8 minutes read

Supported by Google.org and ADB, AVPN has partnered with Dalberg Advisors to develop the Asia Pacific Sustainability Seed Fund 2.0 article series that highlights key insights from its research on the climate technology ecosystem including identifying potential solutions and constraints across social sectors. Through the research, AVPN aims to highlight innovative technology addressing climate challenges and exploring their impact on society. Additionally, the research seeks to pinpoint opportunities for social investors and policymakers to advance progress in this field. The article series will conclude with insights shared in a final report. In its second year running the APAC Sustainability Seed Fund 2.0 (APAC SSF 2.0) aims to catalyse sustainable innovation through multi-disciplinary research and philanthropic seed funding.

Even as climate-vulnerable populations in Asia Pacific confront an escalating climate crisis, the region lacks sufficient adaptation financing and technology adoption required to tackle these challenges. Social investors must deploy catalytic, patient capital to fund unconventional climate tech innovations tailored to APAC needs. Collective action is imperative across sectors to direct capital and policies towards such disruptive climate technologies that build inclusive, equitable resilience. However, a significant hindrance to achieving progress at the desired scale and pace is the lack of access to knowledge and guidance for prioritising the most impactful climate technologies. AVPN is calling upon players across the climate tech ecosystem to collectively support the development and deployment of disruptive innovations in climate technologies for the Asia-Pacific region.

The Rising Costs of Climate Impacts in APAC Call for Urgent Adaptation Action

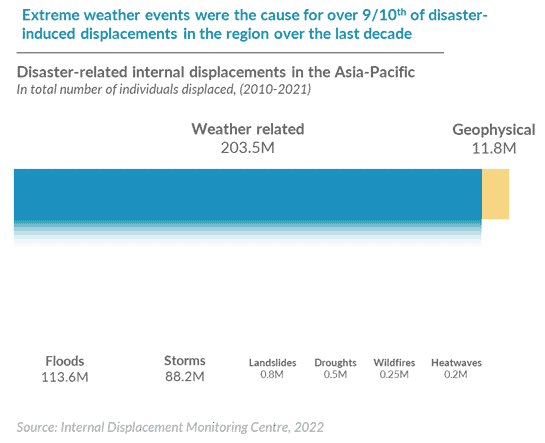

Asia-Pacific nations grapple with severe climate impacts, the increasing intensity and frequency of which jeopardise the region’s socio-economic well-being. Extreme weather events such as droughts, floods, and heatwaves have surged over three times in the last 30 years.[1] Housing eight out of the 15 most affected nations globally, the region witnessed over 225 million displacements between 2010 and 2021, with around 95% of them caused by weather-related extreme events.[2] Some of the most pressing climate challenges in the region include declining crop yields and water availability, rising sea levels displacing coastal communities, increasing heat stress impacting labour productivity and incomes, and a higher incidence of vector-borne diseases like malaria and dengue. Under a business-as-usual scenario, current annual economic losses of USD 780 billion from climate change impacts in Asia-Pacific could nearly double to USD 1.4 trillion annually (4.2% of regional GDP).[3]

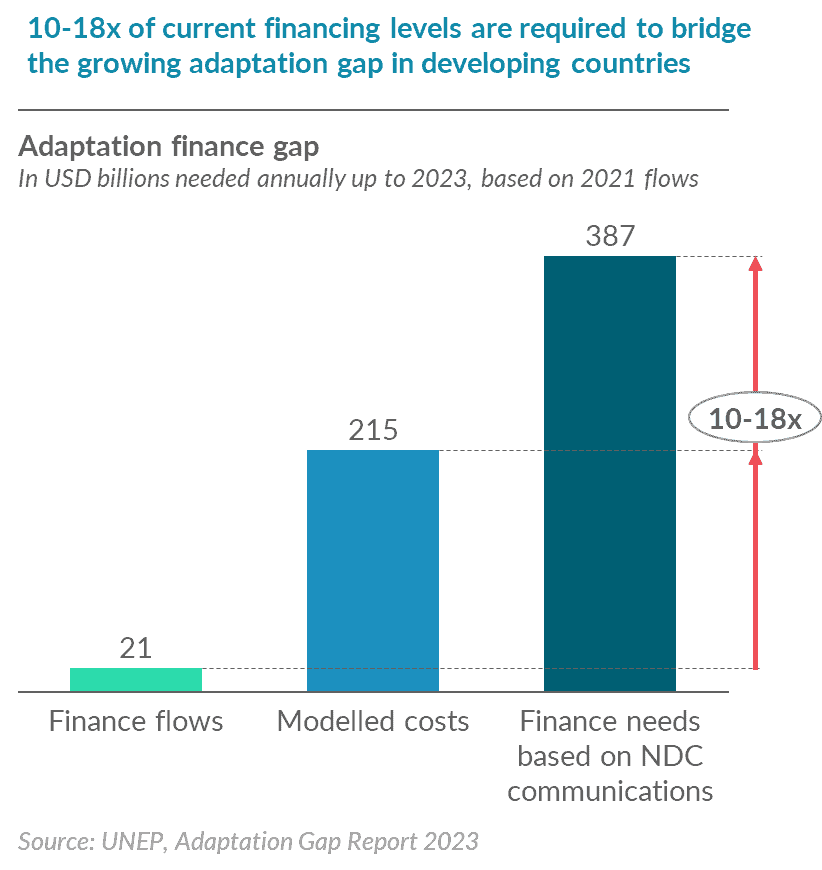

Investments in climate adaptation remain low despite a demonstrated multi-trillion-dollar opportunity. While adaptation finance amounts have increased over time, they continue to represent a small fraction of total climate flows. The widening gap between rising adaptation costs and limited financing leaves at-risk countries in the region severely under-resourced. Adaptation finance was just 8% of total climate flows in 2022-2023, leaving a 10-18 times gap for developing nations versus needed flows.[4] Adaptation financing is seen as a prerogative of the public sector with minimal private sector participation due to high upfront costs, perceived risks and uncertainty, lack of established commercial markets, and limited access to knowledge on the opportunities.[5] This severe underinvestment in resilience building leaves populations constrained in their adaptive capacities. Bridging this climate adaptation finance gap will require mobilising several trillions of dollars in financing over the next decade. There is a strong economic opportunity for scaling up adaptation financing: The Global Commission on Adaptation in 2019 estimated that investing USD 1.8 trillion globally in adaptation measures, between 2020 and 2030, could generate over USD 7 trillion in total net economic benefits.[6]

Technology and Innovation are Key to Unlocking Climate Adaptation at Scale

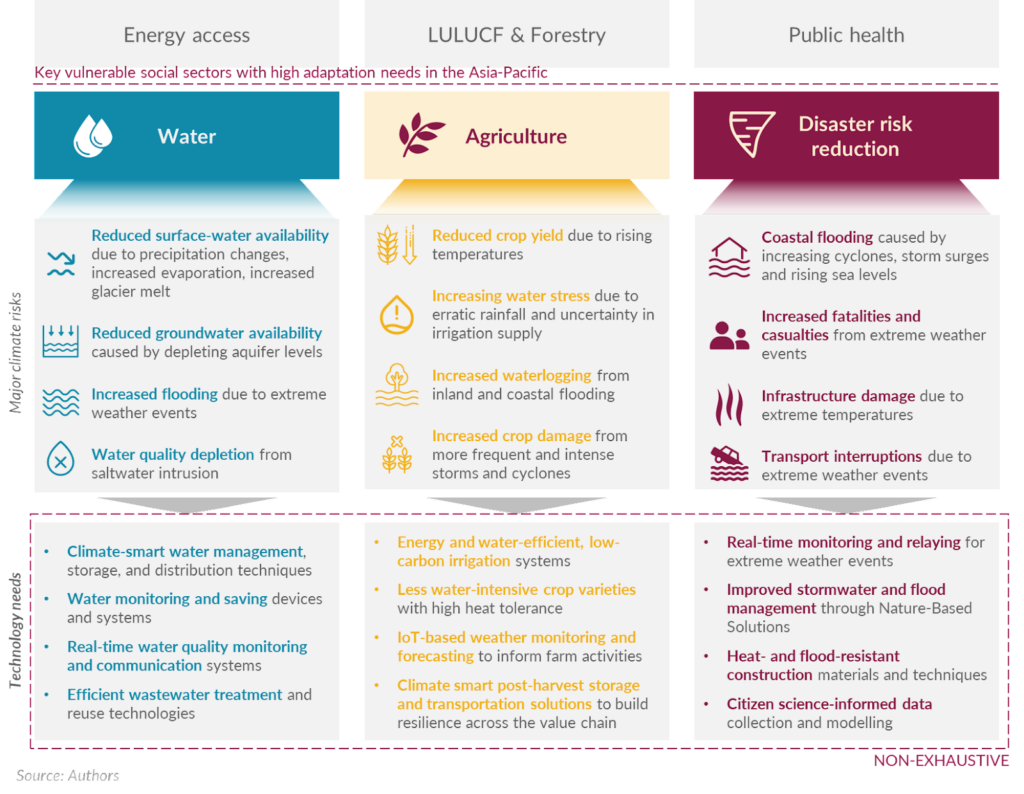

While mobilising adequate adaptation financing is vital, targeted deployment of technologies will be pivotal to ensuring that these capital flows translate to impact on the ground. Climate-adaptive innovations can support vulnerable communities in building resilience. Recognition of the vital role of technology and innovation is evident from the establishment of the United Nations Climate Technology Centre and Network (UN CTCN) under the United Nations Framework Convention on Climate Change. Technologies such as Artificial Intelligence (AI), satellite data analytics, IoT sensors, and biotech can transform climate-sensitive sectors such as agriculture, water, health, and disaster management.[7] Innovations such as heat-tolerant crop varieties, off-grid RE-powered energy solutions for irrigation, and river flood monitoring can protect smallholder farmers from climate-induced water extremes. Early warning systems powered by AI and telecoms could provide life-saving alerts before disasters.

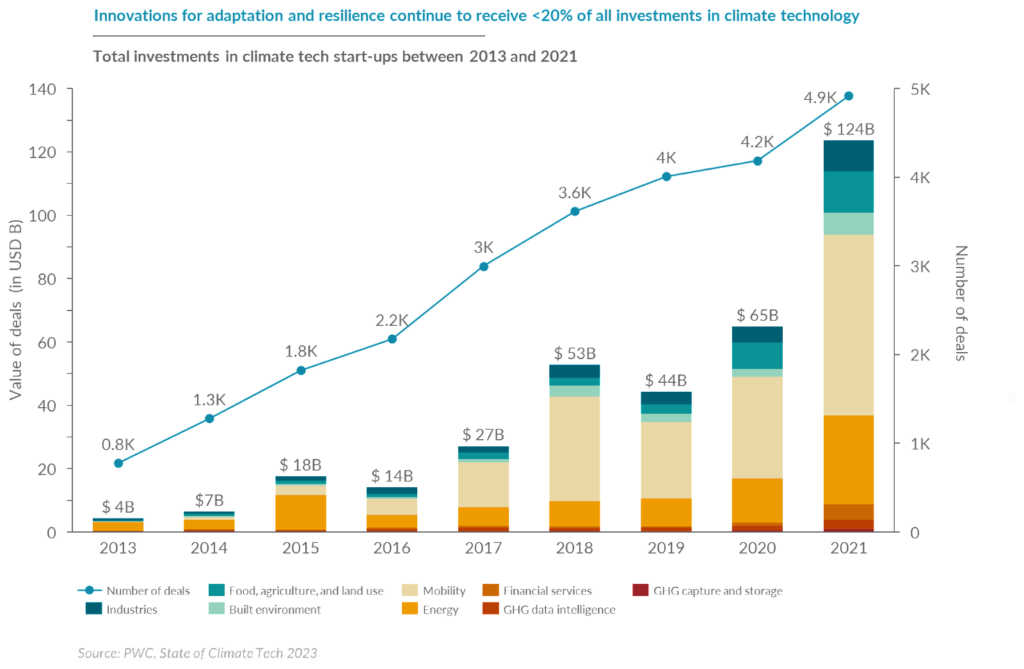

Even though climate tech investments reached an all-time high of around USD 124 billion in 2021[8], they continue to be skewed towards emission reduction efforts in high-income countries, predominantly in Europe, and USA and Canada[9], and concentrated in the energy and transportation sectors. Compounding the problem of the small share of funding, only 30% of patented adaptation technologies are transferred to developing countries bearing the greatest climate impact risks.[10]

While climate adaptation technologies offer vital tools for building resilience, they face barriers to rapid development and deployment at scale. Patent analysis of climate change technologies globally revealed slower diffusion rates for adaptation technologies (16%) compared to mitigation (31%).[11] The lack of clear definitions across the wide diversity of climate adaptation solutions hampers investors’ ability to evaluate opportunities and risks. Innovations range from AI to nature-based solutions, each with distinct risk-return profiles depending on the maturity of their focus areas like agriculture or infrastructure. Unclear metrics to gauge tech investment readiness and impact potential further constrain financing for the development, deployment, and transfer of adaptation innovations. Key challenges faced by the ecosystem include high costs and limited financing access, lack of technical implementation capacities, policy and regulatory gaps, and scarce risk-tolerant capital suited to the high uncertainty involved in the rapidly evolving adaptation innovation landscape.

Creating enabling conditions for rapid development and widespread adoption of climate adaptation technologies is crucial to accelerating efforts. This necessitates not just financing, but also policy and institutional mechanisms that facilitate rapid tech transfer and implementation. Operationalising concepts of adaptation technologies more precisely is key but must be accompanied by enabling conditions such as knowledge sharing and increased access to risk capital to truly unlock innovations in climate adaptation technologies tailored to local needs. Impact-focussed alliances between governments, investors and communities can accelerate this. Furthermore, given the patient and catalytic nature of the capital required, social investors have a pivotal role in addressing the barriers above.

Leadership from Patient Social Capital is Imperative to Scale Adaptation Innovation

Social investors can provide the patient, long-term capital needed to nurture high-risk climate adaptation innovations in Asia-Pacific. The high-risk tolerance that comes with social capital is required for this emerging yet vital ecosystem. Social investors can deploy a range of financing instruments—from patient equity to innovative blended finance structures—to meet the diverse needs of climate tech startups while de-risking investments for mainstream capital. For instance, equity financing with a 10 to 15-year horizon is a prerequisite for the long development cycles of breakthrough agri-technologies such as climate-resilient crops.

Beyond financing, social investors also facilitate capability building and collaborative networks vital for climate tech development and transfer. Initiatives such as AVPN’s Sustainability Seed Fund exemplify social investors’ potential to accelerate climate tech innovation through tailored financing instruments, capability building and fostering collaborative networks. The Fund provides early-stage grants and technical assistance to catalyse the development and deployment of impactful yet commercially viable solutions. Such pioneering efforts by social capital can nurture the next generation of climate adaptation innovations across Asia-Pacific while stringing the implementation capacities and technical expertise across the ecosystem.

AVPN Strives to Systematically Overcome Barriers for Sustainability Tech Deployment Tailored to APAC

As a leading investor network dedicated to creating social impact in Asia, AVPN recognises this urgent need. Through targeted programs such as the Google.org funded Asia Pacific Sustainability Seed Fund providing grants to climate tech startups and the Climate Action Platform connecting investors with opportunities, AVPN is supporting innovative solutions and financing flows. However, we also recognise that wider systemic efforts are still needed in this direction.

To continue addressing these systemic barriers, AVPN is developing a practical framework tailored to Asia-Pacific’s needs to guide climate technology investments and policies. As climate change exacerbates socio-economic disparities in APAC, scaling adaptive innovations inclusively, equitably, and sustainably becomes vital. This necessitates an exploration of ways to harmonise our understanding of sustainability technologies with the region’s adaptation needs across the most vulnerable social sectors. By evaluating deployability, costs, and social impact, this framework will assist investors in identifying high-potential solutions while helping policymakers prioritise enabling environments for validated technologies.

[1] IPCC, ‘Climate Change 2022: Impacts, Adaptation, and Vulnerability’, 2022

[2] Disaster Displacement in Asia and the Pacific: A Business Case for Investment in Prevention and Solutions | Asian Development Bank (adb.org)

[3] Resilience in a riskier world : managing systemic risks from biological and other natural hazards | ESCAP (unescap.org)

[4] Adaptation Gap Report 2023 | UNEP – UN Environment Programme

[5] Global Landscape of Climate Finance 2023 – CPI (climatepolicyinitiative.org)

[6] Adapt now: a global call for leadership on climate resilience – Global Center on Adaptation (gca.org)

[7] Technologies to Support Climate Change Adaptation in Developing Asia | Asian Development Bank (adb.org)

[8] The USD 124 B figure refers to the overall deal value across different financing types, not the total capital invested. The deal value metric can inflate actual amounts received. While climate tech investments have declined 40% in 2023 versus 2022, a shallower drop than the overall market, this downturn stems from economic uncertainty amidst pandemic recovery and geopolitical conflicts. Climate tech funding is expected to rebound despite near-term turbulence. Source: State of Climate Tech 2023: Investment analysis | PwC

[9] Climate tech investment trends – five years on since the Paris Agreement | Dealroom.co

[10] Technology and Innovation Report 2021 | UNCTAD

[11] Knowledge for a warmer world: A patent analysis of climate change adaptation technologies – ScienceDirect