Why partner with avpn

What it means to partner with AVPN

Influence and inspire urgent action to resolve critical issues across Asia

Move more capital towards impact in an effective, impactful manner

Support multi-sectoral collaboration to drive systemic change

Partnership Pathways

There is more than one way to make the most of AVPN

By partnering with AVPN, we can help you develop tailored engagements based on your impact goals. We have helped to scale and champion causes that matter most to our partners, mobilising their capital towards impact more effectively.

Power of networks

Harness the diversity and reach of the AVPN network towards your goals. AVPN welcomes ecosystem building grants to contribute to the multiplier effect of the network to drive capital towards impact.

Investing in pipeline

Empower capital providers with a more strategic approach to reach impact organisations. AVPN bridges the gap between demand for and supply of human, intellectual, and financial capital between capital providers and impact organisations.

Action-oriented communities

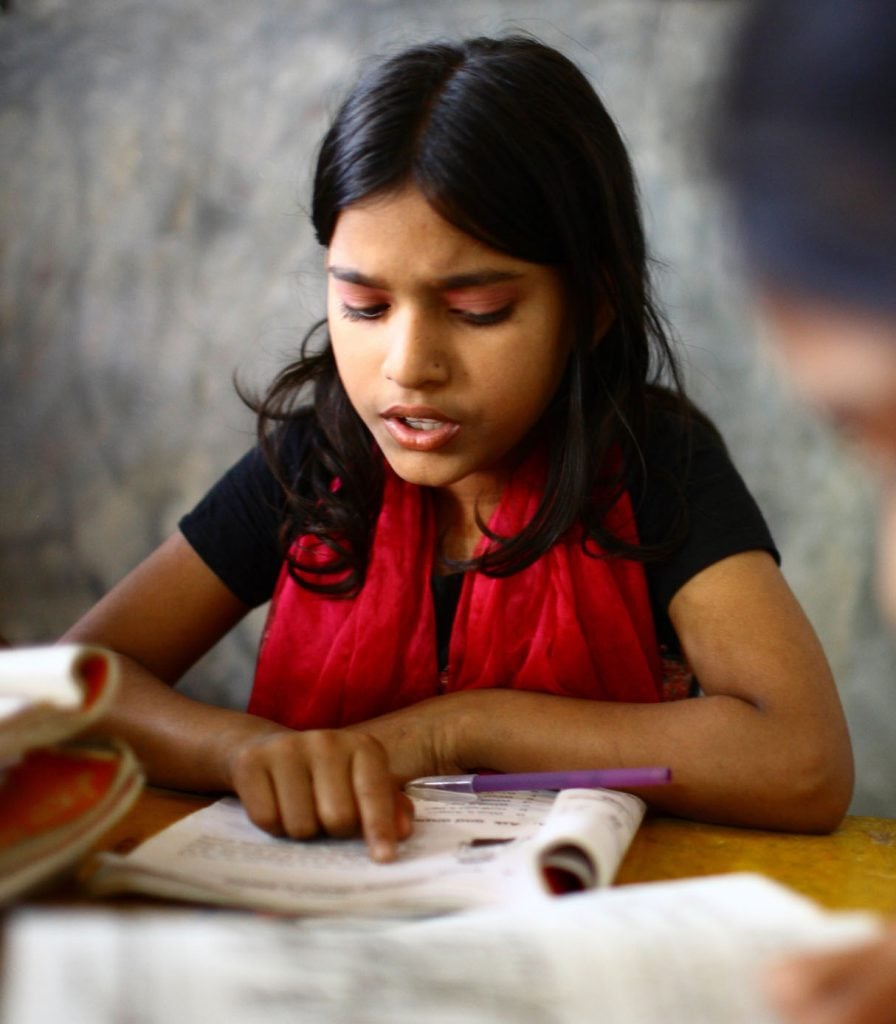

Build action-oriented communities and unlock pipelines of new capital around critical impact areas. AVPN thematic platforms offer opportunities to aggregate cross-sector efforts around critical issues such as climate action, gender, education, healthcare and nutrition.

Connecting with the right audience

Engage with social investors and impact practitioners to drive thought leadership. AVPN hosts industry flagship events annually, including the Annual Global Conference, the largest in Asia, and more intimate regional convenings, such as the Southeast Asia Summit, Northeast Asia Summit and South Asia Summit.

Curated insights for more impactful investments

Identify practical and actionable opportunities for social investors to be more effective through knowledge sharing and advocacy, leveraging the expertise of the AVPN network.

Empowering to scale

Influence global standards to create consensus around best practices. AVPN partners with other impact networks and ecosystem builders, including the Global Impact Investing Network (GIIN) and the Impact Management Project (IMP), who are reaching new audiences to empower practitioners and investors with the right tools and frameworks.

Enrich & educate the community

Contribute to disseminating knowledge for better social investment decisions and collaborate with AVPN in content creation, publishing and promotion. Current industry media partnerships include Alliance Magazine and Stanford Social Innovation Review.

AVPN Partner's Experience

Partnership Stories

See how AVPN ensures the flow of capital into the social sector with the help of our partners.

By AVPN

Leverage the power of networks for greater impact

OUR AVPN PARTNERS

Some of our notable partners

These are some of the partners who have worked with AVPN over the years in mobilising more capital towards impact.

- American Express

- BHP

- Bill and Melinda Gates Foundation

- Chevron

- Children's Investment Fund Foundation

- Citi Foundation

- Fondation CHANEL

- Google.org

- Hewlett Foundation

- The Hong Kong Jockey Club Charities Trust

- Jhpiego

- Johnson & Johnson Foundation

- JP Morgan Chase & Co.

- KPMG India

- Lever for Change

- MacArthur Foundation

- Merck Sharp & Dohme (MSD)

- Micron Foundation

- Moody's

- New Venture Fund

- RPG Foundation

- Schmidt Futures

- Singapore Economic Development Board

- Takeda Pharmaceuticals (Asia Pacific)

- The Nippon Foundation

- The Rockefeller Foundation

- The Target Foundation

- UBS Optimus Foundation

- United Nations Development Programme (UNDP)

- Visa Foundation

- Visa Inc

- Vitol Foundation

- Yayasan Hasanah

- YTL Foundation

PARTNERS’ REVIEWS

What do our partners think about AVPN?

Head of Sustainable Investing at Standard Chartered Bank

Vice President, Global Community Impact at Johnson & Johnson

Former Senior Vice President, Global Policy and Advocacy at The Rockefeller Foundation

Partnership Application

Partner with us

Join us as a supporting partner to help build the ecosystem for social investment in Asia.