Impact investing continues to grow in popularity in the Asia-Pacific region, with a string of recent fund launches, strategic partnerships, and new hires. This growth, however, has been accompanied by questions about how the practices of impact investors in Asia compare to impact investors in more established impact markets, particularly in the U.S. and Western Europe.

BlueMark, a leading provider of independent impact verification and intelligence for the impact and sustainable investing market, continuously explores these types of questions through verifications of investors’ impact management practices in other words, assessments of how impact is integrated throughout the investment lifecycle.

BlueMark’s 2023 Making the Mark report, which provides an annual update on the state of impact management practice, synthesizes findings from 84 verifications for 75 investors managing a combined $209 billion in impact-oriented assets under management (AUM), spanning a variety of investor types and asset classes. These findings are based on verifications of alignment with the Operating Principles for Impact Management (‘Impact Principles’), a leading industry standard that has been adopted by 177 investors (11% of which are based in Asia) with more than $520 billion in combined impact AUM, as of July 2023. Using this verification data, BlueMark is able to evaluate the current state of impact management practice against the core components of impact investing and highlight key trends and challenges among Asia-based impact investors.

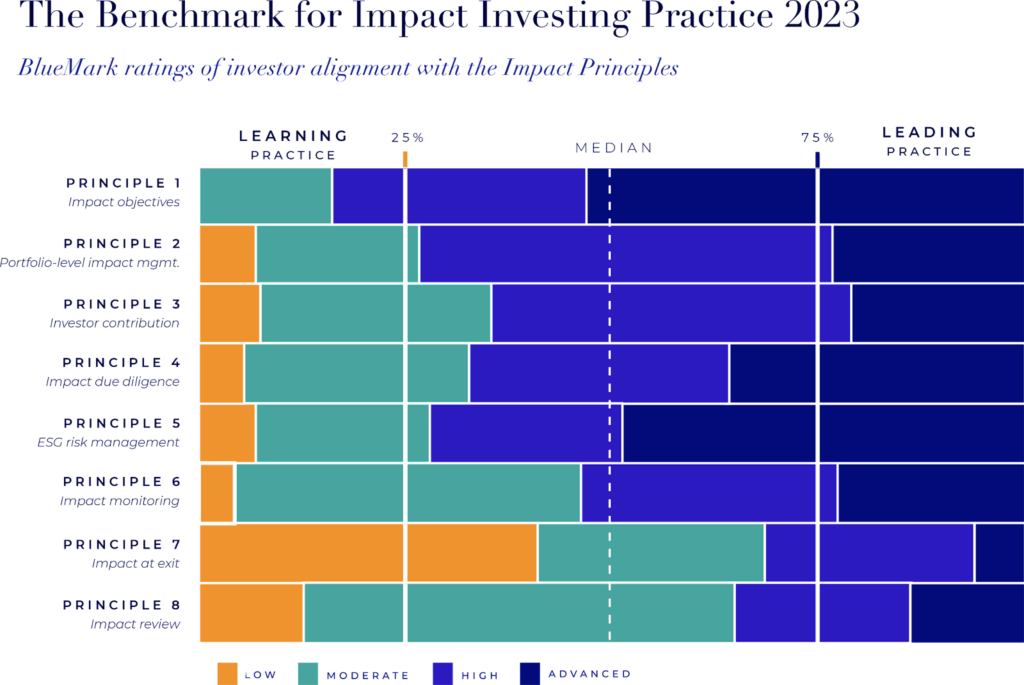

At a high level, we find investors generally perform well in the earlier stages of the investment cycle (defining strategic impact objectives, managing portfolio-level strategic impact, and impact due diligence) and lag behind best practice in the later stages (monitoring risk, measuring impact, and sustaining impact after exit). Our data also indicates that while investors are increasingly adopting foundational impact management practices, only a minority of investors are currently aligned with industry best practices.

When we analyze the data more specifically against the core tenets of impact investing, several key themes emerge:

Intentionality

Explicitly targeting specific social or environmental outcomes (such as the SDGs).

Setting impact objectives, a foundational process in establishing a credible impact strategy, continues to be the strongest practice area among BlueMark-verified investors. Our data demonstrates that the Sustainable Development Goals are used nearly ubiquitously for articulating impact goals, with 91% of investors utilizing the framework and 43% aligning their impact strategies with specific SDG targets.

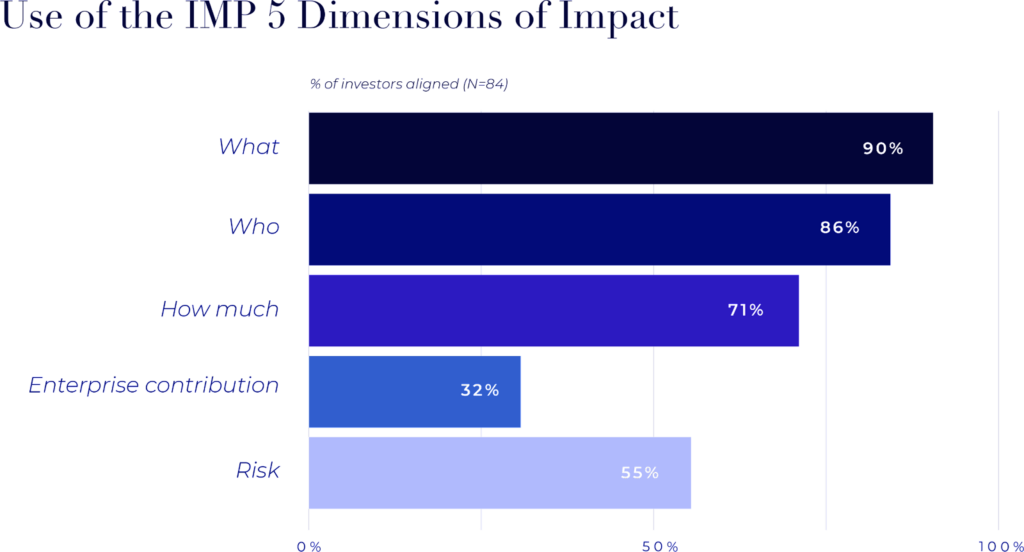

Another foundational impact management practice is ex-ante impact diligence, which is performed by 95% of BlueMark clients. However, it is clear the market has significant room for improvement, as only 26% of investors have due diligence processes that account for all five key components of impact (Who, What, How Much, Enterprise Contribution, Risk).

Meanwhile, the adoption of impact-aligned staff incentive systems remains limited with 31% of verified investors linking staff compensation to impact performance, either by integrating impact considerations into performance reviews (25%), linking annual bonuses to impact targets (15%), or through impact-linked carried interest (7%).

As the impact investing market matures globally, and impact investors become more discerning, advanced practices in impact intentionality – such as developing evidence-based theories of change and linking staff incentives to impact targets – are increasingly becoming table-stakes for using the impact label.

Contribution

Playing a differentiated role to enhance the achievement of the targeted social or environmental outcomes.

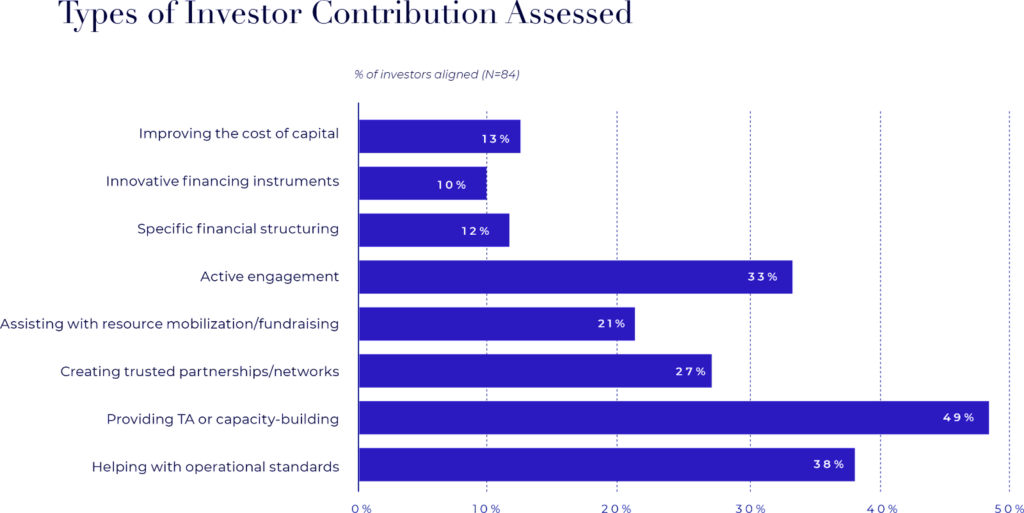

Compared to previous analyses, data from BlueMark’s 2023 Making the Mark report presents higher rates of non-financial investor contribution, demonstrating the growing importance of investor engagement activities in driving impact outcomes among their investees.

In addition to defining approaches to an investor’s impact additionality, 68% of BlueMark-verified investors also have a process to assess expected investor contribution at the investment level during due diligence. However, only 23% of investors are systematically monitoring the results of their contribution activities. As a result, many investors are not able to track results or integrate learnings from their engagement activities, limiting their ability to refine their contribution approaches over time.

Measurement

Monitoring and reporting impact performance based on measurable inputs, outputs, and outcomes.

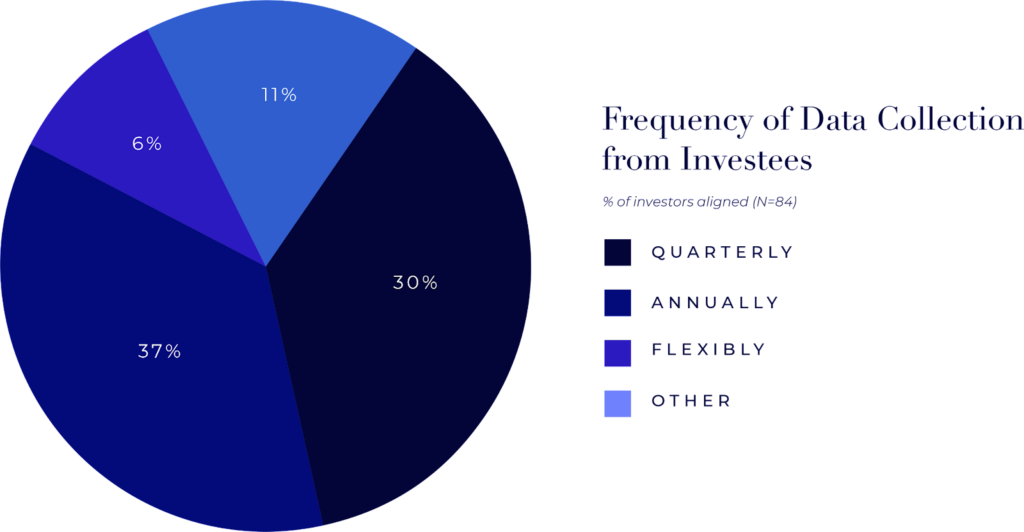

Impact monitoring is crucial to holding both investees and managers accountable to impact performance. Indeed, most BlueMark clients (80%) collect impact data from investees on a regular basis, though the frequency and cadence of data collection depends on the types of data collected and reporting schedules with LPs (limited partners). However, there is significant opportunity for improvement in how this data is analyzed, given only 60% of investors measure impact performance relative to expectations or established targets. This lack of contextualized performance data is a key challenge cited by impact investors, and a significant impediment to high-quality impact reporting, as explored in BlueMark’s Raising the Bar research.

In a move towards best practice, increasing numbers of impact investors are engaging with end-stakeholders (e.g., workers, beneficiaries, or community members) and actively soliciting their input to validate impact outcomes alongside investee data. While still a minority practice, with less than a third of BlueMark-verified investors (32%) systematizing stakeholder feedback, we believe soliciting input from end-stakeholders should, and will, become a key part of holistic impact management.

Summary

BlueMark’s research and data on impact management practices provides a unique lens into different segments of the impact investing industry.

Driving impact management best practice in Asia

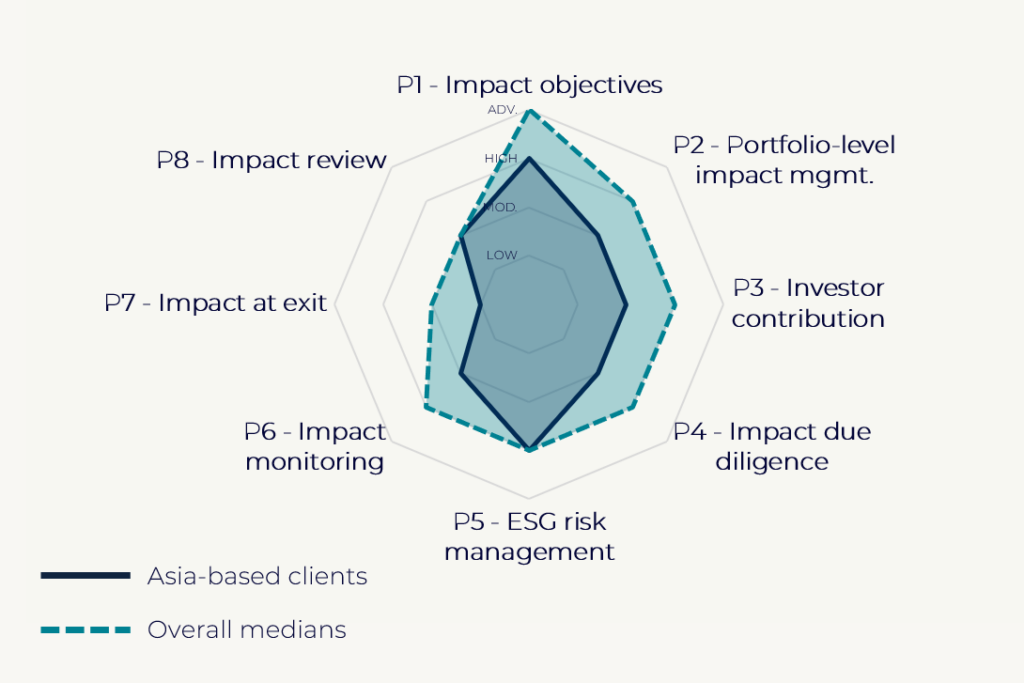

Our data, based on eight verifications of Asia-based impact investors, indicates that impact management practices are still emerging in the Asian impact investing market. Figure E shows that these investors are overall less aligned with the Impact Principles than the broader market.

Perhaps due to limited regulatory frameworks and the slow adoption of voluntary market standards around impact, Asia-based investors tend to receive lower ratings on foundational impact management practices, including strategic intent and impact measurement. On the other hand, Asia-based investors perform comparably to the broader market on ESG risk management and impact review processes. This may be a result of many impact strategies growing out of a more formalized and mature ESG ecosystem in Asia.

As the Asian impact investment market continues to grow, there is a clear opportunity for investors to become impact leaders and demonstrate best practice impact management.

The case for impact verification

Impact verification can help to drive impact management best practice by creating a “race to the top” that enables investors to deliver impact results with credibility and transparency.

For asset managers, verification can help impact strategies stand apart in a crowded market and credibly communicate impact performance with investors. Further, it allows allocators to more efficiently assess and compare the impact strategies and results of different managers, identify the impact leaders in their portfolio, and develop tailored engagement plans.

With a focus on learning and improvement, impact verification is essential to ensuring the Asian impact investing market scales with integrity and accountability.

For more information, see BlueMark’s latest report, Making the Mark: Benchmarking Impact Management Practice, at https://makingthemark.bluemarktideline.com/

BlueMark, Tideline, and AVPN are collaborating to take a deeper dive into the region’s impact management practices in the context of the rapidly evolving global impact investing market and IM standards. If you are interested in being part of that effort, please reach out to Tideline ([email protected]) or AVPN ([email protected]).