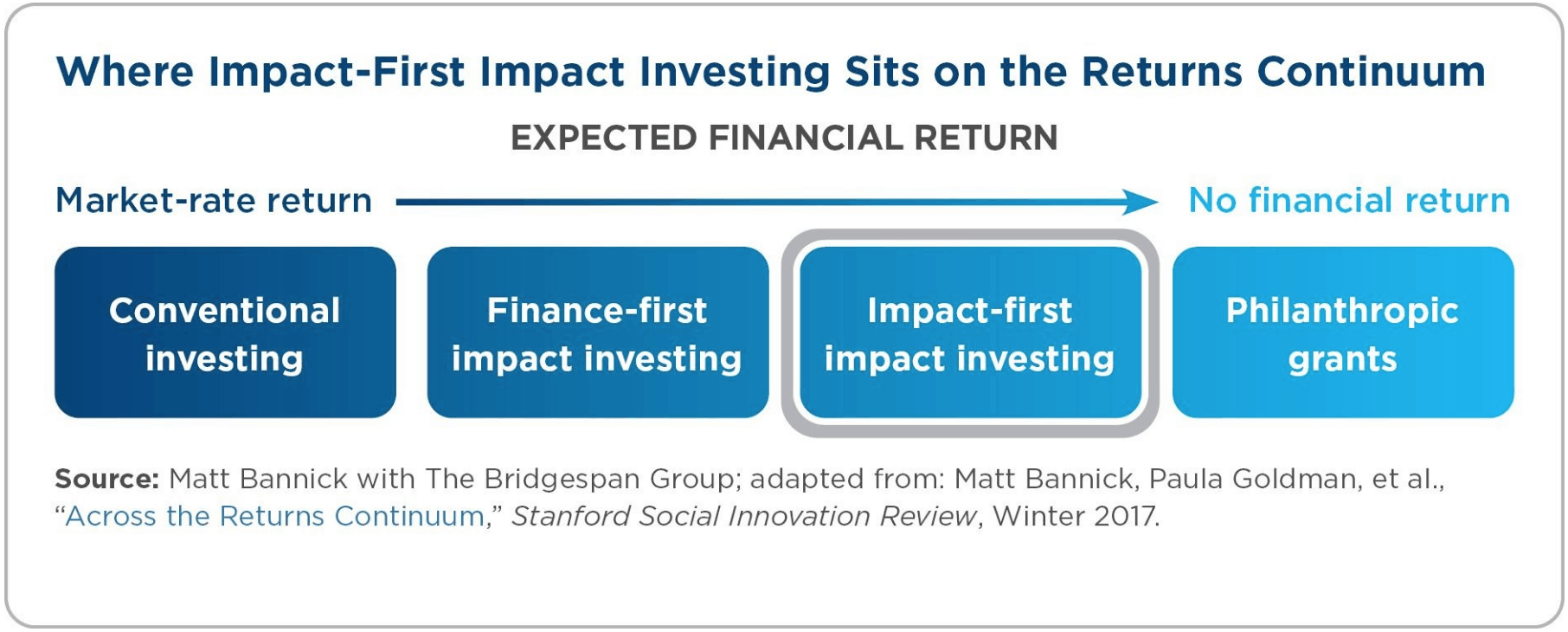

The challenge of winning over investors to the impact-first approach is not unique to India. A recent Bridgespan report found that impact-first investing remains largely an untapped opportunity in the United States. Even so, a small but growing number of high-net-worth individuals (HNWIs) and family investment offices—typically managing more than $100 million—view impact-first investing as an emerging asset class positioned between “finance-first” impact investing, which targets market-rate returns, and philanthropic grants. (See figure below.)

Putting impact first doesn’t mean, as some fear, bad investing, or that you don’t care about returns. It simply means that the returns that matter most are measured in lives changed, not solely financial gain. “This is what impact investing is all about,” says Manoj Kumar, Social Alpha’s co-founder and CEO. “If you are not willing to put off financial return or accept unknown risk, then what are you delivering that the market cannot deliver?”

Around the globe, the COVID-19 pandemic and heightened concerns about climate change, racial, gender, and caste injustice, and income inequality have injected fresh urgency into the need for more impact-first investing in support of enterprises purpose-built to address vexing social and environmental problems. Addressing these issues requires more tools than just philanthropy. Impact-first investing could be one such tool for social change if more investors jumped on board.

Family offices and HNWIs have the discretionary power to choose impact-first as an investment approach when investing their own money. By contrast, fiduciary obligations bar conventional impact investors who have raised capital from multiple parties with the explicit intent to deliver market-rate returns. Given the resources of HNWIs and family offices, even a fraction of their wealth directed toward impact-first investing would have considerable impact. An estimated 7,300 family offices worldwide in 2019 had some $5.9 trillion in assets under management, according to Campden Research.

First Steps in Impact First

In more than three dozen interviews with HNWIs, family office directors, fund managers, and intermediaries, we heard how pioneers in the field, such as Omidyar Network, Blue Haven Initiative, Ceniarth, and Spring Point Partners, have put impact first by pursuing a three-step process:

- Commit to impact: Impact-first investing is one stop on a continuum between market-rate investing and philanthropy. Committing to impact first means embracing values that place social or environmental good ahead of financial return.

- Seek advice from stakeholders: Wealth holders are accustomed to tapping friends and peers for advice when evaluating unfamiliar investment opportunities. To guard against creating an echo chamber where implicit biases can be reinforced, impact-first investors widen their circles of advisers to include stakeholders in the types of investments they intend to make.

- Pick an approach that best fits needs: This is an operational choice with three broad—sometimes overlapping—options: outsource to advisers and fund managers, take a lean approach with one or two impact specialists who complement existing family office staff, or hire a team dedicated to impact investing.

In India, Social Alpha has emerged as a leading advocate for impact-first impact investing. The venture development platform for science and technology start-ups strives to connect socially minded entrepreneurs with risk-averse investors. “High product development risk, longer gestation periods, inability to foresee an exit horizon, and poor assessment and pricing of risk keep most investors away from such early-stage investments,” says Kumar, “What we are trying to do at Social Alpha is to bring this ecosystem together and create a multi-step mentor development model,” says Kumar. “Our plan is to create a national platform that can support this multistage venture development model for social change and then bring in as many partners as possible. Social Alpha aims to become a platform that aggregates both supply and demand.” That demand includes investors whose expectations sit across a returns continuum that includes putting impact first.

Social Alpha exemplifies the outsourcing approach. It operates a nationwide network of technology and business incubator sites that include product innovation labs, venture incubators, grant challenges, accelerator programmes, capital pools, and market access mechanisms. It screens and conducts due diligence on innovative ideas and the entrepreneurs behind them.

Since its founding in 2016, Social Alpha has evaluated more than 1,000 enterprises, incubated 150, and invested in 41. It focuses on disruptive innovations in agriculture, water, sanitation, healthcare, and climate change. To date, most of the nonprofit’s funding has come from philanthropy, the government, and corporate partnerships; private investors have shied away. “Unfortunately, they are not yet ready to support entrepreneurial risk-taking in science and technology innovations where the intent is to solve deep-rooted problems facing the communities and the planet,” says Kumar. As a result, Social Alpha anticipates becoming financially self-sustaining within a few years by recycling earnings from successful investments. Imagine what it and others like it could do with impact-first investments.

Only a decade ago, impact investing struck most people in the global finance community as a novel, even improbable concept. Today, it has achieved mainstream status by demonstrating that an impact mandate can successfully deliver against traditional financial benchmarks. That’s the finance-first approach to impact investing, which stresses market-rate returns.

Advocates for the impact-first approach to impact investing hope to chart a similarly successful trajectory by demonstrating that impact need not be constrained by financial performance. If impact-first means leaving returns on the table in exchange for social or environmental benefit, it’s a tradeoff worth making.

To learn more, review this seminal Monitor Institute report touting the potential of impact investing, and read this recent Bridgespan report on the emergence of impact-first investing.