The First Step

Pre-Engagement

Share

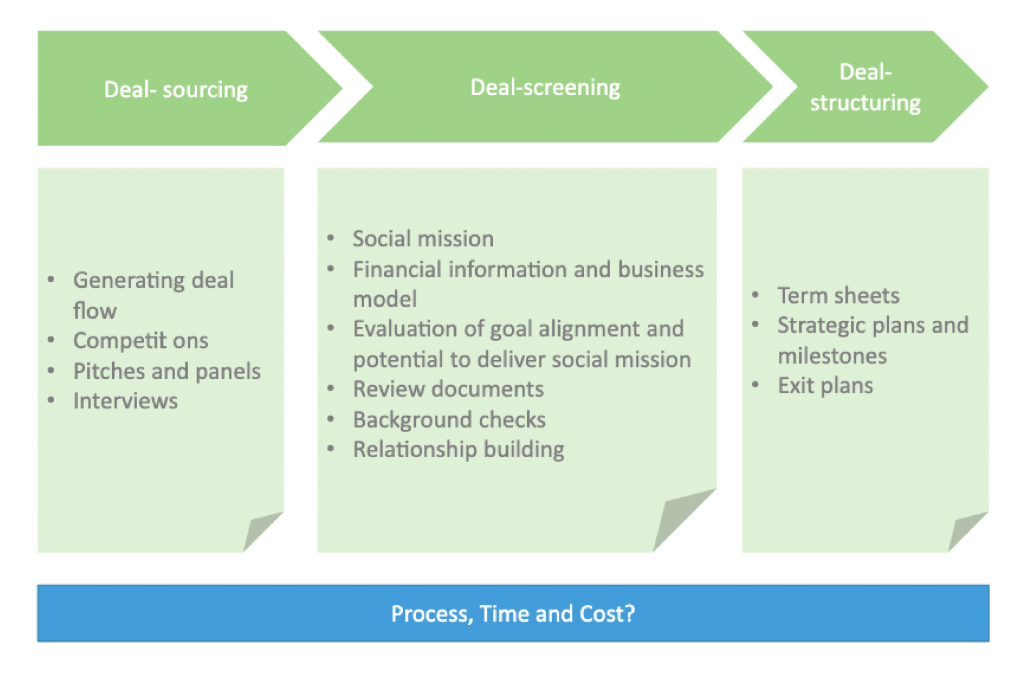

Pre-engagement is the first step on the journey of social investing. It includes three activities: sourcing, screening (including due diligence) and structuring social investment deals. In the sourcing phase, social investors build the pipeline by raising awareness of their mission and investment criteria. Screening candidate organisations, also known as due diligence, can be a lengthy and expensive process. Finally, the process of structuring the engagement for the mutual benefit of social investor and SPO includes negotiations around investment terms, capacity building and impact assessment.