5 min read

“Inequality is Rising or Staying Extremely High Nearly Everywhere” – the World Inequality Report, 2018

The burgeoning need to address the UN Sustainable Development Goals (SDGs) has never been more urgent. Countries and changemakers around the world have been rapidly making progress in coming up with innovative solutions to solve the world’s most pressing problems. However, progress usually stagnates as they are unable to fully integrate into the mainstream government institutions.

To unlock private participation in public investments, speakers at the AVPN Virtual Conference 2020 reaffirmed the need to review national financing frameworks and develop strong domestic public policies for the shift towards sustainable development. Indonesia, in particular, stood out as a leading country in taking action on mobilising the private sector to finance the SDGs. Drawing from their sector experience together with rigorous research conducted by industry experts, policy decision-makers across Asia laid out how governments can remodel their public institutions to support private stakeholders and investments towards impact.

1. Reform Financial Policies

Indonesia has been a pioneer in adopting the Integrated National Financing Framework (INFFs) – a tool to help countries map the multiple streams of development finance available while building and operationalising an effective sustainable development financing strategy. To better manage the country’s finance through the INFF, the Indonesian government underwent an overhaul of its financial management system and put in place SPAN, (also known as Sistem Perbendaharaan dan Anggaran Negara), a new financial management information system to enhance the transparency and accountability of financial transactions. This momentous move by the central government has been especially crucial to funnel resources effectively to priority sectors such as healthcare, education and public infrastructure.

BAPPENAS, the government agency responsible for coordinating, planning and managing non-state resources, introduced the Medium-Term Expenditure Framework (MTEF) in 2011 and remains one of the three Southeast Asian countries to have detailed laws around this framework . MTEF supports central governments in taking a long-term budgetary perspective that spans anywhere from three to five years (rather than an annual view) and includes budget ceilings with future budget forecasts for the country. Indonesia’s commitment to policy reforms also includes encouraging green lending and investment. The country’s financial services regulator, OJK, launched a “Roadmap for Sustainable Finance” that includes channelling funds to industry sectors using the sustainable financing concept. These reforms not only help strengthen the efficiency of government spending, but also instills confidence in private investors to invest and create impact sustainably.

2. Develop a Clear and Well-Coordinated Financing Strategy

One key barrier to private sector investments into public sector projects may be the lack of a systematic and clear overarching resource mobilisation strategy. Public institutions can address this by outlining priorities and the most urgent issues facing the state to solicit support either in monetary or non-monetary terms from non-state actors. A clear roadmap of the government’s aims and policies in the various sectors can help to open up financing and investing opportunities for the private sector.

Building on the case study of Indonesia, the government has sought to improve their strategy by implementing the current five-year National Long‐Term Development Plan (RPJPN). The RPJPN is divided into four medium-term plans that aim to expand the Indonesian economy in a sustainable and efficient manner.

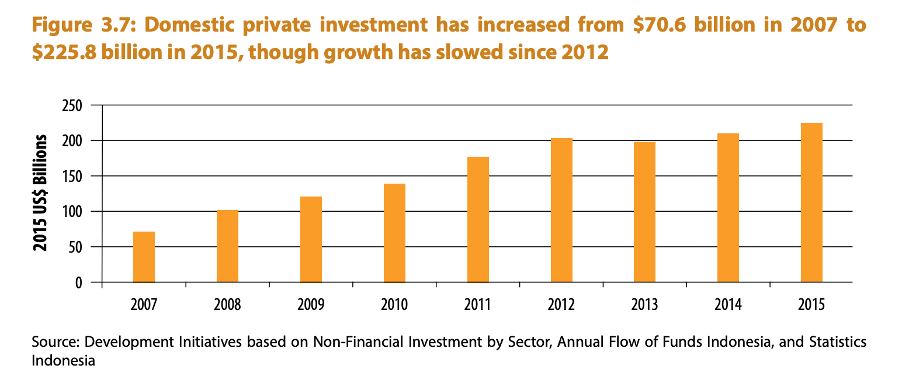

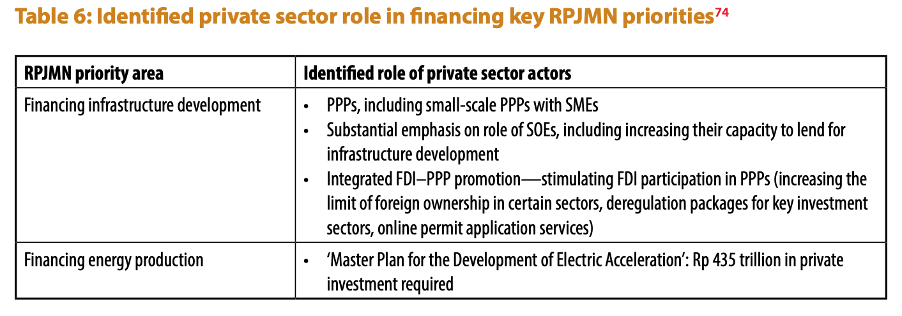

From a research conducted by UNDP, data has shown that Indonesia’s domestic private investments have been contributing to the overall country’s funding trends. According to the report, “In 2015 it [domestic private investments] was equivalent to 1.5 times domestic public resources, 8.5 times international public resources.” However, from the data above we can see that Indonesia’s annual growth rate has slowed since 2012, from an average of 24 percent from 2007-2012 to 4 percent since then. Governments facing a highly decentralized structure or an underdeveloped enforcement culture, similar to Indonesia, should seek to also include improvement plans in their financial strategy to leverage on private wealth that could be ready to make an impact but face significant challenges. A summarized example from an effort of the Indonesian government towards this is presented in Table 6:

3. Build a Supportive and Innovative Financial Ecosystem

“How can we penetrate the mainstream market to generate enough revenue and returns while creating great impact at the same time?” – Wonyoung Kim, Executive Director of Crevisse Partners

This question brought up by Wonyoung during a session on structuring investment products is worthy for in-depth consideration in the public sector and institutions. To stimulate private investments into impact, public institutions must support the growing interest in social enterprise investments, alongside investments into public projects. To build an enabling environment, central banks must take a proactive role in stimulating the development of innovative financial instruments that encourage commercial banks to lend to profitable social enterprises. This could be implemented through innovative reserve management and unorthodox monetary policies, such as “green quantitative easing” and developing a greener portfolio by issuing sovereign green bonds. The Official Monetary and Financial Institutions Forum (OMFIF), an independent think tank for central banking, economic policy and public investment, has drawn up a thorough special report on how the central banking community can step up to improve the climate resiliency of a country’s financial system, thereby facilitating the address of climate action (SDG 13).

“Central banks are no longer the lender of last resort, but have a greater role in ensuring financial stability in the economy.” shared by Adam Cotter, Director and Head of Asia at OMFIF sums this up pretty well. A financial ecosystem that is ready to evolve and come onboard with policy-makers and development-minded market actors has the potential to unlock genuine interest from private investors to support sustainable development outcomes.

Conclusion

There are abundant opportunities for public institutions to develop, evolve and grow. An already vibrant private sector investment scene calls for strengthened participation across the sectors to contribute directly to national development and SDGs. What we need to see more of is public institutions and agents improving their systems to build a more supportive and transparent environment for private participation.

Policy makers and change makers around the world convened virtually to discuss the world’s pressing issues during the AVPN Virtual Conference this year. To learn more about how Bangladesh is also approaching financing to further the SDGs at a national level, hear from policy experts at the session “Building the Policy Environment for SDG Financing in Asia-Pacific: Experiences in Integrated Financing Frameworks”.

References:

- United Nations Development Programme. Indonesia: Financing the future with an integrated national financing framework. https://www.undp.org/content/dam/rbap/docs/dg/dev-effectiveness/RBAP-DG-2018-Development-Finance-Assessment-Snapshot-Indonesia.pdf

- Official Monetary and Financial Institutions Forum. Central banks and climate change. https://www.omfif.org/wp-content/uploads/2020/02/ESG.pdf

- “Global Inequality.” Inequality.org, org/facts/global-inequality/.

- “Regional UN Meeting Reinforces Need for Integrated National Financing Frameworks to Achieve the SDGs.” ESCAP, 8 Nov. 2019, unescap.org/news/regional-un-meeting-reinforces-need-integrated-national-financing-frameworks-achieve-sdgs.