India has achieved a remarkable development goal with the near universalisation of primary education as of 2015.1 96.9% of children in rural India enrolled in school in 20162 and 98% of habitations now having access to a primary school within a 1km radius.3

National policy implementations like the Right to Education (RTE) Act for primary-school age children and Rashtriya Madhyamik Shiksha Abhiyan (RMSA) for high-school age youth are landmark catalysts to large scale improvements in access to education. Many international and local foundations, companies and investors have a stake in the education sector in India, introducing a dizzying diversity of interventions, widely spread all over the nation.

“Yet there are still persistent gaps that are seen in localised pilot ideas that fail to scale, and the difficulty in achieving better education outcomes.”

Nonetheless, many innovative interventions at state and municipal levels are already working closely with governments.

Michael & Susan Dell Foundation, for example, have rolled out integrated school excellence programmes in 4 cities in India. By working with government and private schools, the Foundation focuses on reform and adoption of continuous evaluation to transform the school system and improve education outcomes.

“In a critical sector like education, identifying areas where policies can impact the social economy will set the stage for productive design and implementation of collaboration-driven policies.”

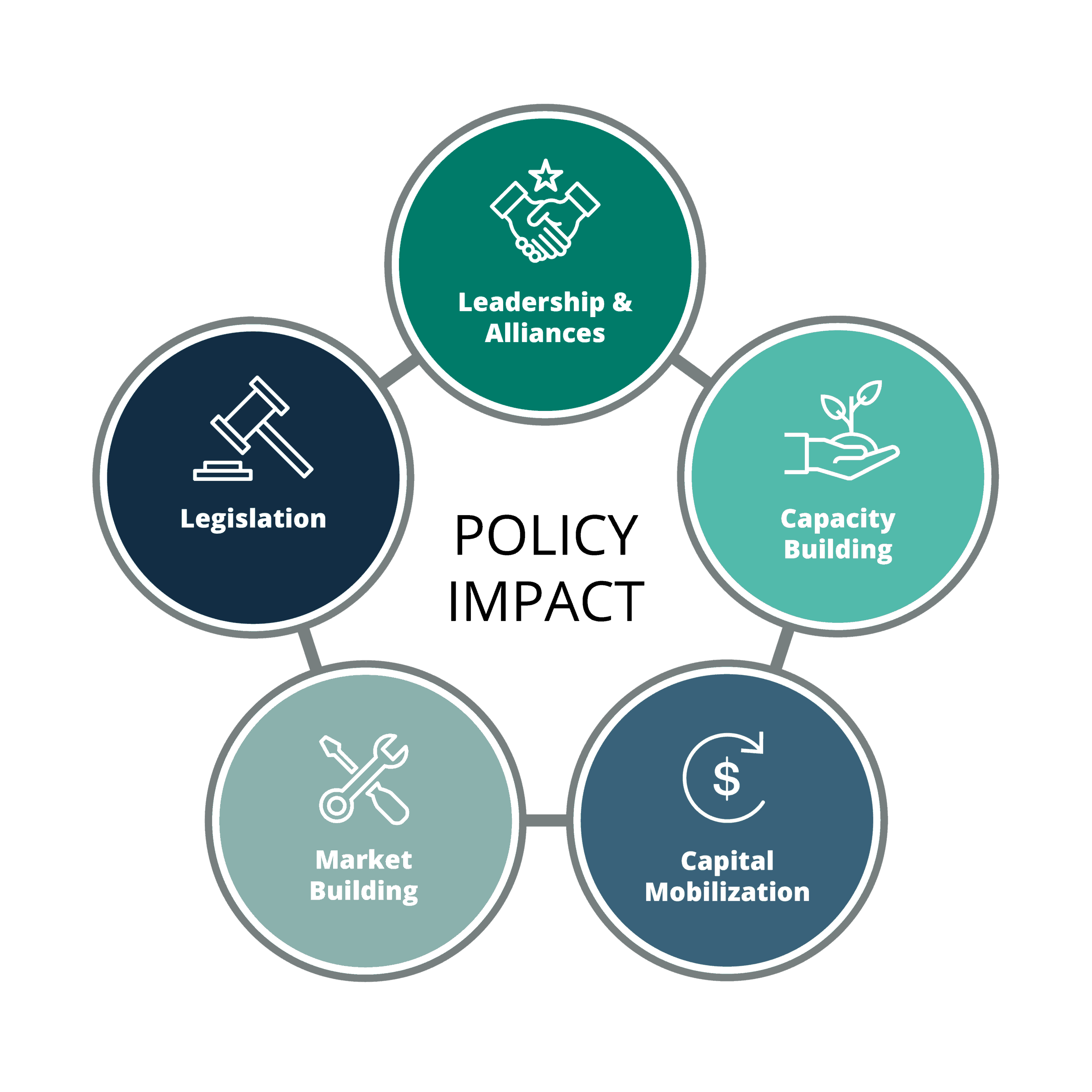

AVPN’s social economy policy framework identified 5 areas where policy can impact the social economy: Capital Mobilisation, Capacity Building, Leadership & Alliances, Market Building and Legislation.

Applying this to education, here are 3 possible areas where policymakers and impact investors may identify breakthrough and impactful collaborations.

Capital Mobilisation

Going beyond traditional scholarships and school-building, impact investors and policymakers can work together to unlock risk-tolerant capital in overlooked areas of funding.

This can include infrastructure and development of inclusive education initiatives for children with special needs.

Capacity Building

A significant advantage of impact investment is its belief in the value of building ecosystems and industry capacity to be more effective in social impact. Thus, there is long-term investment value in leadership development and establishment of benchmarks for education outcomes.

Policymakers can proactively and transparently engage impact investors in strengthening critical parts of the education system through their financial, social and intellectual capital. For example, the private sector can advance learning and development to catalyse future-ready curriculum and pedagogy.

As such, education innovations have more opportunities to get to market and grow to scale, when private sector and education policymakers work together.

Market Building

The provision of universal education for all Indian children has seen a rise in the number of private school operators. However, collaboration and alignment between governments and impact investors can ensure holistic social outcomes are achieved. For instance, impact-oriented private sector interventions can ensure youths are ready for employability, thus going beyond enrolment numbers.

“Collaboration between policymakers and impact investors can bridge very important transition gaps that get lost between education and manpower policies.”

Last but not least, policymakers and impact investors working together are symbolic of Leadership and Alliance-Building, a critical part of a robust social economy. Taking the lead to show that social impact goals can unite resources across sectors is a powerful signal that India’s education policymakers are future-ready.

***

The time is right for exploring such collaboration and learning opportunities in India’s education landscape.

We look forward to uncovering more insights from the AVPN India Summit 2017. The Funding Education with Impact report, launched at the Summit, will go a long way to identifying important trends, opportunities, and gaps for impact investment to make a difference.

——————-

[1] UNESCO, 2015

[2] ASER, 2016

[3] SSA, 2010