Impetus-PEF was formed in 2013, following the merger of two Venture Philanthropy Organisations in the UK, Impetus Trust (founded in 2002) and the Private Equity Foundation (founded in 2006). It is a fundraising funder, and raises majority of its investable funds from donors. Of the total value raised in 2013, 35% (£5.5m) were raised in grants from foundations and statutory funding, 23% (£3.5m) in cash donations from individuals and companies and 29%(£4.5m) in donated services from probono partners[1]. Impetus-PEF practices a Venture Philanthropy model with some elements of Social Investment[2]

Narrower focus Strategy

Impetus-PEF took merger as an opportunity to evolve its strategy and went through intensive theory of change process, drawing on international examples of highly effective charities and funders. As a result it:

- Narrowed its investment focus to educational attainment and sustained employment by 25 for young people from disadvantaged backgrounds

- Developed the driving impact programme which is now at the heart of its package to support charities

Package of Support

Impetus-PEF focuses on two related domains in a single geographical region. It partners with charities and social enterprises working with the 11-24 year old from disadvantages background in the UK focusing on education attainment and work readiness outcomes for these young people .[3] It is not a deliverer of programmes to beneficiaries itself but partners with promising charities and social enterprises that work with these young people.

Impetus-PEF provides a combination of financial and non-financial support to its investees, by offering a hybrid, three pronged investment package:

- Hands-on Management support: Highly experienced, in-house investment team provides hands-on management support to the CEO and SMT of the investee organisation.

- Pro bono expertise: Impetus-PEF maintains a highly engaged pool of skilled experts, who volunteer their skills to portfolio investees. This expertise is deployed for specific, mutually agreed capacity-building activities, with the pro bono associate and investee organisation agreeing the brief before a project starts.

- Funding: provide significant, long-term, unrestricted grant funding, often in partnership with other funders, enabling the organisation to build its capacity to deliver high quality programmes. This funding is linked to the investee meeting pre-agreed milestones, which are tracked on a quarterly basis.

![Figure1 – Pie graph of sources of value delivered to investees in 2013 [4]](https://avpn.asia/wp-content/uploads/2015/08/image02.png)

Dual Outcomes led Portfolio Management

Even with the progressive work happening in the social investment space (SIB AND PbR) in the UK, the lack of sufficient pipeline of investment ready organisations is widely recognised inhibitor to market growth. This investment pipeline also has shortage of interventions with sufficient robust evidence of their ability to deliver intended beneficiary outcomes. Impetus-PEF addresses this by working on the high risk investing space on the risk continuum; investing in capacity building the nonprofits to create outcomes.

Impetus-PEF’s investment process is modeled to produce dual outcomes:

- Robust nonprofits able to produce targeted outcomes reliably

- Greater (quantum and statistically relevant) intended beneficiary outcomes around education attainment and work readiness.

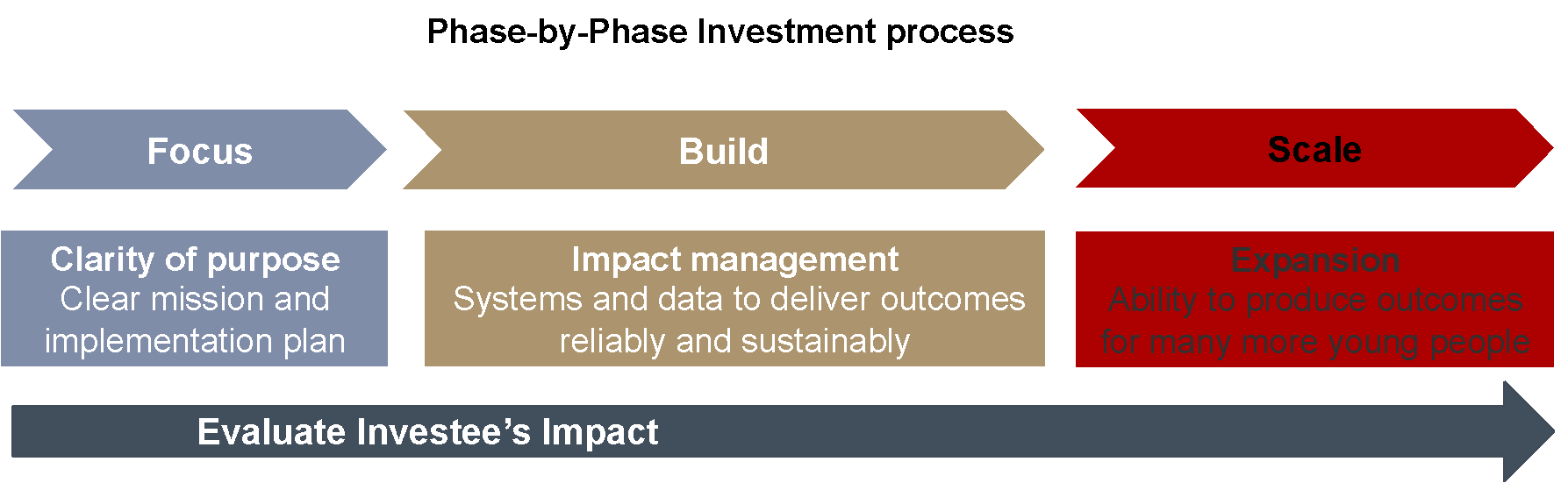

It aims to produce these outcomes by working with investees in depth and over a number of years taking a progressive filtering approach to managing its investments. The partnership with investees is managed through a series of phases on a continuum, with investees starting at the top of the funnel.

At a high-level, organisations are assessed on their solution potential, organisation potential and partnership potential. It works with non-profits having £250k+ annual income, typically a few years past start up mode and a programme that incorporates research-backed practices with some evidence of impact.

Some of the features of Impetus-PEF’s phase-by-phase filtering approach are:

- Each phase starts with agreeing with the investee, a programme of work, financial commitment, duration and set of milestones

- At the end of each phase, the investee is assessed on its readiness and commitment to progress to the next phase of investment[5]

- Not every investee entering the portfolio progresses to subsequent phases, as it may not meet the eligibility criteria for progression and thus graduates from the Impetus-PEF portfolio.

- Supports growth in scale only where rigorous evaluation shows evidence that investee’s services are benefiting participants as intended[6]

Over the 5 years period of its 2014-2018 business plan; Impetus-PEF will aim to have 4 investees reach the Scale phase of its work out of the 76 investees with whom it plans to work with at the start of the Investment funnel[7]. Collectively since inception of preceding organisations, Impetus-PEF have screened some 2,500 non-profits and invested in over 50 of these[8].

Knowledge based Portfolio Selection to Drive Impact

Impetus-PEF doesn’t accept unsolicited applications for funding, instead conducts ongoing research into the evidence about what is needed to change the life opportunities of the targeted beneficiaries and then scouts for promising charities and social enterprises through referrals from trusted individuals and organisations familiar with Impetus-PEF’s investment model.

The choice of these domains stemmed from the two founding organisations’ collective experience and extensive commissioned research that identified these two prime areas of intervention lead to meaningful and lasting change in the lives of young people from disadvantaged backgrounds. Impetus-PEF has further identified specific outcomes within these domains that help further filter the interventions that are eligible to be part of the portfolio. Portfolio strategy is to invest in non-profits with interventions that fall under these four Impetus-PEF programmes –

![Figure 3: Impetus-PEF’s current portfolio –Programmes and Charities [9]](https://avpn.asia/wp-content/uploads/2015/08/image03.png)

Practicing this value creating portfolio management framework produces additional outcome for Impetus-PEF in form of knowledge on –

- Capacity building non-profits

- Building effectiveness of programmes

- Body of evidence in the targeted social domain

- Critical success factors to deliver beneficiary outcomes

This is further augmented by commissioned research to develop a deeper understanding as to what works and what doesn’t –and as to how resources can be better deployed to achieve impact[10]. Impetus-PEF’s policy and advocacy function is integral part of the investment team and it

- Shares it’s knowledge with policymakers

- Advocates that they design or fund only programmes that are based on evidence

- Works to ensure that policy and practice, resource, and legislation that affect young people from disadvantaged backgrounds is evidence-based and delivers meaningful outcomes

[1] Data from Impetus-PEF Annual report 2013

[2] Impetus-PEF website – http://www.impetus-pef.org.uk/how-we-work/social-investment/

[3] Impetus-PEF website – http://www.impetus-pef.org.uk/who-we-are/our-mission/

[4] Impetus-PEF Annual report 2013

[5] Impetus-PEF website – http://www.impetus-pef.org.uk/how-we-work/partnering-with-charities/

[6] Impetus-PEF Annual report 2013

[7] Impetus-PEF Annual report 2013

[8] Impetus-PEF website –http://www.impetus-pef.org.uk/how-we-work/partnering-with-charities/

[9] Impetus-PEF website- http://www.impetus-pef.org.uk/charity-partners/current-partners/

[10] Impetus-PEF website – http://www.impetus-pef.org.uk/campaigns-and-research/Research

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.