Empowering Women in Agriculture through Responsible Investing: Perspectives from Asia

6 min read

Responsible financing models, platforms and activities have skyrocketed in the last few years. Trends show that stocks with sound environmental and social targets may fare better than those without these targets, even in times of crisis. At the basic level, a claim of responsible finance indicates that investments catalyze positive outcomes alongside financial returns. Responsible finance can also help investors reach their sustainable development goal (SDG) targets. In Southeast Asia, there is growing interest in one responsible financing approach that focuses on women’s economic empowerment, often called “gender-lens investing”. Gender-lens investing can have positive impacts on women (and their families’) health, safety, education and livelihoods.

Empowering Youth to Tackle Climate Change and Preserve Cultural Rights

5 min read

Climate change is here and it is happening now. In October last year, NASA and several other global organisations have predicted that 2020 is set to be the warmest year on observable record , with the first nine months of the year seeing unprecedented concentrations of major greenhouse gases – such as carbon dioxide, methane, and nitrous oxide – despite a global pandemic that halted much of the planet’s activities.

Enabling Visibility, Insights, Collaborations at the Deal Share Live Investment Showcase

2 min read

At the AVPN Conference 2017, 30 Social Purpose Organisations (SPOs) pitched on various issues, from responsible consumerism, to empowerment through technology.

Glean 3 ways the AVPN Deal Share can facilitate a funding pipeline for SPOs to seek continued resources, and members to collaborate with each other.

Endeavor Catalyst looks to increase Asian investments

Endeavor Catalyst, an innovative funding programme initiated by the international nonprofit organisation Endeavor Global, is looking to increase its focus on Asia with the launch of its Malaysia office next month. The firm has had an office in Indonesia for the last two years. Cindy Ko, Vice President of international expansion at Endeavor, says Endeavor […]

Engaging C-Suite Executives in Volunteerism Across Asia

AVPN took the Pilotlight model of skilled volunteerism on a 5 city road show in October – travelling to Mumbai, Singapore, Hong Kong, Seoul and Tokyo. The sharing in each city with local leaders on corporate volunteerism differed in each country, but enthusiasm on the concept was extremely encouraging in all our stops. The revolutionary […]

Engaging Corporations on Environmental, Social and Governance Issues

AVPN and AVPN member Oxfam hosted a roundtable discussion on corporate engagement on environmental, social and governance issues.

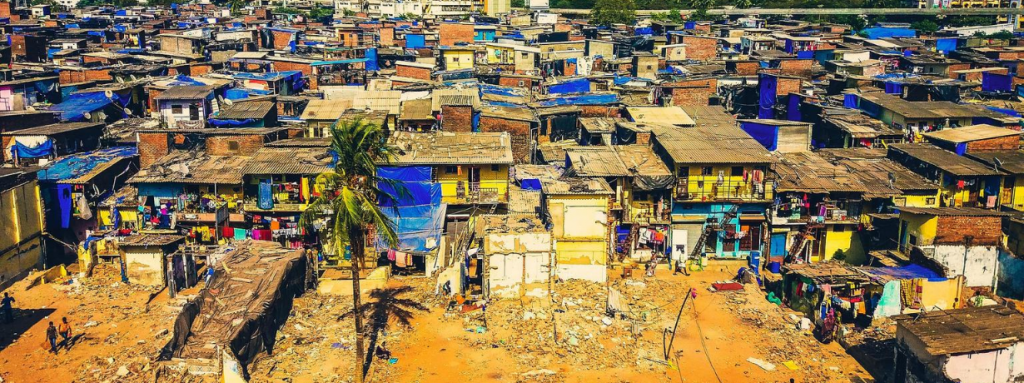

Engaging Slum Communities to Combat COVID-19

4 min read

An understanding of community engagement models can be illuminating for those working—or aspiring to work—with slum communities in the context of COVID-19. The Bridgespan Group has identified critical ways for policymakers, funders, and practitioners to better engage communities and build back better.

Engaging Social Entrepreneurs and Social Investors in Partnerships

5 min read

At the AVPN-Impact Hub Yangon Myanmar Speaker Series, social investors and entrepreneurs gathered to discuss what it takes to become investment-ready.

Find out how you can leverage on key gap areas to build a community of highly engaged stakeholders in Myanmar.

ESG Investing: What Is It and Will It Give Me Better Returns?

5 min read

Member Standard Chartered discusses why and how investors who apply ESG criteria to their investment allocation could see significant benefits.

This article was first featured on Insights, Standard Chartered’s external thought leadership hub.

ESG Investments Emerge Strong Amidst COVID-19 Uncertainties

4 min read

The public health emergency triggered by the COVID-19 pandemic has led to a substantial contraction in economic activities globally, wiping off jobs, engulfing ‘business as usual’ scenarios and pummelling stock markets.

ESG Trends to Watch for 2022

In 2022, climate change has come to surpass corporate governance as the most pressing ESG issue commanding investors’ attention, and ESG investing truly has gone mainstream (and is attracting the regulatory attention to prove it). Yet there are new risks emerging for companies, investors and the planet in the coming decade that will test how well we have learned the lessons of the past.

Europe Learns About Asian VP Scene at the 2015 EVPA Conference

Europe learns about Asian VP scene at the 2015 EVPA conference for further collaboration to provide globally relevant insights on venture philanthropy.

EVPA talks Venture Philanthropy and Social Investment trends in Europe

Venture philanthropy and social investment trends in Europe and the key data to help benchmark organisations.

EVPA’s 9th Conference in Geneva Shares Failures in the Midst of Celebrating Successes

EVPA’s annual conference in November last year was a refreshing departure from the usual repertoire of showcasing only the successful cases within the industry. Instead, leading investors also discussed failures and what we can learn from those. In addition to dedicating an entire session on the topic of failure (‘The good, the bad and the […]

Facing Hard Truths Head-On: Lessons and Opportunities in Catalytic Capital Investment From Pioneer Practitioners in Asia, Africa, Latin America and Europe

4 minutes read Eighteen months of extensive research and engagements with social investors in Asia, Africa, Latin America and Europe have revealed an important uniting fact about the field of catalytic capital: the practice is gathering pace in these regions, and there are untapped opportunities that could accelerate this much needed, positive trajectory. To ensure […]

Fight Malnutrition in Asia With the Power of Philanthropy

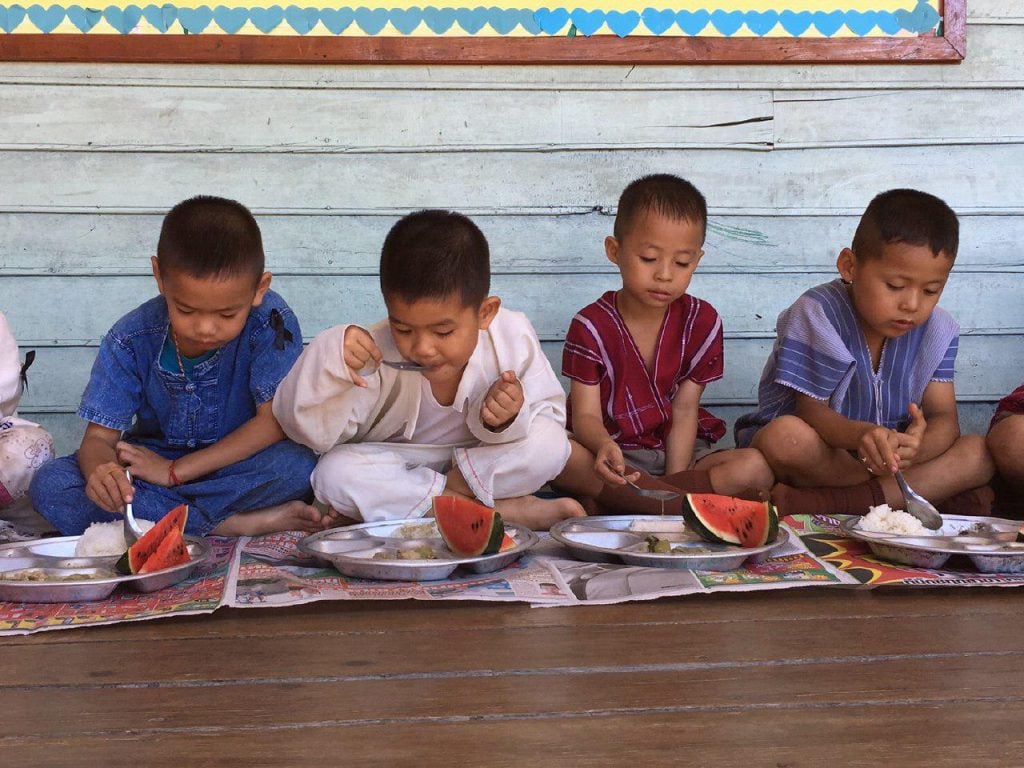

5 min read

It is painfully clear that investment for nutrition is not comparable to the scale of the issue at hand. Interventions in nutrition in Asia receive merely an estimated 1% of public sector funding despite the fact that 45% of all child deaths occur as a direct or indirect result of malnutrition. In fact, the triple burden of undernutrition, micronutrient deficiencies and overnutrition at today’s levels costs the global economy up to US$3.5 trillion annually. In light of this, it is not only imperative that actors in the space consolidate their efforts to achieve global standards for nutrition but also make room for more private sector engagement.

Financial Inclusion for a Sustainable Tomorrow

For years, women have always had less access to monetary facilities than men in many parts of the world. In a 2021 World Economic Forum Report on gender gap, India’s performance is one of the worst in South Asia and ranks 140 out of 156 countries.

Finding Alternative Financing by Partnering With ‘Unusual Suspects’

5 min read

Yayasan Annisa Swasti, known as Yasanti, was established in Yogyakarta, Indonesia in 1982 as one of Indonesia’s first non-profit organizations that empowers women through community organizing, education, and financial independence. Focusing on women porters in traditional markets, home-based workers, industry workers, and entrepreneurs, Yasanti has not only supported women to independently manage their finances but also formally recognize home-workers through government decrees.

First Austrian SIB: Economic and Social Empowerment for Women Affected by Violence

Guest post by Franz Karl Prüller, CEO, ERSTE Foundation. What can be done to make projects aimed at overcoming social challenges more effective and efficient? A pilot project implemented by the Austrian Ministry of Social Affairs in the state of Upper Austria aims to answer this very question. Launched in September 2015, it is the […]

First Steps to Effective Collaboration With Policymakers

5 min read

Social investors who partner with policymakers can scale their impact, but finding the right avenues to kickstart conversations is difficult.

Five Sectors at the Forefront of Southeast Asia’s Transition to a Green Economy

2 minutes read Southeast Asian nations have initiated ambitious transitions to green economies that promote sustainable, climate-friendly growth. The potential is huge: up to US$1 trillion in annual economic opportunities and 30 million green jobs by 2030, according to a new report from The Bridgespan Group. Five sectors are capable of generating US$150 billion in […]

Foundations Make Grants as if They’re Wall Street Day Traders

5 min read

Are today’s global-development philanthropists the equivalent of Wall Street day traders in a world that needs more patient capital?

Four Innovative Approaches to De-risking Financing in Asia’s Plastic Circular Economy

Up to US$ 995 billion needs to be mobilised between 2022-2040 to ensure circular supply chains can meet the global demand for plastics. This immense financing need has been a persistent point of discussion as negotiations continue on the legally binding instrument to prevent plastic pollution. We know that investment into interventions along the whole […]

Four Practices to Build Stronger and More Resilient NGOs in India

3 min read

Recent research focusing on India’s nongovernmental organisations (NGOs) is upending conventional funding wisdom. By and large, funders prefer to bolster programmes and restrict most of their contributions from being used on non-programme-related expenses.

Four Things You Should Know About Blended Finance for Climate

4 min read During COP26, Convergence and the UK’s Foreign, Commonwealth & Development Office (FCDO), published the Blended Finance for Climate Report, exploring the successes and the gaps in mobilizing private capital to climate solutions. The report includes insight and feedback from our engagement with over 20 donor organizations, MDBs, DFIs, 100+ investors (e.g., asset […]

Four Ways Social Investors Can Harness the Power of Data for Better Nutrition

4 min read

We live in a data-driven world. From social media and navigation maps to mobile health trackers and disaster prediction sensors, data has transformed our society in unprecedented ways. As momentum around leveraging data intensifies, the opportunities to spark change and drive development are endless.

From Ambition to Actualisation: What Would It Take for Mgnregs to Transform India’s Rural Landscape?

4 min read Census India Ensuring social protection for low-income households is crucial in India, with 65% of its population residing in rural areas, where economic opportunities may be thin. This is where the Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS) steps in—the world’s largest employment guarantee scheme that assures employment to every rural […]

From Grassroots to Global Impact: Asia’s Impact-Driven Social Entrepreneurs

3 mins read Asia is currently facing various socio-economic and environmental challenges, including poverty, inequality and climate change. However, amidst these challenges, there is hope. The rise of Asia’s young social entrepreneurs is a true source of optimism and inspiration. Young people in Asia are often at the forefront of social change and many are […]

From Plausible to Possible: How Strategic Partnerships Can Accelerate ESG in Asia

Environmental, Social, and Corporate Governance (ESG), though slow to gain traction, has captured the focus of investors, corporates, and financial institutions in Asia. It is a term that is hailed frequently in the financial sector, but it lacks universal benchmarks and a consensus on how it can be applied practically across different industries.

From Plausible to Possible: How Strategic Partnerships Can Accelerate ESG in Asia

Environmental, Social, and Corporate Governance (ESG), though slow to gain traction, has captured the focus of investors, corporates, and financial institutions in Asia. It is a term that is hailed frequently in the financial sector, but it lacks universal benchmarks and a consensus on how it can be applied practically across different industries.

From SDG Alignment to SDG Action

What are the SDG Impact Standards? Why should organisations and investors adopt them and what does that entail? Ben Carpenter, the CEO of Social Value International (SVI), which has partnered with the United Nations Development Programme (UNDP) in developing the SDG Impact Standards, answers all your questions about the framework. What are the SDG Impact […]

From Thought to Action: How Inclusive Business Policy Can Reach the Last Mile

5 min read

Policies encouraging the growth of Inclusive Business (IB) models need to complement the state of maturity, readiness and willingness of the larger ecosystem to capitalise on opportunities. In the Philippines, some see the need for strong policy involvement to institutionalise IBs, while others see it as a market-driven process to stimulate IB investment and model creation.

Fund Resilience: Create Systemic Change by Working at the Nexus of Climate and Gender

6 min read

COVID-19 has made very visible how climate change will affect us all on a global scale, which has stirred renewed energy to “build back better” through climate resiliency. Some of us, however, will be harder hit by climate change than others.

Funding Field Catalysts from Origins to Revolutionising the World

3 min read Co-author: Emma Nothmann, Kevin Crouch, and Cora Daniels Even with modest beginnings, systems-change organisations seek world-changing outcomes. But solving complex social problems offers unique challenges. We surveyed these social-change makers to learn what they can use most from funders. In mission-driven circles, systems-change work — which is focused on the root causes […]

Future of impact investing in Southeast Asia

Investors generally operate within market infrastructures that do not prioritise social, environmental and economic considerations. We are, therefore, required to ask: how can more capital be mobilized towards impact?

Future Proofing Education

4 min read

The cancellation of classes because of the pandemic has placed the urgency of education innovations in sharper focus. Clearly, no society can afford leaving an entire generation of students unprepared for the future. Yet, even before Covid-19, education systems were in dire need of reform to prepare the youth for the 21st century, which many experts say will be shaped by the Fourth Industrial Revolution in a world that is already becoming more volatile, uncertain, complex and ambiguous.