4 min read

Why is impact management not well understood?

“These metrics and resources seem to complicate things, more than help in the due diligence process” seems to be a key concern among stakeholders along the value chain, from investors to enterprise to beneficiaries. With impact metrics and outcomes differing across different actors, what the investor thinks as an effective framework may not work as well for the enterprise or beneficiary group.

“The truth is, what’s best for an organization on the impact value chain may not be best for adjacent entities. This causes a proliferation of frameworks, often reinventing the wheel. Therefore, how can it make sense for the whole ecosystem?” Kevin Teo, AVPN, COO

“[There are] 2 different dimensions of impact: company impact on the world [from the company’s activities] and investor impact on the company [the change in the amount of the company’s impact on the world].” James Gifford, Credit Suisse, Head of Impact Advisory

After participating in the AVPN Conference 2020, in which a session had been dedicated to impact management, I will be sharing more details on impact management resources and how it can be utilized by investors, hopefully helping investors in their process of deciding which metrics to adopt.

The speakers kickstarted the discussion by exploring what is considered a “good” impact outcome, how much standardization to metrics should be applied and if certain metrics are more effective. They also assessed which impact management frameworks have been working best for them. Herein, I will highlight two of frameworks that were highlighted as a basis for practitioners’ impact investing journey: The Impact Management Project (IMP) and the Global Impact Investing Network’s IRIS+.

IMP measures the change in outcome caused by an organisation, thereby assessing the impact performance of different enterprises and investments against the Sustainable Development Goals. IMP not only measures these outcomes at different points of a company’s journey, but also measures them against a threshold to reach a conclusion of its performance. These 4 outcome categories are 1) Negative outcomes 2) Act to avoid harm outcome 3) Benefit stakeholder outcome 4) Contributing to solutions outcome.

On the other hand, as a huge database, IRIS+ system identifies core metrics, evidence and research to help investors streamline their due diligence process. By aligning itself with over 50 standards and frameworks, it can be used with any standard or proprietary impact measurement and management framework. As such, it readily helps to integrate social and environmental factors into investment decisions alongside risk and return.

How are investment firms using impact management frameworks

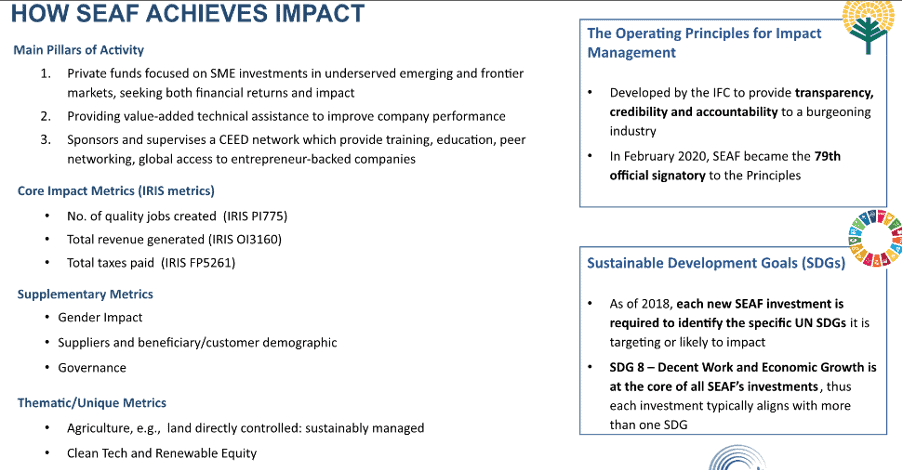

SEAF provides entrepreneurs in emerging markets with the capital, knowledge, and networks they need to grow their businesses and has been achieving meaningful and measurable impact results alongside positive financial returns. Robert Vodicka, Vice President at SEAF shared their investment process as a global impact private equity manager, and demonstrated how they utilized metrics from IRIS+ whilst including metrics of their own.

Using a combination of IRIS+ core impact metrics, supplementary metrics, and thematic/unique metrics to analyse the impact of the investee, which is then used in the investment decision. As of 2018, each new SEAF investment is also required to align with one or more specific UN SDGs. Robert believes that it is important to have a set of metrics that can be used across all sectors, so that it can be a quick reference set when accessing all the 400+ companies across the portfolio. “Depending on what impact you want to see for your portfolio, you can choose the suitable metrics to collect and measure,” he says. As such, SEAF’s metrics include:

- Core impact metrics – from IRIS+ – such as the number of quality jobs created, total revenue generated, total taxes paid;

- Supplementary metrics that assesses gender impact, suppliers and beneficiary/customer demographic and governance;

- Thematic/unique metrics, from agriculture to clean tech and renewable equity;

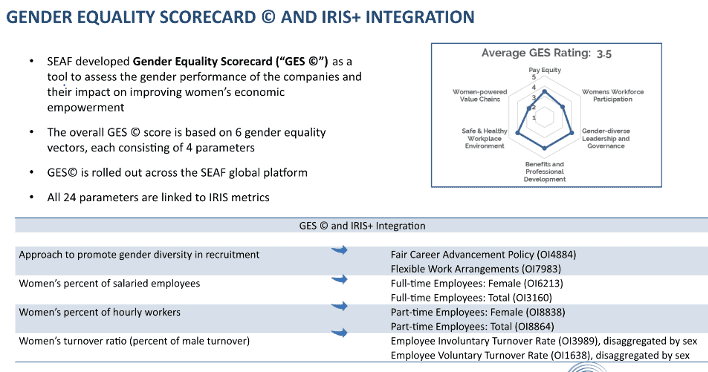

- SEAF also developed their own Gender Equality Scorecard that consists of 6 gender equality vectors, each with 4 parameters. All 24 parameters are linked to IRIS+ metrics.

These standards, framework, and metrics are there for investors to utilize to enhance their investment decision. It is also a good way that investment firms can use to access their performance, or for investees to access their own impact. Hear from impact investing practitioners who are leading the way in accounting for measuring the work that they do to address socio-environmental challenges in Asia.