At the heart of venture philanthropy is an engaged approach with the funded organisation. Capacity building of social purpose organisations is one of the main activities funders in this region engage in. Ideally, what is provided by the social investor or resource provider matches what is needed on the side of the social purpose organisation.

The social purpose organisations’ needs tend to come from internal parameters in the social purpose organisation, e.g. the development stage of the organisation, the management team, its social mission, business model and growth plans, as well as the external environment, which shapes the entrepreneurial eco-system, economic stage of the country and the role of the government. Social investors then have different in-house capabilities to support capacity building and hence need to draw on third-party providers (either paid, low- or pro-bono). This requires the venture philanthropy organisation to manage the third-party interactions.

The outcome of this relationship is then capacity building through a variety of tools such as strategic support, professional services and physical infrastructure, which aims to create real value for the social purpose organisation by helping them to achieve their social missions and value for the social investor or resource provider by increasing their impact.

To understand what works best, previous AVPN 2015 conferences outlined practices on building strong intermediaries to help SPOs and on leveraging skills-based volunteers. Beyond the conference, we will unearth and document further effective practices delivered by foundations, venture philanthropy funds, incubators/equity providers and intermediaries funding to build the capacity of various social purpose enterprises.

Here, AVPN presents Social Ventures Hong Kong’s (SVhk’s) capacity building practices as some particularly robust samples of how a VPO can engage with its portfolio organisations to help them fulfill their potential and meet their goals.

Social Investing Marketplace in Hong Kong – Looking for “Champions”

Hong Kong currently ranks 10th highest in the World Giving Index 2014, which measures giving behaviours across more than 160 countries. It uses three metrics in its evaluation of giving behaviour: the percentage of people who in a typical month donate money to charity (in Hong Kong, 68% of the population in 2014), the proportion of people who volunteer their time (15%), and proportion of people who help a stranger (57%).[i]

Up from #19 in 2012, #11 in 2011 and #18 in 2010[ii] (Hong Kong was not included in the 2013 survey), Hong Kong’s latest overall rank at #10 appears to reflect increasing interest in social engagement among its population.

About Social Ventures Hong Kong (SVhk)

Established in 2007 by Francis Ngai, SVhk was conceived out of its founder’s perceptions of an intersection of needs in Hong Kong: first, a need for solutions to enduring social problems; and second, a need for a supportive space for those social enterprises and social investment entities capable of providing those solutions.

Targeting social issues in Hong Kong like poverty, education, elderly, and the environment, SVhk was founded with the objective of creating innovative and sustainable business solutions for these issues within Hong Kong communities using venture philanthropy models that leverage impact capital, professional volunteers and collaborative networks.[iii]

As of June 2015, SVhk has supported over 20 portfolio projects in Hong Kong, most of which have engaged with SVhk since the inception of ideas. [iv] SVhk adds around 1 to 3 new projects to its portfolio each year. Although SVhk’s long-term plan is to be able to exit its engagements with investees when appropriate, thus far SVhk has not made any exits; depending on the investee’s stage of development and capacity, there have been instances where SVhk has scaled back its involvement from active management to taking a back-seat role.[v]

SVhk’s preferred form of investment is equity in its investees, through its investment arm SVhk Capital – a venture philanthropic fund that provides financial support to social purpose organisations.

SVhk describes its structure, with around 15 in-house staff running the bulk of operations, as “lean”. While SVhk leverages various resources provided by its partners, namely event management or sector-specific expertise, most activities are handled by their dedicated, in-house project staff. SVhk also negotiates pro-bono and low-bono rates for certain services, like legal and audit. The in-house staff is roughly organised into three teams:

- The Incubation and Innovation team, which is the first point of contact for social ventures by receiving ideas, collaborates and networks with corporates.

- The Business Services team, which provides professional services such as company secretary, finance and accounting.

- The Impact Capital team, which manages ventures and funders engagements at a more developed stage to after the incubation team, identifies financial capital means, does monitoring and performance style and portfolio management.

A fourth, additional team is the Promotion and Advocacy team, responsible for promoting the SVhk concept (especially SVhk’s most early stage enterprises) among the general public through public talks, workshops and SVhk’s annual 12-month long House of Social Innovator Program.[vi]

How does SVhk contribute to the social investing market space in Hong Kong?

Echoing the findings from the World Giving Index, SVhk’s 2011 Money for Good research notes that interest in the social investment market has been increasing in Hong Kong in recent years among donor-investors and SPOs alike, as evidenced by the recent establishments of organizations including, among others, SVhk, Social Investors Club (SIC), Self-Sustainability, Opportunity and Well-being Asia (SOW Asia), and Avantage Ventures.[vii] In regards to government support, the HKSAR Government has demonstrated active support of the social investing market in Hong Kong, through efforts in substantial funding, public education and cultivation of market players. Social entrepreneurs in Hong Kong benefit from a large amount of public funding (approximately HK$8.7 billion) and 50% of social enterprises are HKSAR Government funded (the other half being funded from the private sector).[viii]

Despite these promising movements, as Money for Good notes, significant steps are still needed to develop a healthy and diversified ecosystem for social investing: at the moment, most engaged giving is done through either club investing (where a number of individuals pool their funds for investment into a cause) or in-house enterprise incubation (where a donor-investor appoints a staff member to work as part of the SPO’s management team),[ix] with minimal presence of other investing models and vehicles (for instance, wholesale banks, venture capital funds or community foundations). Increasing the diversity of available institutional models and vehicles for social investing is expected to go a long way in meeting the expectations of donor-investors as well as enticing more individuals to create SPOs.[x]

In this respect, SVHK has gone beyond the Works Integration Social Enterprise (WISE) approach, which focuses on the integration of disadvantaged individuals into the mainstream workforce, in order to promote the creation of other innovative models and possibilities for individuals and businesses to support the society in different ways.[xi]

To this end, SVhk focuses on engaging businesses and corporates in Hong Kong, where traditional businesses are increasingly “looking into social innovation”. SVhk sees this interest as an opportunity to “create other innovative possibilities for people to invest in”: for instance, in the past SVhk was brought in to consult for a Hong Kong hotel to identify ways that the hotel’s core operations, including its marketing, sourcing and training departments, could be used to support local social enterprise initiatives. SVhk is also seeking to redefine the nature of corporate engagement with social enterprises in Hong Kong by engaging employees from major corporations as skill-based volunteers to support its social ventures incubation efforts. As SVhk describes, currently professionals often “volunteer [with SVhk] on a more personal, after work basis – but that’s changing since [SVhk’s] strategic partnership allows professionals to volunteer on behalf of their firm”.[xii]

A second unique feature of SVhk’s philosophy is its perception of the strong relationship between the impact assessment and capacity building components of its engagements, which effectively means that KPIs are defined on a “rolling basis”, with SVhk’s impact assessments of an SPO feeding back into its setting of the SPO’s KPIs as the SPO’s vision and objectives mature and change.

In 2015, SVhk’s founder Francis Ngai still found that despite the government’s schemes, household incomes have not risen, nor have the advantages from businesses trickled down to communities or the city’s HNWI[xiii], which is an ongoing incentive for SVhk’s investment and capacity building.

SVhk’s Investment Process is powered by a “dual engine”

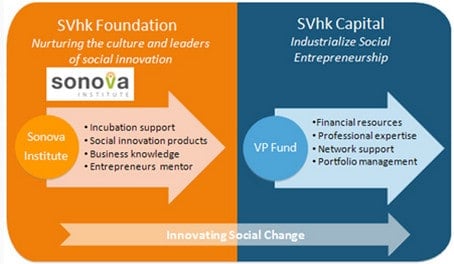

SVhk’s “dual engine model”, offering a “flexible” option to donor-investors from both the finance-driven and impact-driven ends of the spectrum, has been developed as part of a response to some of these needs in Hong Kong. The “dual engine model” – composed of SVhk Foundation and SVhk Capital, depicted below – seeks to create a symbiotic relationship between the demand-side and supply-side of the social investment landscape in Hong Kong by enabling a self-perpetuating cycle: individuals are encouraged to create new social ventures with confidence in finding funding, while donor-investors are attracted to participate in engaged giving after seeing the diversity of financial and non-financial tools, vehicles and outcomes available.[xiv]

SVhk targets early-stage and mid-stage investees who fulfill criteria like: the potential to scale their impact through a clear articulation of their social mission, catalytic impact with unique ideas and expertise in their social issue, clear understanding of their market and competition, and compliance with ESG (environmental, social and governance) framework.

The “dual engine model” in motion

As previously mentioned, SVhk’s “dual engine model” is composed of two branches: SVhk Foundation and SVhk Capital. SVhk Foundation is a charitable organization that aims to promote social innovation culture by incubating new social solutions, while SVhk Capital is Hong Kong’s first venture philanthropy fund dedicated to providing financial and non-financial support to high-impact social ventures.

The SVhk Foundation acts as a nexus where changemakers and innovators can connect with others and channel their collective energies and ideas into tangible enterprises. This process grows into engagements with SVhk Capital – the investment arm, SVhk Capital’s funds come from, primarily, individual philanthropists and family foundations – which enters when enterprises graduate from conceptualisation to incubation and investment stages to provide them with longer-term professional pro bono support and funds.[xv]

Together, the two aspects of this “dual engine” work to enhance and build the capacity of the SPO by developing its internal capabilities as well as leveraging external resources. Ultimately, this comprehensive approach embodies SVhk’s “culture of engaged incubation”, which strives to “tailor-make” each of its engagements to fits each SPOs’ stage of development and nature. In this way, SVhk hopes to distinguish its model of bespoke incubation to other incubators and accelerators in Hong Kong (which largely offer workshops for the general startup population).

SVhk Foundation & SVhk Capital Diagram

As mentioned above, SVhk’s most common form of investment is equity. Loans/debt are used to a lesser degree. SVhk believes that this approach helps it establish a stronger relationship with its investee and places SVhk in a position of “partner, not just investor”. SVhk has also found that taking equity instead of issuing loans is often more appropriate for the kind of investee it often engages in: that is, those at an early stage of development with nascent business and operational models. Because an early-stage investee’s “capacity to repay loans [may be] tough,” providing equity instead of a loan allows SVhk more assurance in such situations.

The average amount of equity varies along with the level of engagement with the investee. Majority shareholding for SVhk involves a particularly close level of engagement with the operations and governance of the SPO, including bringing in professional support from SVhk’s professional network, while minority shareholding would require less direct, detailed effort in the SPOs activities.[xvi]

In practice SVhk’s Investment Process follows this process:

Capacity Building is integrated into the process under the investment management and is a product of goal setting and KPIs.

Capacity Building integrated with Impact Assessment

SVhk’s capacity building is strongly linked to its impact assessment. Due to this, goal setting and defining KPIs are crucial for the effort. There tends to be three areas for SVhk Capital’s capacity building: goal setting and defining of KPIs; engaging with the SPO team and developing their skill sets; and providing in house and pro bono expertise in legal, human resources, marketing and operations:[xvii]

- Goal Setting & Defining KPIs: SVhk has a set of general metrics e.g. number of lives touched and number of lives transformed, for all of its portfolio projects. In addition, SVhk also defines specific KPIs on a case-by-case basis depending on the SPO’s stage of development, industry, operation and impact models. For instance, one of SVhk’s most successful portfolio projects, Diamond Cab, started out in 2011 with an initial set of KPIs for its original objective (of providing accessible and professional transport services for individuals in wheelchairs in Hong Kong). Since then, however, Diamond Cab’s services have gradually expanded in response to demand – now, it also act as a tour operator, organising activities and tours for individuals in wheelchairs, necessitating SVhk to reevaluate how the original KPIs can be adapted. SVhk requires, at a minimum, quarterly reports to its management team and board from each of its portfolio SPOs, with the goal of ensuring that SVhk has an “active dialogue throughout the year on how [the SPO] is doing” – this is often achieved by SVhk taking a board seat at the SPO and directly participating in its decision making processes.[xviii]

SVhk draws its impact assessment practices from a number of existing frameworks that SVhk has merged to meet its wide range of SPOs and their needs. While SVhk initially utilized the SROI framework for its work, it found that due to its wide range of SPO partners, the SROI framework was not appropriate in all cases. After this realisation, SVhk began developing its own proprietary templates, drawing upon the Bridges Ventures framework[xix] for analysing risk and the Global Impact Investing Network’s IRIS database.[xx] While SVhk notes that its impact assessment framework requires quarterly reporting, SVhk’s guiding philosophy is to engage very closely, on a day-to-day basis, with its investees to understand how SVhk needs to alter its template in each case to meet its investees’ needs.

SVhk regards this capacity building process as largely tied-in with its impact assessment process. To maintain a flexible stance capable of absorbing changes to investees’ needs, it has found that its proprietary impact assessment framework is a good place to start defining its KPIs. SVhk returns to this impact assessment framework throughout the engagement as KPIs are frequently redefined. [xxi]

- Capacity & Team Engagement: At the early stage of engagement, SVhk works with SPO teams as partners to identify specific business needs. SVhk then convenes its in-house incubation team, business service team, impact capital team and network of professional volunteers to provide capacity building and network support. Enterprises start with the Incubation and Innovation Team, and upon reaching a more mature stage are managed by the Impact Capital Team while being supported throughout by the Business Services team.

In cases where SVhk is a majority shareholder it’s usually “easy to talk about what [the SPO’s] needs are,” since SVhk’s in-house team has a high degree of involvement with the internal workings of the SPO, including its financials. For cases in which SVhk is a minority shareholder, SVhk may still maintain a board seat at the SPO for general monitoring purposes but does not regard this as the “active incubation” characterising its deeper engagements.[xxii] Additionally, SVhk advertises open positions in its SPOs on its website to support recruitment.

- Skills & Expertise: Throughout its engagement with the SPO, SVhk also leverages on its extensive pro bono professional network to provide its investees with legal, accounting and consulting support that enhance investees’ own efforts. Since its establishment, SVhk has benefited from more than 20,000 volunteer hours by over 120 professionals.[xxiii]

Volunteers are managed on two different tracks: on a project-by-project basis and by an event-basis. Project volunteers are those brought in when SVhk requires specialised expertise – for instance, when Light Be, an affordable housing initiative SVhk was supporting “touched upon legal issues that SVhk hadn’t thought about,” SVhk sought and enlisted property development specialists from its pro bono network. Event volunteers are individuals who assist during the various events hosted year-round by SVhk to promote social enterprise ideas and initiatives in Hong Kong. SVhk has found that this is a good way for “volunteers to understand and be exposed to real social issues” on the ground in Hong Kong. There are certain services- specifically event organising and graphic design – which SVhk will outsource to professionals at pre-negotiated rates.[xxiv]

Value creation of capacity building efforts – a “fluid situation”

While SVhk notes that it is constantly working to improve upon its capacity building processes, SVhk has defined certain internal KPIs for itself that help the organisation perceive the value its capacity building efforts have created for investees. These include the number of individuals impacted by the investee’s activities, the overall bottom line and top line financials, and the overall quality of the relationship between SVhk and the SPO throughout the engagement.[xxv]

Sources

- Asian Venture Philanthropy Network (AVPN), 2015: Member’s day- Hong Kong country session, accessed 25 June 2015 online athttps://avpn.asia/country-session-2-hong-kong/.

- Bridges Ventures, 2014: Shifting the Lens – A De-risking Toolkit for Impact Investment. Accessed 25 June 2015 online at http://bridgesventures.com/wp-content/uploads/2014/07/BV_BoA_de-risking_report_FINAL_printer_friendly.pdf

- Charities Aid Foundation (CAF), 2014: World Giving Index (WGI) 2014, accessed 18 June 2015 online at https://www.cafonline.org/pdf/CAF_WGI2014_Report_1555AWEBFinal.pdf

- Charities Aid Foundation (CAF), 2012: World Giving Index (WGI) 2012, accessed 18 June 2015 online at https://www.cafonline.org/PDF/WorldGivingIndex2012WEB.pdf

- Charities Aid Foundation (CAF), 2011: World Giving Index (WGI) 2011, accessed 18 June 2015 online at https://www.cafonline.org/docs/default-source/about-us-publications/world_giving_index_2011_191211.pdf

- IRIS Database, Global Impact Investing Network (GIIN), https://iris.thegiin.org/.

- Social Ventures Hong Kong website, sv-hk.org

- Social Ventures Hong Kong, conversation with AVPN. 25 June 2015, teleconference.

- Social Ventures Hong Kong, 2010: SVhk Impact Report 2007 – 2010, accessed 17 June 2015 online at http://www.sv-hk.org/files/SVhk-Impact-Report-2010.pdf

- Social Ventures Hong Kong: Overview of Portfolio Projects.

- Yuen, Terence; Ngai, Francis; Kan, Olivia; and Rikkie Yeung, 2011: Money for Good: Global Trends and Local Potentials in Engaged Giving and Social Investing. SVhk, Hong Kong.

[i] Charities Aid Foundation (CAF), “World Giving Index (WGI) 2014”, p. 12

[ii] Charities Aid Foundation (CAF), “World Giving Index (WGI) 2012” p.11 and “World Giving Index (WGI) 2011”, p. 11

[iii] SVhk website, “Model” http://www.sv-hk.org/model.php

[iv] SVhk website, “Portfolio” http://www.sv-hk.org/investment.php

[v] Conversation with Karen Ng from SVhk on 25 June 2015

[vi] Conversation with Karen Ng from SVhk, 25 June 2015.

[vii] Yuen, Terence; Ngai, Francis; Kan, Olivia; and Rikkie Yeung, 2011: “Money for Good: Global Trends and Local Potentials in Engaged Giving and Social Investing”. Social Ventures Hong Kong, Hong Kong.

[viii] Asian Venture Philanthropy Network (AVPN), 2015: “Member’s day- Hong Kong country session”

[ix] SVhk, “Money For Good” Report (2011), pp. 50-51

[x] AVPN, “Member’s Day”; and “Money for Good”

[xi] Conversation with Karen Ng from SVhk on 25 June 2015

[xii] Conversation with Karen Ng SVhk, 25 June 2015.

[xiii] http://www.scmp.com/news/hong-kong/economy/article/1817230/business-not-just-about-making-money-says-hong-kong-social accessed on 22 June 2015

[xiv] SVhk, 2011: “Money For Good”

[xv] Social Ventures Hong Kong, 2010: “SVhk Impact Report 2007 – 2010”, accessed 17 June 2015 online at http://www.sv-hk.org/files/SVhk-Impact-Report-2010.pdf

[xvi] Conversation with Karen Ng SVhk, 25 June 2015.

[xvii] See Appendix for an image of “SVhk’s Investment Process”.

[xviii] Conversation with Karen Ng SVhk, 25 June 2015.

[xix] Bridges Ventures, 2014: Shifting the Lens – A De-risking Toolkit for Impact Investment. Accessed 25 June 2015 online at http://bridgesventures.com/wp-content/uploads/2014/07/BV_BoA_de-risking_report_FINAL_printer_friendly.pdf

[xx] IRIS Database, Global Impact Investing Network (GIIN) website, https://iris.thegiin.org/.

[xxi] Conversation with Karen Ng SVhk, 25 June 2015.

[xxii] Conversation with SVhk, 25 June 2015.

[xxiii] SVhk website, “Directors & Members” http://www.sv-hk.org/members.php

[xxiv] Conversation with Karen Ng SVhk, 25 June 2015.

[xxv] Conversation with Karen Ng SVhk, 25 June 2015.

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.