8 minutes read

Supported by Google.org and ADB, AVPN has partnered with Dalberg Advisors to develop the Asia Pacific Sustainability Seed Fund 2.0 article series. The series of articles highlights insights from the research done on the climate technology ecosystem. Through this research, AVPN aims to highlight innovative technological solutions addressing climate challenges and explore their impact on society. Additionally, the research seeks to pinpoint opportunities for social investors and policymakers to advance solutions to address the impacts of climate change. The article series will conclude with insights shared in a final report.

Choosing between Climate Action and Socio-Economic Development: A False Dilemma for APAC

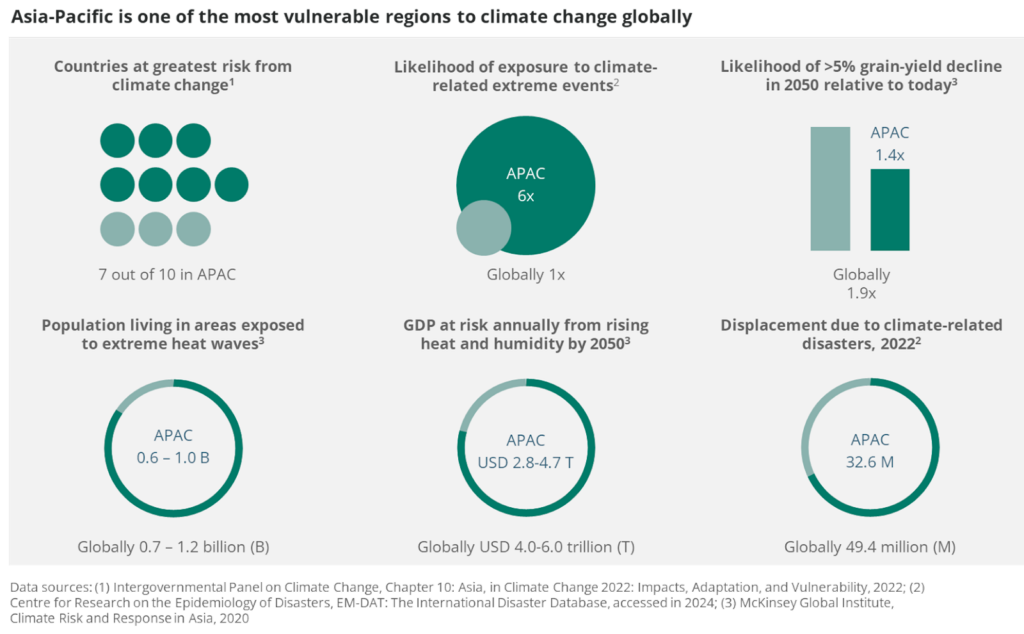

The Asia-Pacific (APAC) region is grappling with urgent challenges at the intersection of climate change impacts and socio-economic developmental imperatives. The region is home to seven of the world’s ten most climate-vulnerable countries, making it one of the most climate-vulnerable regions globally (Figure 1). From devastating floods and cyclones to prolonged droughts and rising sea levels[1], the impacts of climate change are deeply intertwined with the region’s economic growth and social well-being. Climate and weather-related disasters have surged fivefold in the last 50 years, with economic losses in 2022 surpassing the last 20-year average for the region by ~20% [2][3]., These challenges, along with other macroeconomic factors such as the slow pace of post-pandemic recovery and higher debt levels and inflation rates, make the region especially vulnerable.

Large-scale social investments for APAC are needed to address the escalating climate risks while fostering social and economic growth for all. The Asian Development Bank (ADB) estimates that annual investments of USD 1.7 trillion in infrastructure alone until 2030 are necessary to sustain growth, alleviate poverty, and address climate change effectively.[4]

Regional and international stakeholders often perceive a trade-off between investments for climate action and development. This false dichotomy severely undermines efforts to climate-proof the region’s current and future socio-economic growth and well-being. The reality is that effective adaptation to the risks of climate change is essential for ensuring sustainable growth and economic resilience.[5] Most crucially, integrating climate considerations into development initiatives necessitates a paradigm shift acknowledging their interdependence. This shift is critical to align planning and financing for socio-economic development in the region in ways that are resilient to current and future climate change risks.

Why invest in immediate climate action?

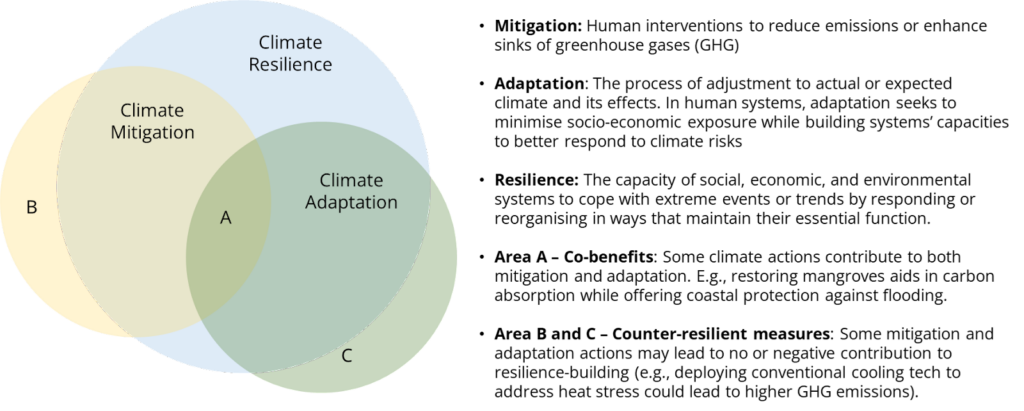

Investing in climate adaptation and resilience measures alongside mitigation efforts is essential for climate-proofing APAC’s socio-economic growth. Reducing emissions is imperative to combating climate change—adopting climate mitigation measures, including net-zero strategies, is crucial for facilitating the transition to low-carbon economies. Yet, due to historical and ongoing emissions, global temperatures are expected to exceed 1.5 degrees Celsius above pre-industrial temperatures by 2030[6], with far-reaching consequences on APAC economies, lives, and livelihoods. Mitigation actions are not designed to address the immediate physical risks of climate change; they must be supplemented by more immediate climate adaptation measures to enhance the region’s resilience.

Given the heightened vulnerability of the region to escalating climate risks, the need is urgent to scale up solutions that help anticipate and adapt to these risks (Figure 2). Bolstering investments in adaptation alongside ongoing de-carbonization efforts is crucial: in developing countries today, the shortfall in climate adaptation financing is an estimated 10–18 times larger than current funding levels.[7]

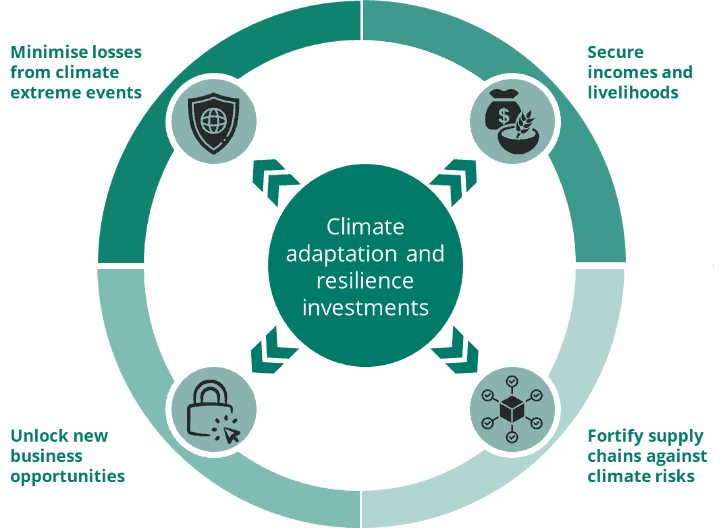

The goal must be to integrate adaptation considerations into all efforts to secure the region’s climate transition and growth trajectory. To achieve this, potential funders need to understand how adaptation efforts link with socioeconomic development in APAC. Investments in climate adaptation and resilience not only secure future growth but also safeguard current progress (Figure 3) by:

- minimising losses from climate-related extreme events,

- securing incomes and livelihoods,

- fortifying supply chains against climate risks, and

- unlocking new business opportunities.

Minimising losses from climate-related extreme events

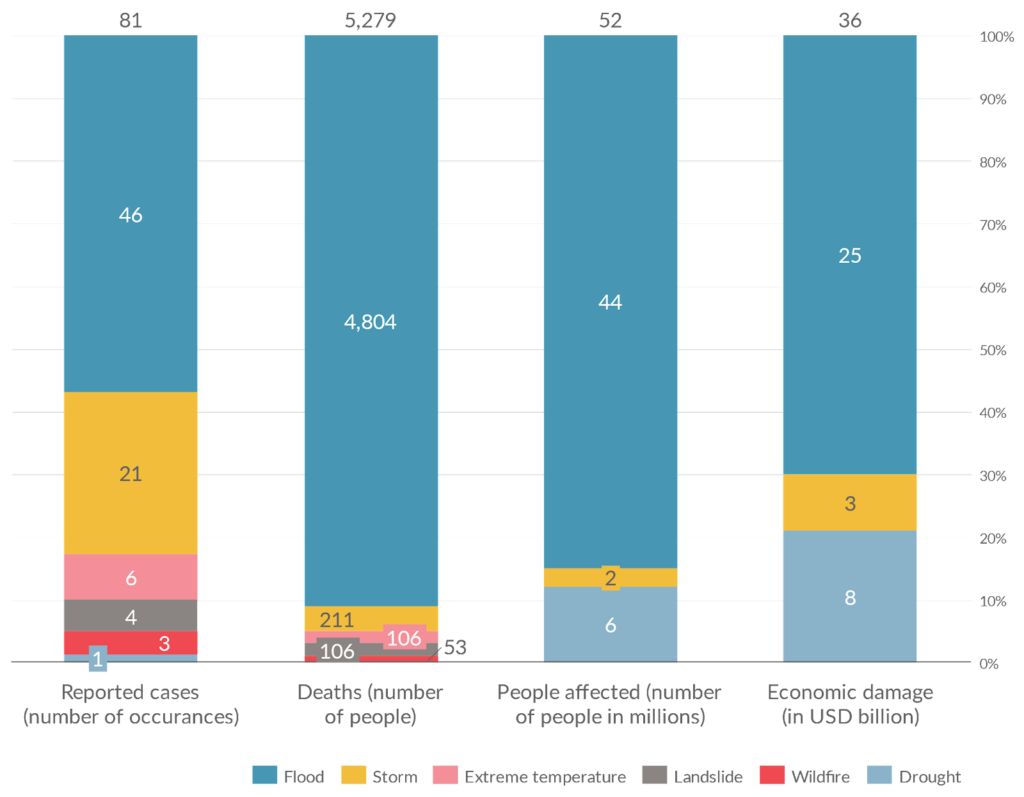

Investing in climate adaptation and resilience is essential for minimising the social and economic losses of climate hazards. In 2022 alone, the region’s 81 climate-induced disasters (of which over 83% were flood and storm events) directly affected more than 50 million people , resulting in more than 5,000 lives lost and upwards of USD 36 billion in economic damages (Figure 4).[8] The same year, APAC was home to 70% of global internal displacements caused by climate-related disasters.[9] Moreover, extreme temperatures and changing rainfall patterns threaten agricultural productivity, leading to food insecurity and exacerbating malnutrition.

Investments in initiatives such as early warning systems (EWS) can save lives and assets while providing tenfold investment returns. Investing in EWS in developing countries could avert losses ranging from USD 3–16 billion.[10] Countries such as Bangladesh, India, and Vietnam stand to benefit most from such interventions due to substantial flooding challenges along their coastlines.

Securing livelihoods and incomes

Investments in climate-proofing APAC’s economic sectors are urgent and critical for stabilising regional economies and preventing job losses. Given that over 40% of APAC’s workforce is employed in climate-sensitive sectors such as agriculture and manufacturing, the growing impacts of climate change on these activities across the supply chain will have cascading effects on the livelihoods of a significant portion of the population. By 2030, rising temperatures could result in losing about 3.8% of total working hours in India and Cambodia alone, equal to roughly 136 million full-time jobs. This could inflict a cumulative economic loss of USD 2.4 trillion.[11] Additionally, erratic rainfall and pest outbreaks in India and other parts of South Asia continue to diminish crop yields and income stability for smallholder farmers. Adaptation solutions such as floating farms[12] and solar-powered cold storage facilities empower individuals and households to protect their economic well-being by lessening their susceptibility to extreme weather events such as floods and heat waves, and more gradual changes such as rising temperatures and shifting monsoon patterns.[13]

Fortifying supply chains against climate losses

Climate adaptation investments play a crucial role in securing supply chains against growing threats posed by climate change. Studies suggest that climate change-induced disruptions could affect nearly half of global logistics operations and workforce availability, leading to a significant loss in profits for businesses.[14] By minimising exposure to climate-related risks and impacts, businesses can ensure the continuity and reliability of their operations.

Supply chain resilience is paramount to safeguarding the micro, small, and medium-sized enterprises (MSMEs) that form the backbone of APAC economies. As of 2021, MSMEs constituted ~97% of all enterprises in Southeast Asia, employing ~70% of the total workforce and contributing 41% to the GDP.[15] These entities are often situated in disaster-prone regions or reliant on supply chains highly exposed to climate impacts, making them particularly vulnerable to climate risks. MSMEs face financial and capacity constraints that hinder their ability to evaluate climate risks and adopt environmentally friendly practices, including investing in energy-efficient and climate-smart technologies.[16] Given their vital role in economic growth and job creation, supporting supply chain resilience among MSMEs through climate adaptation measures is critical.

Unlocking new business opportunities

A strategic focus on adaptation can help investors unlock untapped potential. Investing in adaptation and improved resilience yields a significant return, ranging from two to ten dollars for every dollar invested.[17] Focussing on adaptation can help investors pioneer novel approaches that not only mitigate climate risks but also drive economic prosperity.

Further, adaptation investments open additional funding streams for APAC nations by driving down the cost of capital for businesses. Investments in adaptation initiatives contribute to reducing the cost of capital for businesses by improving risk management practices, leading to higher sovereign ratings for developing economies in APAC. These countries consequently become more appealing to global markets, attracting increased capital inflows that can further support climate-proofing efforts and fuel the creation of new climate-smart business opportunities.

The opportunity to invest is clear across all sectors, from agriculture to infrastructure. Investments in resilient agricultural technologies and value chain interventions empower smallholder farmers and agribusinesses to access new markets and secure livelihoods. Innovations in water efficiency and ecosystem restoration, for instance, not only safeguard precious resources but also stimulate economic growth and promote environmental stewardship. Moreover, the emerging market for climate-resilient infrastructure and risk transfer mechanisms presents lucrative opportunities for private sector engagement. By investing in EWS and disaster resilience efforts, businesses can not only safeguard their operations but also pioneer new business models that align profit with social purpose.

Social investors are indispensable in catalysing climate adaptation investments due to their unique ability to drive both social impact and financial returns. With a focus on socially purposeful companies and funds, social investors, ranging from impact-first to financially focused actors, form a crucial part of the investment spectrum. They contribute across the investment spectrum, from providing patient grants to seed solutions to making equity investments in those ready to scale, thus playing a crucial role in advancing climate adaptation efforts.

Social investing in adaptation and resilience outcomes for APAC – the adaptation framework

Social investments in climate adaptation are essential for capitalising on emerging opportunities, but they must be guided by a thorough understanding of how climate impacts manifest across different sectors. Climate adaptation and resilience strategies such as resilient infrastructure upgrades, watershed planning and development, and community-based disaster risk reduction have been considered and deployed for two decades, yet guidance on investing in them remains sparse. This has constrained funding for adaptation efforts. Adopting a thematic approach that builds on sector-specific insights can serve as a roadmap to strategically guide investments in APAC, where the need to adapt is paramount. Such an approach would direct funding to solutions that contribute to climate-proofing sectors by addressing both their contributions and vulnerabilities to climate change.

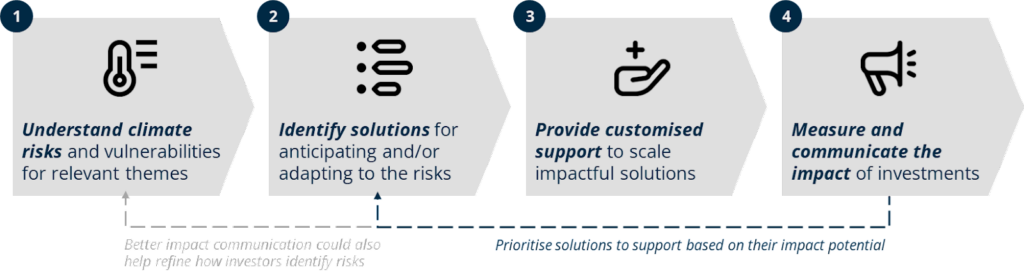

A four-step framework can help social investors identify climate adaptation investment opportunities. Social investors can follow four sequential steps aligned with their programmatic priorities to streamline their support in developing and deploying adaptation solutions across the region (Figure 5). The next section elaborates on each of these four steps.

- Understand the climate risks across thematic areas relevant to the investors’ programmatic areas; develop a deeper understanding of the intersection of climate impacts and priority themes; prioritise key risks within investors’ areas of focus and target communities based on their exposure and vulnerability to climate hazards, identifying adaptation needs accordingly.

- Identify climate adaptation and resilience solutions that will help in either anticipating or adapting to the climate risks. Solutions can include either those that aid in real-time understanding of localised needs or those that support on-the-ground implementation of adaptation actions. The identification process for such solutions must prioritise the involvement of climate-vulnerable communities. Digital technologies such as AI-based prediction models and blockchain-based ledgers have a key role to play in enabling these solutions and must be considered. investors need to understand both the potential impacts and maturity levels of such technologies.

- Support impactful solutions to scale through means that align with investors’ preferences for impact and financial returns while balancing the affordability of these solutions. Investors should strategically allocate a combination of grants, debts, and equity instruments to scale solutions at different stages of development. This must be accompanied by ecosystem-building initiatives to create a conducive enabling environment, including capacity building and policy advocacy

- Measure and communicate the impact of investments. Social investors must collaboratively develop and adopt a standardised or comparable impact measurement and reporting framework/s suitable for the priority sector for adaptation investments in APAC. This may also bolster the case for climate adaptation investments by showcasing their impact potential.[18] Moreover, such measurement creates a feedback loop that can inform the identification of relevant solutions in steps 1 and 2.

Social investors of different types each have a distinct role in scaling the deployment of these solutions. Philanthropies, corporate office foundations, and other investors which disburse grant funding could support both ecosystem-building initiatives as well as early product development of innovative climate solutions. For instance, Massive Earth Foundation recently collaborated with UNEP and UN Women to host a 12-week accelerator program for climate tech start-ups, particularly emphasising on women-led initiatives. Impact-focused venture capitalists and other return-seeking investors could then support the scaling of those impactful solutions which show early commercial promise.

Additionally, venture philanthropies and multilateral institutions such as development banks and financial institutions could also play a part by de-risking investments for return-seeking investors. For instance, they could provide concessional debt and first loss guarantees to demonstrate the commercial viability of early-stage solutions through innovative finance approaches, such as blended finance. This continuum of support, from initial funding to market expansion and subsequent impact creation, is essential for realising the full potential of climate adaptation innovations throughout the region.[19]

AVPN calls upon the social investor community to champion impactful interventions that catalyse sustainable innovation and progress towards climate adaptation. With initiatives like the APAC Sustainability Seed Fund 2.0 (APAC SSF 2.0), AVPN continues to pave the way for collaborative action, bringing together social investors and philanthropists to drive positive change. As the impacts of climate change advance, tackling social and environmental issues in siloes is no longer an option, and forward-thinking social investors should lead the way in championing a holistic, cross-sector approach to advancing solutions.

[1] IPCC, “Chapter 10: Asia”, in Climate Change 2022: Impacts, Adaptation, and Vulnerability, 2022

[2] World Meteorological Organisation, “State of Climate in Asia”, 2022

[3] UNDP, “Making Our Future: New Directions for Human Development in Asia and the Pacific”, 2023

[4] Asian Development Bank, “Meeting Asia’s Infrastructure”, 2017

[5] International Institute for Sustainable Development, “Is it Adaptation or Development”, 2018

[6] Hansen et al., “Global warming in the pipeline”, in Oxford Open: Climate Change, 2023

[7] UNEP, “Adaptation Gap Report 2023”, 2023

[8] World Meteorological Organisation, “State of Climate in Asia”, 2022

[9] UNDP, “Making Our Future: New Directions for Human Development in Asia and the Pacific”, 2023

[10] Global Center on Adaptation, “Adapt now: a global call for leadership on climate resilience”, 2019

[11] International Labour Office, “Working on a warmer planet: The impact of heat stress on labour productivity and decent work”, 2019

[12] Wentworth, “Floating farms are transforming life on India’s waterways”, in Climate Home News, 2023

[13] World Economic Forum, “The future of jobs report 2023”, 2023

[14] Gartner, “3 key actions for supply chain’s response to climate change”, 2022

[15] Asian Development Bank, “Asia Small and Medium-Sized Enterprise Monitor 2021: Volume I-Country and Regional Review”, 2021

[16] UNFCCC, “Mapping study on Capacity-Building Needs of MSMEs to Engage in Climate Action in the Southeast Asia Region”, 2022

[17] Global Center on Adaptation, “Adapt now: a global call for leadership on climate resilience”, 2019

[18] Abouzied, “To Make Adaptation Projects Bankable, Reimagine Returns”, Boston Consulting Group, 2022

[19] AVPN, “The Continuum of Capital in Asia”, 2018