Co-Author: Sarah Hussain

6 min read

Summary Points:

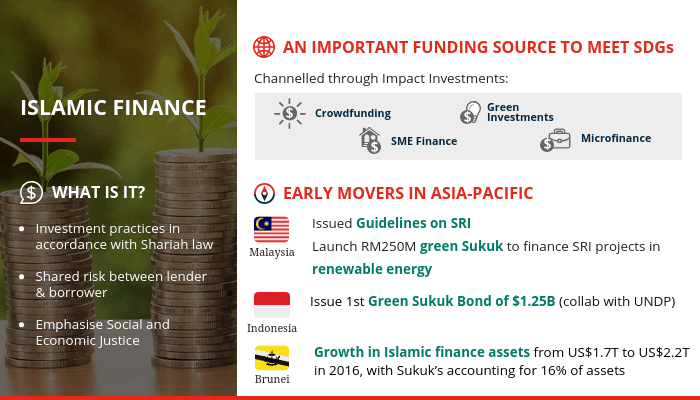

- With the recognition for a need for increased collaboration between different forms of capital for greater impact, Islamic finance can play an important role in the Continuum of Capital as a funding source for impact investment.

- As one of the first countries to launch the Green Sukuk and the Social and Responsible Investment (SRI) Framework, Malaysia is poised to leverage advancements in the area to mobilize Islamic finance to create environmental and social impact.

- Islamic finance can converge with other kinds of capital to facilitate growth-stage social organizations and help achieve the Sustainable Development Goals through crowdfunding, green investments, microfinance and other kinds of financing.

As the mainstream capital markets and sustainable development movement converge, the silos that represent types of funding are breaking down to meet the demand of mobilising capital for greater impact. In this context, Islamic finance can potentially complement, even collaborate, with other forms of capital in the Continuum of Capital to serve as a source of funding for initiatives aimed at creating environmental and social impact alongside economic development.

What is Islamic Finance?

Islamic finance is being globally recognized as a key enabler for achieving social goals. In 2016 the United Nations Development Program (UNDP) and the Islamic Development Bank established the Global Islamic Finance and Impact Investing Platform to position Islamic finance as a part of the impact investment ecosystem.

Islamic finance simply refers to lending practices that are in accordance with Shariah law. Central to the understanding of Islamic finance is that interest is prohibited, and that risk must be shared between the lender and borrower[1].

Along with Iran and Saudia Arabia, we have seen Malaysia emerge as a global leader in Islamic finance[2]. Therefore, combined with Islamic finance’s value-oriented approach towards investing and its potential for growth, it can potentially serve as a critical source of funding in the Continuum of Capital for social organizations and impact enterprises in the country.

Malaysia and Indonesia Catalysing their Islamic Finance Ecosystems

In Asia, Malaysia has shown early efforts in institutionalising Islamic finance since the 1970’s. In 1983 the Malaysian government enacted the Islamic Bank Act of 1983, after which numerous financial institutions joined the market. Today, commercial banks, investment banks and finance companies alike carry out Islamic finance activities in Malaysia, including supporting the growth of Small and Medium Enterprises (SMEs). Since 2012, the International Trade Ministry has approved RM1.6 billion from 13 banks in funding under a Shariah Compliant SME Financing Scheme, providing assistance to entrepreneurs and businessmen across the country.

Malaysia also became one of the first countries to launch a Sustainable and Responsible Investment (SRI) Sukuk[3] framework to facilitate socially responsible investments that can mobilise Islamic finance. Khazanah Nasional Berhad established a SRI sukuk programme under the Securities Commission Malaysia’s SRI framework and issued Sukuk Ihsan in 2015 to fund schools under the Yayasan AMIR (YA) Trust School Programme. YA is a not-for-profit foundation incorporated by Khazanah to improve accessibility of quality education in Malaysian Government schools through a Public-Private Partnership with the Ministry of Education.

“Concepts such as Waqf, Zakat and Sadaqah have been central to Islamic social finance. Sukuk Ihsan pushed the envelope further by combining education and Islamic finance with socially responsible investments through an innovative structure thus creating a new investable Islamic asset class. The subscription by a diverse investor group including foundations, corporations, banks, pension funds and asset management companies showed that there is demand for investments that not only generate financial returns but also have positive social and environmental impact,” said Hafizuddin Sulaiman, Director of Finance.

By 2016, the Islamic finance sector made up of almost 20 percent of financing that was approved for 120 projects initiated under the Malaysian Green Technology Financing Scheme. In December 2017 the Securities Commission Malaysia issued the Guidelines on Sustainable and Responsible Investment to encourage fundraising and investment for socially viable initiatives.

According to the Chairman of the Securities Commission Malaysia Tan Sri Ranjit Ajit Singh, “The introduction of the SRI Funds Guidelines is another significant step towards further development of the SRI ecosystem in the Malaysian capital market, reinforcing our positioning in the regional SRI segment and global leadership in Islamic finance”[4]. Earlier that same year, Malaysia became the first country in the world to launch a green Sukuk, a RM250 million offering by Tadau Energy to finance SRI projects in renewable energy and was used to fund a 50MW solar photovoltaic power plant.

Aside from Malaysia, Asia is home to other markets that can benefit from, and be a source of, this new form of impact capital, such as Indonesia, Bangladesh, Pakistan, Brunei. In 2014 the Islamic Development Bank (IsDB) officially opened its Country Gateway Office in Indonesia, to more effectively manage IsDB’s portfolio in the country. In 2017, the UNDP hosted a conference in Jakarta on leveraging innovative finance for achieving the SDGs and is supporting Indonesia’s Ministry of Finance in issuing their first ever Green Sukuk Bond of $1.25 billion. Additionally, a recent report by the UNDP and Baznas illustrates the potential of different types of Islamic finance to achieve the SDG’s in Indonesia, and showcases different initiatives by Baznas in mobilizing Islamic finance in different poverty alleviation projects. Brunei has also seen a growth in Islamic finance assets from US$1.7 trillion in 2012 to US$2.2 trillion in 2016, with Sukuk’s accounting for 16% of the assets[5]. In the Islamic Finance Development Report 2017, Brunei was ranked among the top ten in Islamic finance performance.

A Critical Source of Funding to Meet the SDGs

Islamic finance can also contribute to the growth of impact enterprises by providing capital to growth-stage social organizations and impact enterprises. It can be channeled as impact investment through crowdfunding (murabahah[6]), green investments, microfinance, social investments and SME finance, particularly playing an important role in providing asset-based financing options for SME’s.

According to Dr. Ahmad Mohamed Ali Al-Madani, President of the Islamic Development Bank, “partnership financing, the core element of Islamic finance, is an important source of funding for SMEs that can provide opportunities for entrepreneurship, jobs creation and income generation”[7].

AVPN’s Continuum of Capital study launched in AVPN Conference 2018 shows that there are clear gaps to the capital that can support the growth of impact organisations – the Asian Islamic finance market estimated at USD$528.7 billion as of end 2017[8] could be directed towards the ‘missing’ areas to potentially bridge those gaps.

Call-To-Action

While there are clear opportunities for these various forms of capital to contribute to greater impact in Asia, the challenge is how to design and execute impactful capital partnerships and collaborations between foundations, development institutions, investors (secular and faith-based), companies, and governments. The intent is evident among the increasingly vocal interest from public and private funders, the need of the hour is to identify actionable, practitioner-guided steps to bring these different capital streams together, towards impact. Globally, the impact investment markets are estimated to grow to US$307 billion by 2020[9]. Relative to the Islamic Finance market size of $2.2 trillion[10] worldwide, it is clear that scalable change can be possible if these sizable capital pools, aligned around common impact objectives, can work together for the greater good of the people and the planet.

AVPN invites you to join us in Kuala Lumpur, Malaysia, on 1 November to explore how partners from the private, public and people sectors can embrace all forms of capital, including Islamic Finance, for greater impact. Including participation from large institutional funders like Khazanah Nasional Berhad and its corporate foundation Yayasan Hasanah, policymakers, development finance institutions and local private investors, we will invite speakers from the AVPN membership and stakeholders to share their experience and ideas to embark on their impact investment journey.

[1] McKenna, John. “What Is Islamic Finance?” World Economic Forum, World Economic Forum, 16 May 2017

[2] Idris, Ahmad Naqib. “Malaysia Emerges as Global Leader in Islamic Banking and Finance.” The Edge Markets, 10 May 2016

[3] Unlike conventional bonds that represent debt obligation of the issuer, a Sukuk bond represents shared ownership of an asset. The issuer of the Sukuk bond sells a certificate to a buyer and uses its proceeds to purchase an asset, of which the buyer will then have partial ownership. The issuer then buys back the bond after a pre-fixed period of time.

[4] “SC Issues New Guidelines on SRI Funds .” Nation | The Star Online, 19 Dec. 2017

[5] “Brunei among Top 10 in Islamic Finance.” Borneo Bulletin Online, 15 Mar. 2018

[6] A method of Islamic financing where the seller sets the cost and profit of a commodity, and the buyer pays over time

[7] Al-Madani, Ahmed Mohamed. World Islamic Economic Forum, 3 November 2015, Kuala Lumpur, Malaysia. Special Address. https://wief.org/speech/special-address-h-e-dr-ahmed-mohamed-ali-al-madani-president-islamic-development-bank-honorary-fellow-wief-foundation-saudi-arabia/

[8] Islamic Finance in Asia: Reaching New Heights. Malaysia International Islamic Finance Centre, Apr. 2018

[9] Impact Investing Market by Illustrative Sector (Education, HealthCare, Housing, Agriculture, Environment, Clean Energy Access, Climate Change, Financial Inclusion, Rural Development, Sanitation & Waste Management), and Country – Global Forecast to 2020. Markets and Markets, July 2017 https://www.marketsandmarkets.com/Market-Reports/impact-investing-market-265004523.html.

[10] Islamic Finance Development Report 2017. ICD-Thomson Reuters, 2017