6 min read

- Market failure at the bottom of the pyramid calls for innovative financing solutions

- Kaizen Private Equity identifies 2 high-impact gap areas to address schools and students’ inaccessibility to capital

- Join KIES 2018 in their flagship education symposium on Singapore, 1-2 March, to learn best practices from social investors in the field

Deep-Seated Challenges to Quality Education for All

One of the biggest challenges in the growth of a developing nation is ensuring access to affordable and high-quality education for the masses. Supply side issues can include the absence of schools in the vicinity, inadequate or unqualified teaching staff in existing schools or lack of infrastructure. On the demand side, affordability is the primary constraint. In either scenario, there is often a common underlying problem – access to capital.

Financing solutions for schools and students in these geographies, especially in rural and non-urban areas, are few and far between. Conventional credit products do not work for a variety of reasons – inability to obtain credit scores, difficulty in assessing borrowers’ intent to pay etc. As aptly said by Roopa Kudva of Omidyar Network, “Markets rarely function at the bottom of the pyramid”[1].

To truly bridge this financing gap and achieve massification of affordable and quality education, we need innovative, tailor-made products created with the target audience in mind. From an investor’s perspective, this calls for adopting a different approach.

Innovative Financing Solutions

Global multilateral organizations have already taken part in several education financing initiatives. Instead of providing loans to students, they support banks and other financing institutions, who are reluctant to lend to students because of default risk and long period from loan disbursement to payback. In one case, IFC has been able to minimize this risk by forming triangular relationships with banks and private institutions. The institutions bear the first 10% of losses and the balance is borne by IFC and the banks[2].

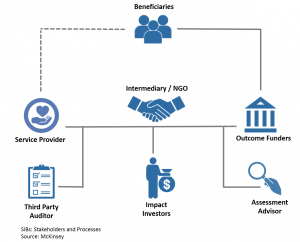

Social and development impact bonds (SIBs and DIBs) or Pay-For-Success bonds are also gaining popularity. For example, the Education DIB is the first of its kind. It seeks to improve education outcomes for 18,000 children in government schools in Rajasthan, India. Under this arrangement, the Children’s Investment Foundation Fund (CIFF – the outcome payer) has partnered with Educate Girls (the service provider) and UBS Optimus Foundation (the investor). CIFF will compensate UBS Optimus Foundation with reimbursements and incentives if specific educational outcomes such as enrolment of out-of-school girls and improved literacy and numeracy skills are achieved.[3]

The student financing side has good potential as well to bring more learners into mainstream learning. Through Income Share Agreements (ISA), private investors can fund the cost of education in exchange for a percentage of the student’s future income for a specified period.[4] Students are not burdened with lifelong debts that are beyond their means and only pay based on their incomes. Think of it as venture capital for students.

In the Indian context, through our work with Varthana (Kaizen investee), an education–financing company in India, and ties with Indian financial institutions, we see huge potential in affordable education-centric lending. These high-impact gap areas can be segregated into two segments:

Affordable Private Schools Underserved by Financial Providers

Of the nearly 320,000 private schools in India, approximately 100,000 are affordable private schools (APS) that charge fees in the range of INR 500-3000 a month (USD 8-45). These schools are largely underserved by established banking channels because of extensive documentation requirements, higher turnaround times and low penetration. The alternative is to seek funding from informal lenders, albeit at high costs.

Inaccessible Low-Income Group Student Financing

The microloan industry in India is pegged at USD 18 billion. Of this, USD 3.5 billion is attributable to non-banking microfinance institutions (NBFC-MFIs) and a minimum of 85% of an MFI’s loan book must be related to income generating activities. As a result, loans for education purposes account for merely 2% of the total loan portfolio.

The Challenges:

- Most APS in India are inadequately staffed to maintain complete financial records. Moreover, salaries are collected and paid in cash. Thus, lenders have neither adequate records to determine a borrower’s ability and intent to repay.

- The management teams are not adequately qualified to optimally deploy loans for scaling up, resulting in wasteful expenditure

The solution – Intelligent Capital

Solving a problem on a massive scale requires significant financial resources, no doubt. But strategic and superior execution requires the right combination of funding, expertise, insight and network. This is where intelligent capital comes in, maximizing value on every dollar invested through customized, creative investing models.

Through an investors network, beneficiary institutes gain access to global education improvement initiatives such as the School Transformation Program, cluster schools by Opportunity International. This is a group of APS – all or most of whom are borrowing from the partner bank – focused on improving the quality of education that they provide.

KIES2018 will be touching upon such initiatives at its Education Symposium in Singapore on March 1-2, 2018.

Kaizen Private Equity and INSEAD are back with the next edition of the flagship education symposium – KIES 2018. KIES 2018 will serve as a platform for building capacity, consensus and relationships between five critical stakeholders, namely educators, private enterprises (i.e. Investors and Education enterprises), policy makers, impact champions and future business leaders. Join us in Singapore on the 1st and 2nd of March 2018.

Visit www.kies2018.kaizenpe.com for more details on speakers and session information.

[1] https://in.avpn.asia/session/closing-plenary-continuum-of-capital-for-education-in-india/

[2] http://www.universityworldnews.com/article.php?story=20120224110837965

[3] https://ciff.org/grant-portfolio/education-development-impact-bond/

[4] https://www.forbes.com/sites/akelly/2014/04/30/creative-solutions-to-higher-education-finance-part-2-using-private-money-to-promote-the-public-good/#77315a097b28