- About AVPN

-

-

-

About AVPN

Who We Are

We are a leading ecosystem builder that is increasing the flow of financial, human, and intellectual capital from Asia and around the world into the social sector in Asia. We provide a network of peers, rigorous learning programmes, and innovative capital mobilization opportunities that make sure resources are more effectively deployed.

-

-

-

- Members

-

-

-

Membership Benefits

Unrestricted access to AVPN research reports and case studies

Access market-specific snapshots and opportunities

Increased visibility for events, programs and insights via AVPN website, blog, newsletters and social media channels

Leverage the AVPN platform to bring under-represented social issues top of mind for more than 600 social investors

-

-

-

- Resources

-

-

-

Resources

Highlights of the week

Trust-Based Philanthropy

In the face of increasingly complex and, sometimes rapidly, changing needs on the ground, it is crucial to take a step back and reconsider the status quo.

APAC Sustainability Seed Fund 2.0

By leveraging the success of the first round of the APAC Sustainability Seed Fund, AVPN continues to mobilise continuum of capital into supporting climate solutions in the region.

Faith and Giving

Faith, and the values, belief systems, moral codes, and religious doctrines, that underlie it, shape much of philanthropy across the world. From addressing needs in underserved communities to investing in sustainable energy solutions, faith-aligned givers are demonstrating that compassion can be a catalyst for a more just and equitable world. However, the fundamental drivers of faith-aligned giving often remain unexamined.

-

-

-

- Markets

-

-

-

Markets

We are a leading ecosystem builder that is increasing the flow of financial, human, and intellectual capital from Asia and around the world into the social sector in Asia. We provide a network of peers, rigorous learning programmes, and innovative capital mobilization opportunities that make sure resources are more effectively deployed.

Explore Markets

-

-

-

- Impact Communities

-

-

-

Impact Communities

-

-

-

- Capital Mobilisation

-

-

-

Capital Mobilisation

Featured Deals

Socio-Economic Empowerment of Women

Climate Action and Environment, Education, Financial Inclusion, Gender, Livelihood and Poverty Alleviation

Solve Education: Education through Innovative Learning Platform

Education, Employability, Livelihood and Poverty Alleviation

Lotus Petal Sr. Sec School, Gurugram

Education, Employability, Health

IT Training Against Poverty in Cebu

Education, Employability, Livelihood and Poverty Alleviation

IT Vocational Training Against Poverty

Education, Employability, Livelihood and Poverty Alleviation

Gigatonne: Addressing Problems within the Carbon Credits Market

Climate Action and Environment, Financial Inclusion, Gender, Livelihood and Poverty Alleviation

-

-

-

- Events

-

-

-

Events

Upcoming Signature EventsAVPN Global Conference 2024

23 April 2024

-

25 April 2024

Signature Event

Upcoming Events

Restoring Equilibrium: SVCA 2024 Annual Conference – Seeking Balance in A Turbulent World

16 May 2024

-

-

-

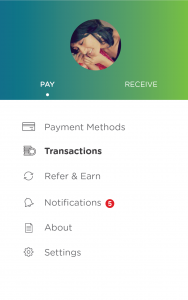

ftcash

Empowers micro-merchants and entrepreneurs in India through electronic payments and loans with zero upfront cost, no monthly rentals and risk assessment tools.

By

ftcash

Click here to learn more about the Impact Organisation

This is member exclusive

content. Click here to unlock

Social causes

Beneficiaries

SDGs covered

Market of Implementation

- India

Problem

India has 55+ million micro-merchants and small businesses but only 1.25 million swipe/POS machines. On a yearly basis these merchants transact $1600 billion dollars in transactions every year in India. Currently, these merchants have no alternatives to accepting cash. Most of these merchants cannot afford a POS machine due to the upfront cost and additional infrastructure requirement. Merchants with large transactions on a daily basis also struggle with rendering exact change, counterfeit notes and daily reconciliation being time-consuming. Lastly, with or without a POS machine, the customers have to meet the merchant to pay him in-person. Nearly 98% of small & micro merchants have never received institutional finance and rely on the distributors or money lenders to finance them. In most cases, these micro-merchants are given loans at exorbitant rates by devious money lenders. These merchants are never catered by the banks and NBFCs as they do not have any credit history or collateral. In India, only 52.8 percent of individuals have a bank account and 22.1 percent have used a payments card. On the other hand, India is supposed to have 500 million Internet users by next year, with 314 million using the internet only through their smartphones. Therefore a combination of bank accounts and phones has the capability to provide cheaper and efficient access to payments and finance than the current approach of branches and ATMs.

Solution

ftcash enables businesses, merchants or home-based entrepreneurs in India with a feature phone or a smartphone to receive online payments securely, conveniently and cost-effectively. Our platform is built upon existing financial infrastructure of bank accounts of the merchants to create a real-time payment solution. We deliver a product ideally suited for SMEs, offline micro-merchants, remote businesses currently underserved by traditional payment mechanisms. We have removed entry barriers like upfront costs (of Point of Sale/Swipe Machines), monthly rentals, technical know-how, providing market for small businesses to sell & collect payments, manage & grow rapidly. We are converting cash to digital payments thereby creating unique transaction history which didn't exist earlier. We provide pre-approved advances/loans which can be disbursed at the click of a button and which can be uniquely paid back from their daily transactions, something like a daily EMI. While the proliferation of whatsapp and facebook has transcended from metros to cities and even villages we believe ftcash will be the enabler for them to accept electronic payments and access to institutional finance. We believe that it's time "The Missing Middle" comes of age and gets access to better health, education and nutrition through financial inclusion.

ftcash enables businesses, merchants or home-based entrepreneurs in India with a feature phone or a smartphone to receive online payments securely, conveniently and cost-effectively. Our platform is built upon existing financial infrastructure of bank accounts of the merchants to create a real-time payment solution. We deliver a product ideally suited for SMEs, offline micro-merchants, remote businesses currently underserved by traditional payment mechanisms. We have removed entry barriers like upfront costs (of Point of Sale/Swipe Machines), monthly rentals, technical know-how, providing market for small businesses to sell & collect payments, manage & grow rapidly. We are converting cash to digital payments thereby creating unique transaction history which didn't exist earlier. We provide pre-approved advances/loans which can be disbursed at the click of a button and which can be uniquely paid back from their daily transactions, something like a daily EMI. While the proliferation of whatsapp and facebook has transcended from metros to cities and even villages we believe ftcash will be the enabler for them to accept electronic payments and access to institutional finance. We believe that it's time "The Missing Middle" comes of age and gets access to better health, education and nutrition through financial inclusion.

ftcash enables businesses, merchants or home-based entrepreneurs in India with a feature phone or a smartphone to receive online payments securely, conveniently and cost-effectively. Our platform is built upon existing financial infrastructure of bank accounts of the merchants to create a real-time payment solution. We deliver a product ideally suited for SMEs, offline micro-merchants, remote businesses currently underserved by traditional payment mechanisms. We have removed entry barriers like upfront costs (of Point of Sale/Swipe Machines), monthly rentals, technical know-how, providing market for small businesses to sell & collect payments, manage & grow rapidly. We are converting cash to digital payments thereby creating unique transaction history which didn't exist earlier. We provide pre-approved advances/loans which can be disbursed at the click of a button and which can be uniquely paid back from their daily transactions, something like a daily EMI. While the proliferation of whatsapp and facebook has transcended from metros to cities and even villages we believe ftcash will be the enabler for them to accept electronic payments and access to institutional finance. We believe that it's time "The Missing Middle" comes of age and gets access to better health, education and nutrition through financial inclusion.